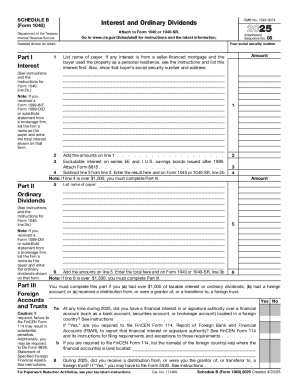

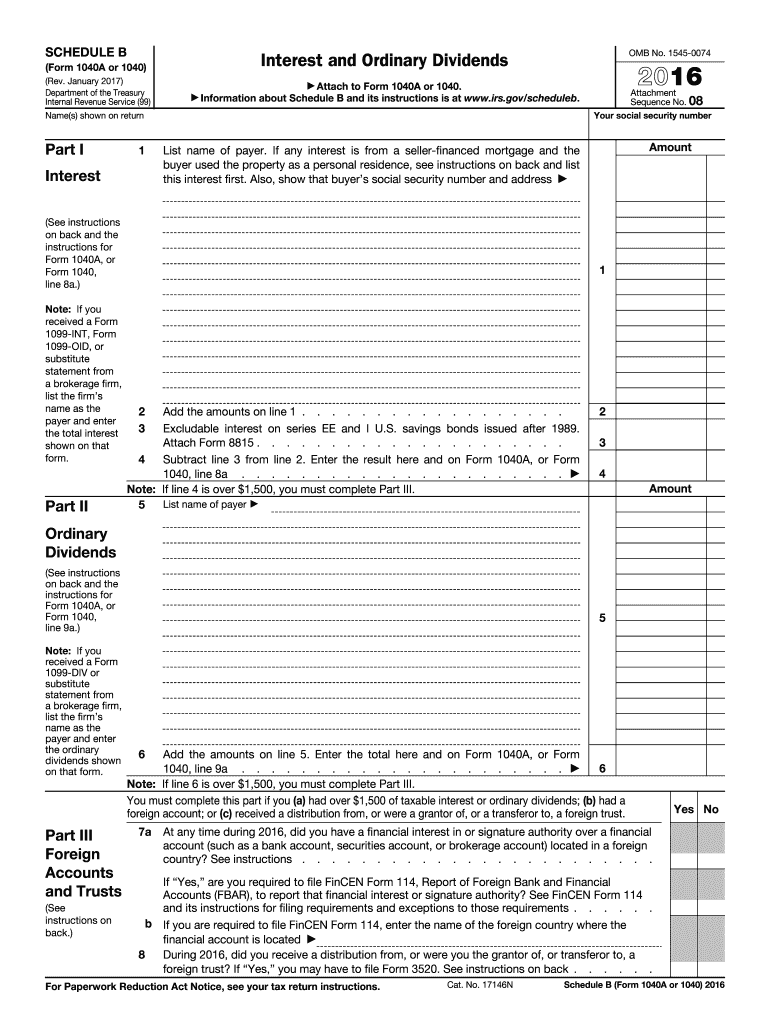

IRS 1040 - Schedule B 2016 free printable template

Instructions and Help about IRS 1040 - Schedule B

How to edit IRS 1040 - Schedule B

How to fill out IRS 1040 - Schedule B

About IRS 1040 - Schedule B 2016 previous version

What is IRS 1040 - Schedule B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule B

What should I do if I realize I've made a mistake on my submitted schedule b 2016 form?

If you discover an error after filing your schedule b 2016 form, you can submit a corrected form. Ensure to clearly indicate on the new submission that it is an amendment to avoid confusion. Keep records of both submissions for your files.

How can I track the status of my schedule b 2016 form after submission?

To verify receipt and processing of your schedule b 2016 form, you can check the online processing tool provided by the IRS. If you've e-filed and encounter rejections, note down the common rejection codes to troubleshoot accordingly.

What common errors should I be aware of when filing the schedule b 2016 form?

One common mistake when completing the schedule b 2016 form is omitting required information, such as interest or dividend sources. Double-check each entry to ensure completeness to avoid processing delays or penalties.

Can an authorized representative file the schedule b 2016 form on behalf of someone else?

Yes, an authorized representative can file the schedule b 2016 form on behalf of another individual. Proper power of attorney documentation must be submitted to validate representation. This ensures compliance and accurate filing.

What are the implications for data privacy and security when submitting the schedule b 2016 form electronically?

When e-filing the schedule b 2016 form, it's essential to use secure software that complies with IRS guidelines for data protection. This helps safeguard your sensitive information during transmission and storage, maintaining privacy throughout the process.

See what our users say