Get the free SBA 504 LOAN PACKAGE DOCUMENTATION CHECKLIST

Show details

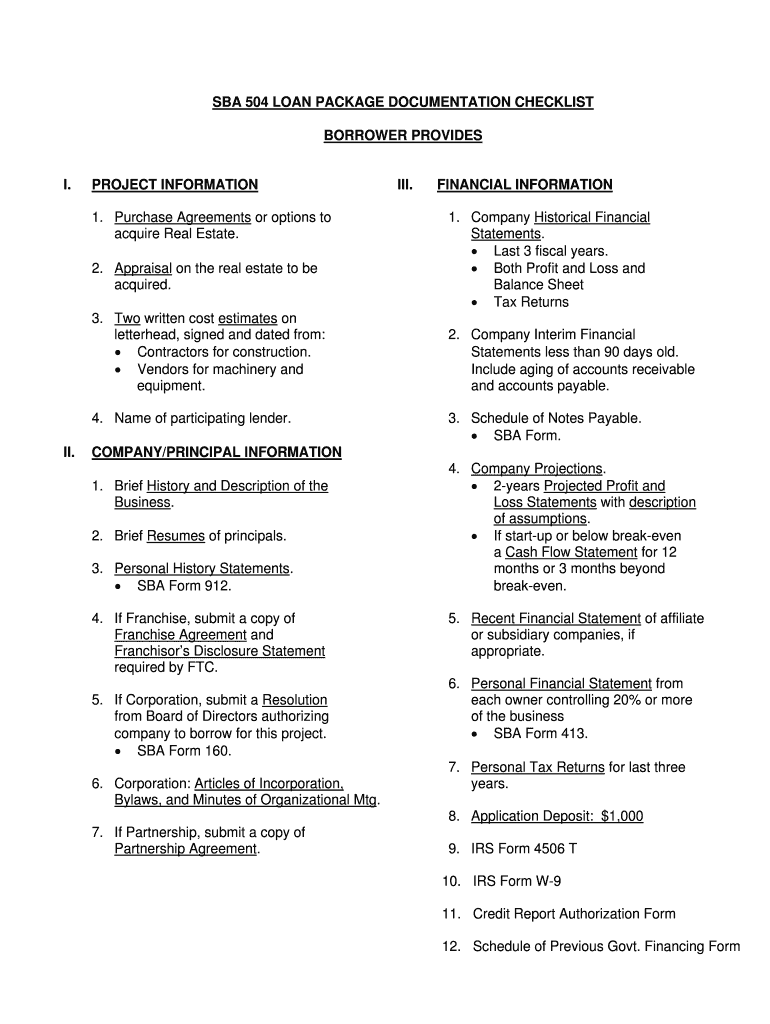

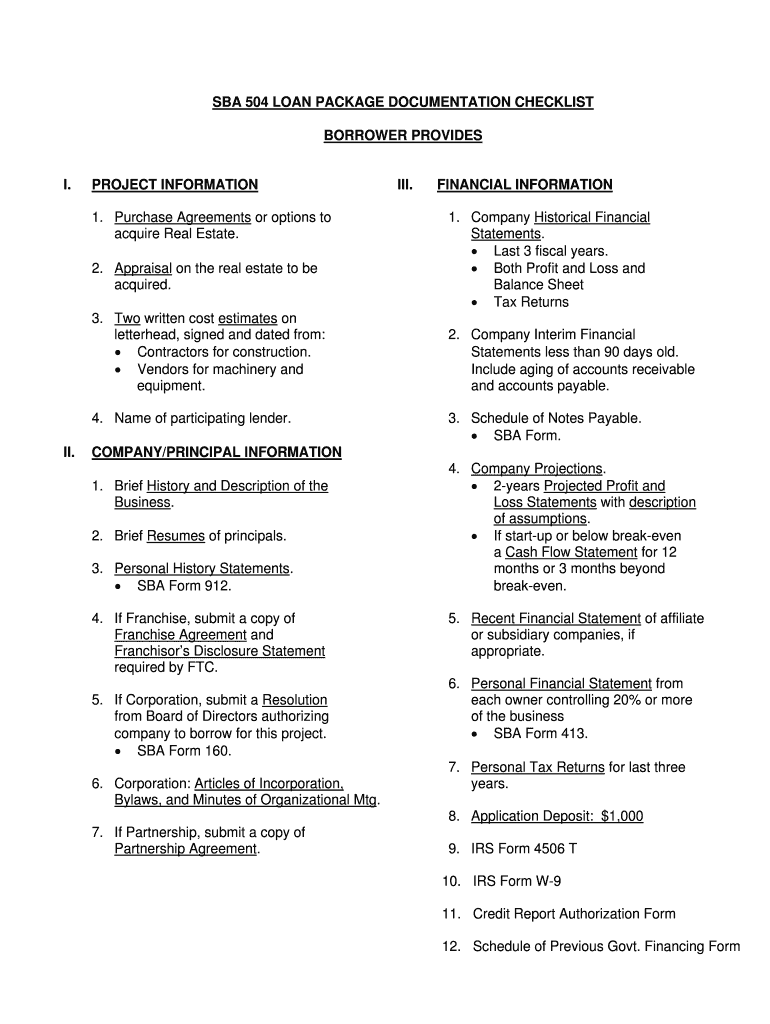

SBA 504 LOAN PACKAGE DOCUMENTATION CHECKLIST BORROWER PROVIDES.PROJECT INFORMATION 1. Purchase Agreements or options to acquire Real Estate. 2. Appraisal on the real estate to be acquired. 3. Two

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sba 504 loan package

Edit your sba 504 loan package form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sba 504 loan package form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sba 504 loan package online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sba 504 loan package. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sba 504 loan package

How to Fill Out SBA 504 Loan Package:

01

Begin by gathering all the necessary documentation required for the SBA 504 loan package. This typically includes financial statements, tax returns, business plans, and personal information of the applicants.

02

Familiarize yourself with the application forms provided by the SBA. These forms may include SBA Form 1244, SBA Form 1919, and SBA Form 912, among others. Review each form carefully to understand the information and documentation required for each section.

03

Fill out the personal information section of the application forms. This includes providing personal details such as name, address, social security number, and contact information. Make sure to provide accurate and up-to-date information.

04

Complete the financial information section of the application forms. This requires providing details about your business's financial history, including cash flow statements, balance sheets, profit and loss statements, and tax returns. Be thorough and accurate when filling out this section, as it significantly impacts the loan approval process.

05

Include any necessary collateral information. If you are pledging assets as collateral for the loan, provide a detailed description of the assets and their value. This can include real estate, equipment, inventory, or other business assets.

06

Prepare a comprehensive business plan that outlines your company's history, objectives, financial projections, and marketing strategies. The business plan is a crucial component of the SBA 504 loan package, as it helps lenders evaluate the viability and potential of your business.

07

Include any additional supporting documents that are relevant to your loan application. This may include purchase agreements, leases, industry analysis, or any other documentation that strengthens your loan request.

Who Needs SBA 504 Loan Package:

01

Small business owners looking to purchase or improve commercial real estate or heavy machinery.

02

Entrepreneurs seeking long-term, fixed-rate financing with lower down payments and competitive interest rates.

03

Companies that meet the eligibility criteria set by the SBA for the 504 loan program, including certain size and revenue thresholds, operating in eligible industries, and demonstrating a need for funding for real estate or equipment.

Note: It is important to consult with a professional such as a lender, financial advisor, or Small Business Administration representative to ensure accuracy and completeness when filling out the SBA 504 loan package.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the sba 504 loan package electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your sba 504 loan package in seconds.

How do I fill out sba 504 loan package using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign sba 504 loan package and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit sba 504 loan package on an iOS device?

Use the pdfFiller mobile app to create, edit, and share sba 504 loan package from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is sba 504 loan package?

The SBA 504 loan package is a financing option designed to help small businesses purchase fixed assets like land, buildings, and equipment.

Who is required to file sba 504 loan package?

Small business owners looking to acquire fixed assets for their business are required to file the SBA 504 loan package.

How to fill out sba 504 loan package?

To fill out the SBA 504 loan package, applicants must provide detailed information about their business, financial statements, and the purpose of the loan.

What is the purpose of sba 504 loan package?

The purpose of the SBA 504 loan package is to provide small businesses with long-term financing for the acquisition of fixed assets.

What information must be reported on sba 504 loan package?

The SBA 504 loan package must include information about the business, its financial standing, the intended use of the loan, and the collateral being offered.

Fill out your sba 504 loan package online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sba 504 Loan Package is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.