IRS 1040 - Schedule C-EZ 2016 free printable template

Show details

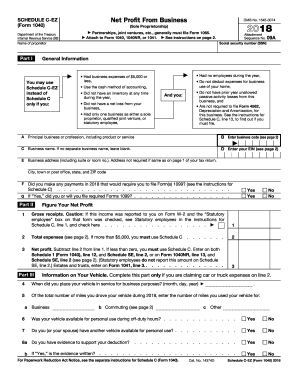

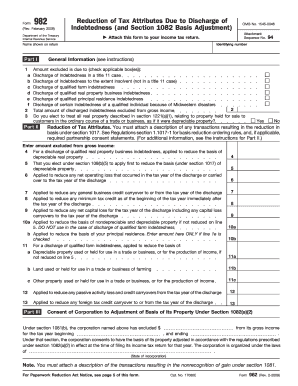

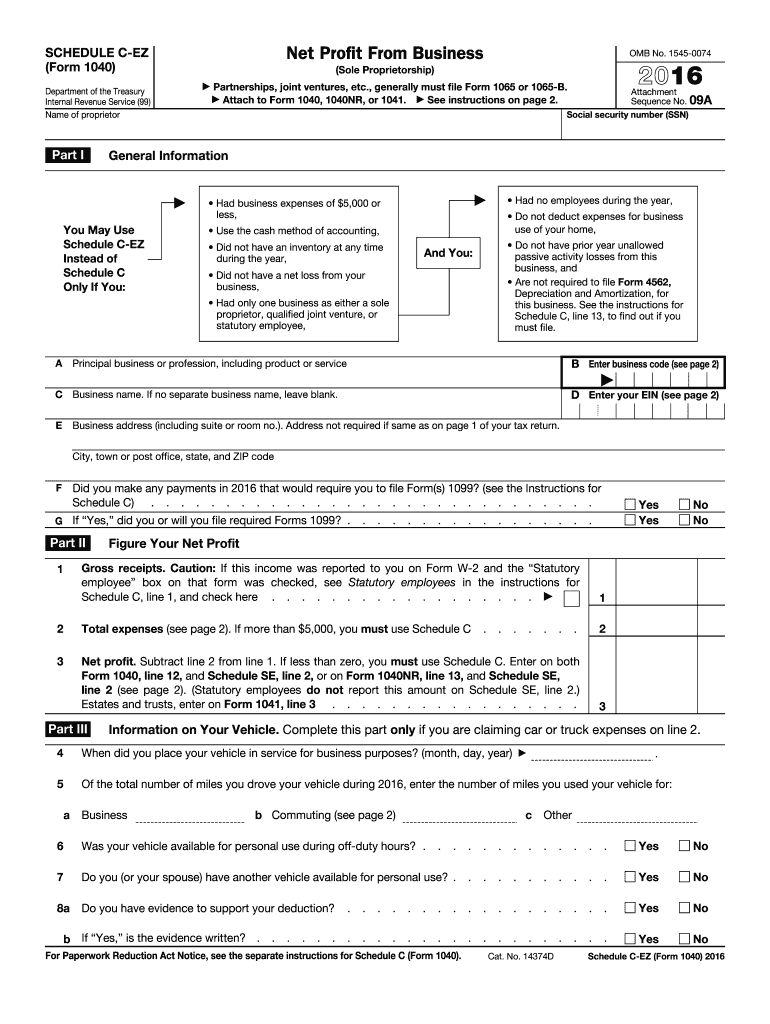

For the latest information about developments related to Schedule C-EZ Form 1040 and its go to www.irs.gov/schedulecez. Net Profit From Business SCHEDULE C-EZ Form 1040 Partnerships joint ventures etc. generally must file Form 1065 or 1065-B. Attach to Form 1040 1040NR or 1041. See instructions on page 2. Attachment Sequence No. 09A Social security number SSN General Information You May Use Schedule C-EZ Instead of Only If You Had no employees during the year Had business expenses of 5 000 or...less Do not deduct expenses for business use of your home Use the cash method of accounting Did not have an inventory at any time during the year Do not have prior year unallowed passive activity losses from this business and Are not required to file Form 4562 Depreciation and Amortization for this business. CAUTION Line F See the instructions for Schedule C line I to help determine if you are required to file any Forms 1099. Before you begin see General Instructions in the 2016 Line 1 You can...use Schedule C-EZ instead of Schedule C if You operated a business or practiced a profession as a sole proprietorship or qualified joint venture or you were a statutory employee and You have met all the requirements listed in Schedule C-EZ Part I. Before you begin see General Instructions in the 2016 Line 1 You can use Schedule C-EZ instead of Schedule C if You operated a business or practiced a profession as a sole proprietorship or qualified joint venture or you were a statutory employee and ...You have met all the requirements listed in Schedule C-EZ Part I. For more information on electing to be taxed as a qualified joint venture including the possible social security benefits of this election see Qualified Joint Venture in the Instructions for Schedule C. You can also go to IRS.gov and enter qualified joint venture in the search box. Enter gross receipts from your trade or business. See the instructions for Schedule C line 13 to find out if you must file. And You Did not have a net...loss from your Had only one business as either a sole proprietor qualified joint venture or statutory employee A Sole Proprietorship Department of the Treasury Internal Revenue Service 99 Name of proprietor Part I OMB No* 1545-0074 B Enter business code see page 2 Principal business or profession including product or service D Enter your EIN see page 2 C Business name. If no separate business name leave blank. E Business address including suite or room no. Address not required if same as on...page 1 of your tax return* City town or post office state and ZIP code Did you make any payments in 2016 that would require you to file Form s 1099 see the Instructions for Schedule C. F G If Yes did you or will you file required Forms 1099. Yes No Figure Your Net Profit Gross receipts. Caution If this income was reported to you on Form W-2 and the Statutory employee box on that form was checked see Statutory employees in the instructions for Total expenses see page 2. If more than 5 000 you...must use Schedule C Net profit. Subtract line 2 from line 1. If less than zero you must use Schedule C.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

How to fill out IRS 1040 - Schedule C-EZ

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

To edit the IRS 1040 - Schedule C-EZ, first obtain a copy of the form, either in print or digital format. If you are using an editable PDF, you can fill in the fields directly. For handwritten versions, utilize a black or blue pen for clarity. Make sure to check your edits against IRS guidelines to ensure compliance before submission.

How to fill out IRS 1040 - Schedule C-EZ

To fill out the IRS 1040 - Schedule C-EZ, follow these steps:

01

Gather necessary documents such as your business income and expense records.

02

Complete personal information at the top of the form, including your name and Social Security number.

03

Report your business income in Part I of the form by entering the gross receipts or sales.

04

In Part II, list your business expenses within the applicable categories.

05

Calculate your net profit or loss and transfer this information to your Form 1040.

About IRS 1040 - Schedule C-EZ 2016 previous version

What is IRS 1040 - Schedule C-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1040 - Schedule C-EZ 2016 previous version

What is IRS 1040 - Schedule C-EZ?

IRS 1040 - Schedule C-EZ is a tax form used by self-employed individuals to report business income and expenses. This simplified form is designed for small businesses with minimal expenses, making it easier to file taxes compared to the standard Schedule C form. It allows eligible filers to streamline their reporting process while still complying with U.S. tax regulations.

What is the purpose of this form?

The primary purpose of the IRS 1040 - Schedule C-EZ is to help self-employed individuals accurately report their income and deduct certain business expenses. By providing a straightforward means of documenting business profits and losses, this form makes tax filing more efficient for qualifying taxpayers.

Who needs the form?

Individuals who are self-employed and meet specific eligibility criteria should use IRS 1040 - Schedule C-EZ. This includes sole proprietors with uncomplicated business operations. Common filers include freelancers, independent contractors, and small business owners whose expenses do not exceed certain limits.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1040 - Schedule C-EZ if your business expenses exceed $5,000, your net profit is zero, or if you operate as a partnership or corporation. Additionally, if you were a statutory employee, different reporting requirements will apply, and you won’t use this form.

Components of the form

The IRS 1040 - Schedule C-EZ consists of two main sections: Part I focuses on gross receipts or sales, while Part II outlines specific business expenses. Taxpayers will also need to calculate their net profit or loss and provide their business address. This layout simplifies data entry and tracking for small business owners.

What are the penalties for not issuing the form?

If you fail to file IRS 1040 - Schedule C-EZ when required, you may incur penalties. The IRS imposes fines for late filing, which can escalate over time. Additionally, failing to report income might trigger interest on unpaid taxes, and could lead to further scrutiny during audits, resulting in additional penalties.

What information do you need when you file the form?

Before filing IRS 1040 - Schedule C-EZ, gather the following information:

01

Your total gross receipts or sales

02

All relevant business expenses, including costs related to supplies, travel, and advertising

03

Your business name and address, if applicable

04

Your Social Security number or Employer Identification Number (EIN), if you have one

Is the form accompanied by other forms?

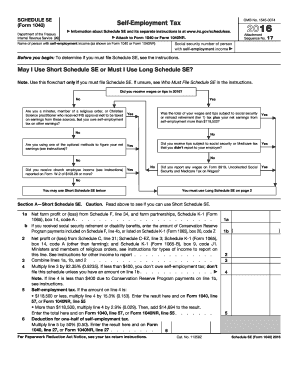

IRS 1040 - Schedule C-EZ is often submitted alongside Form 1040, the U.S. Individual Income Tax Return. Depending on your tax situation, you may also need to include other forms, such as the Schedule SE for self-employment tax calculation. Ensure that all required documents are properly filled and attached to avoid processing delays.

Where do I send the form?

After completing IRS 1040 - Schedule C-EZ, send it to the address listed in the instructions for Form 1040. Mailing addresses may vary based on your state of residence and whether you are enclosing a payment. Consult the latest IRS guidelines to confirm the correct submission location.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

PDF Filler makes it possible to do my job.

My company doesn't offer the software to do so.

Best PDF fill and sign application I have used.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.