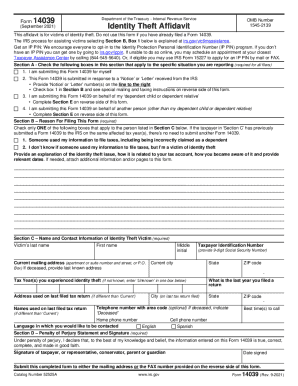

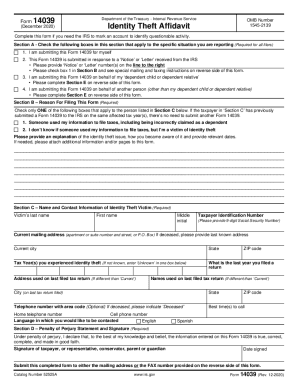

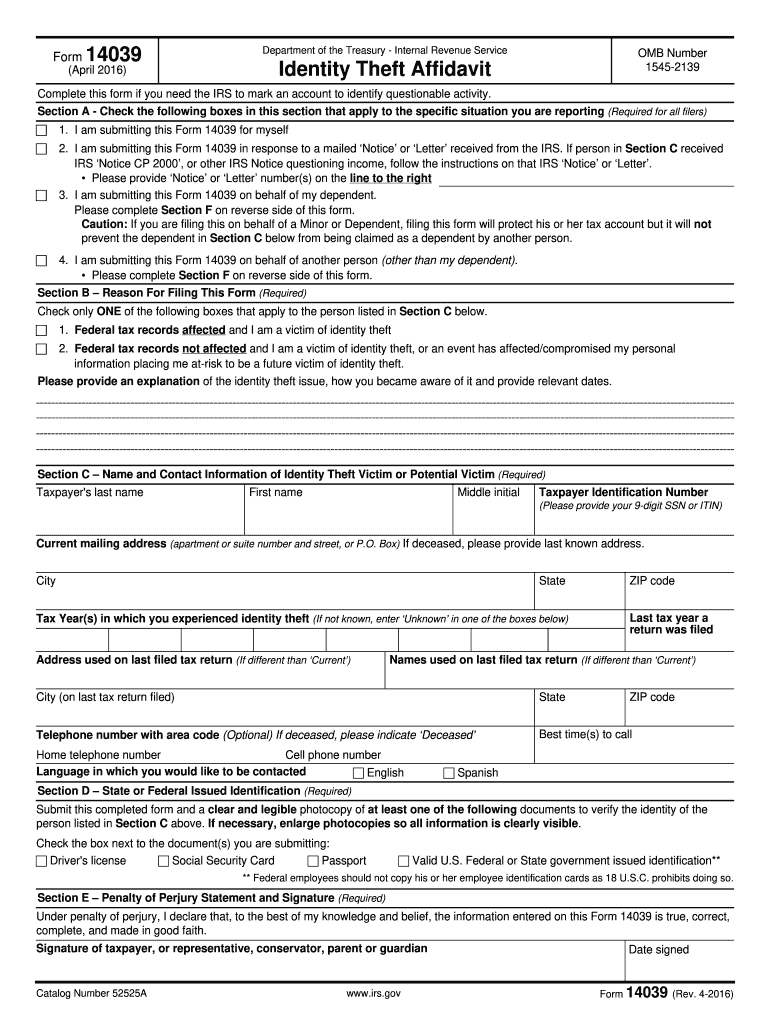

IRS 14039 2016 free printable template

Instructions and Help about IRS 14039

How to edit IRS 14039

How to fill out IRS 14039

About IRS 14 previous version

What is IRS 14039?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

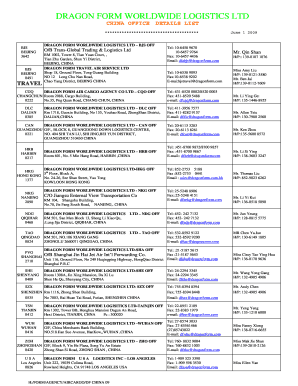

Where do I send the form?

FAQ about IRS 14039

What should I do if I notice a mistake on my filed IRS Form 14039 2016?

If you realize there’s an error after filing your IRS Form 14039 2016, you should promptly submit a corrected version. Depending on the nature of the mistake, you may also need to include an explanation. Keep copies of any corrected submissions and related communications for your records.

How can I track the status of my IRS Form 14039 2016 after submission?

To verify the status of your IRS Form 14039 2016, you can use the IRS's online tools or contact them directly for updates. Ensure you have your submission details handy, as they will assist in retrieving your information accurately.

Are e-signatures accepted when filing IRS Form 14039 2016?

Yes, e-signatures are generally accepted for IRS Form 14039 2016, provided the filing methods allow it. Be sure to check the specific guidelines related to your filing method to ensure compliance.

What should I do if my IRS Form 14039 2016 is rejected?

If your IRS Form 14039 2016 is rejected, you will receive a notification stating the reasons for the rejection. Review these reasons carefully, make the necessary corrections, and resubmit your form promptly.

How can nonresidents or foreign payees effectively manage IRS Form 14039 2016 requirements?

Nonresidents and foreign payees should familiarize themselves with specific filing guidelines pertaining to IRS Form 14039 2016. It's important to ensure all required documentation is correctly completed, as the tax obligations may vary significantly from those of residents.

See what our users say