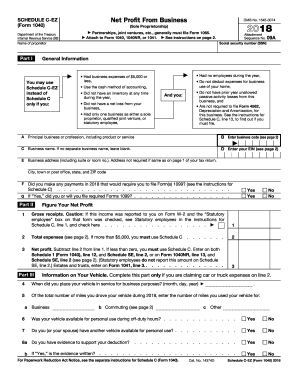

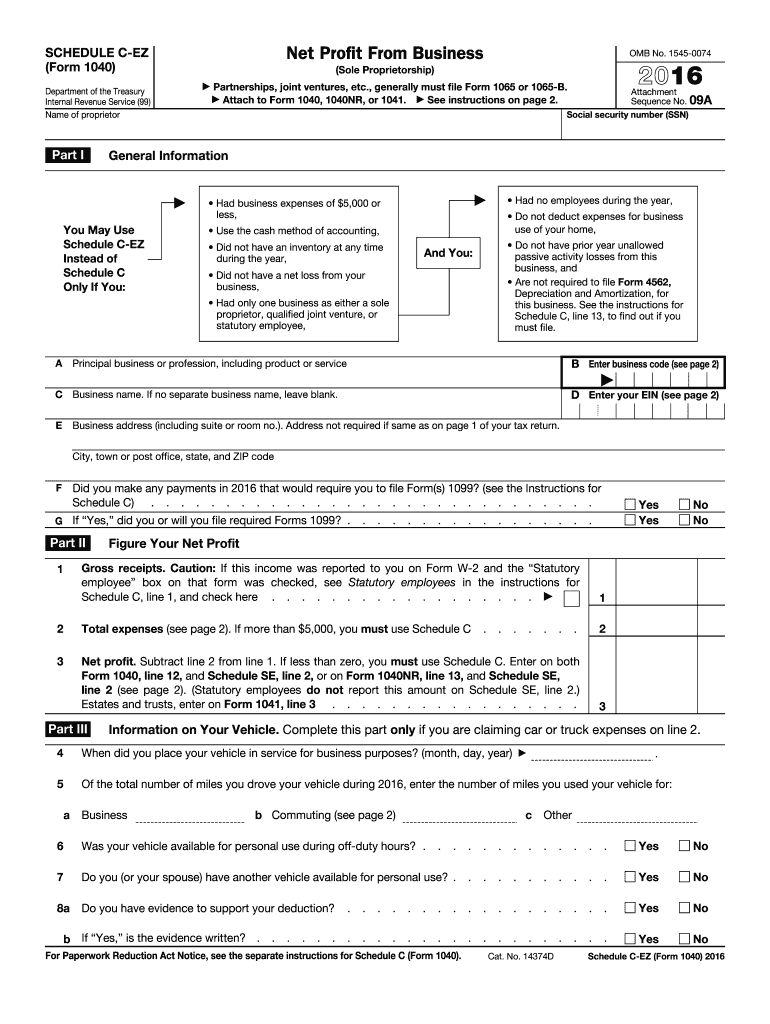

IRS 1040 - Schedule C-EZ 2016 free printable template

Instructions and Help about IRS 1040 - Schedule C-EZ

How to edit IRS 1040 - Schedule C-EZ

How to fill out IRS 1040 - Schedule C-EZ

About IRS 1040 - Schedule C-EZ 2016 previous version

What is IRS 1040 - Schedule C-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 1040 schedule c ez

How can I send [SKS] for eSignature?

[SKS] is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the [SKS] in Gmail?

Create your eSignature using pdfFiller and then eSign your [SKS] immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit [SKS] straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing [SKS] right away.

What is IRS 1040 - Schedule C-EZ?

IRS 1040 - Schedule C-EZ is a simplified form used by sole proprietors to report income from their business activities. It is designed for individuals with uncomplicated business income and expenses.

Who is required to file IRS 1040 - Schedule C-EZ?

Taxpayers who operate a sole proprietorship with single-member LLC status and have business expenses that total less than $5,000, do not file any inventory, and do not have losses are eligible to file Schedule C-EZ.

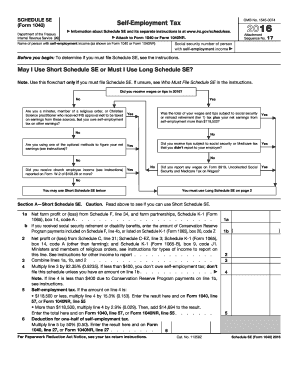

How to fill out IRS 1040 - Schedule C-EZ?

To fill out IRS 1040 - Schedule C-EZ, provide your business information, report your gross receipts, enter your expenses as applicable, and calculate your net profit or loss before transferring this information to your Form 1040.

What is the purpose of IRS 1040 - Schedule C-EZ?

The purpose of IRS 1040 - Schedule C-EZ is to enable small business owners to report their income and expenses in a straightforward manner, facilitating easier tax reporting for those with simple business structures.

What information must be reported on IRS 1040 - Schedule C-EZ?

Information that must be reported on IRS 1040 - Schedule C-EZ includes business name, income from sales, gross receipts, and allowed business expenses such as car and truck expenses, supplies, and certain other costs.

See what our users say