FL RTS-70 2014 free printable template

Show details

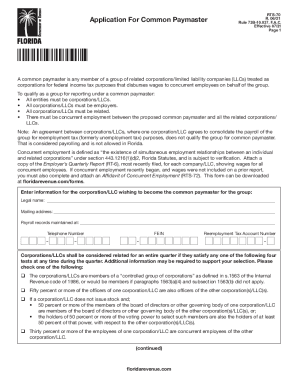

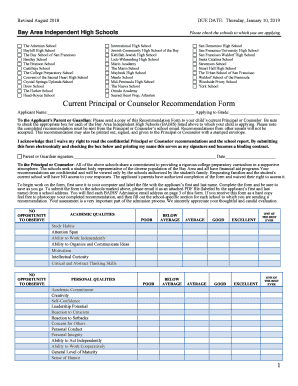

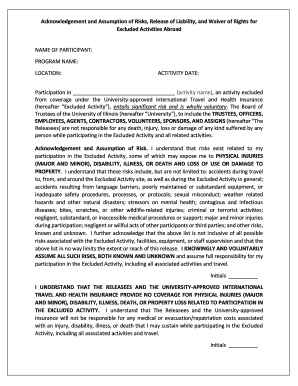

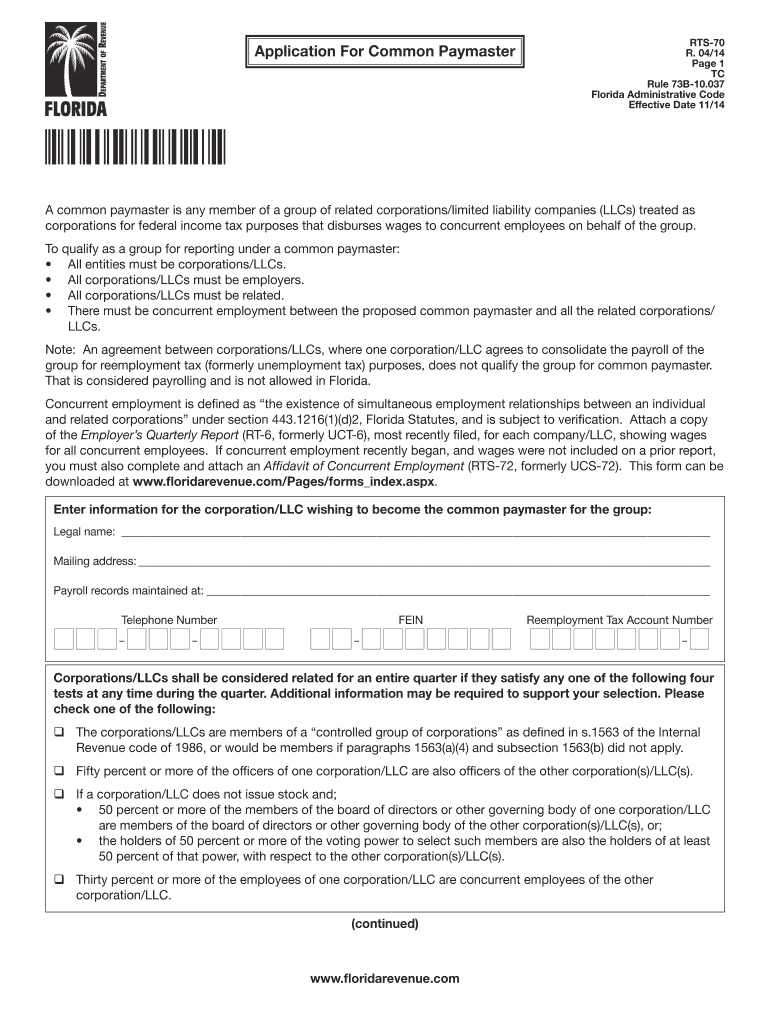

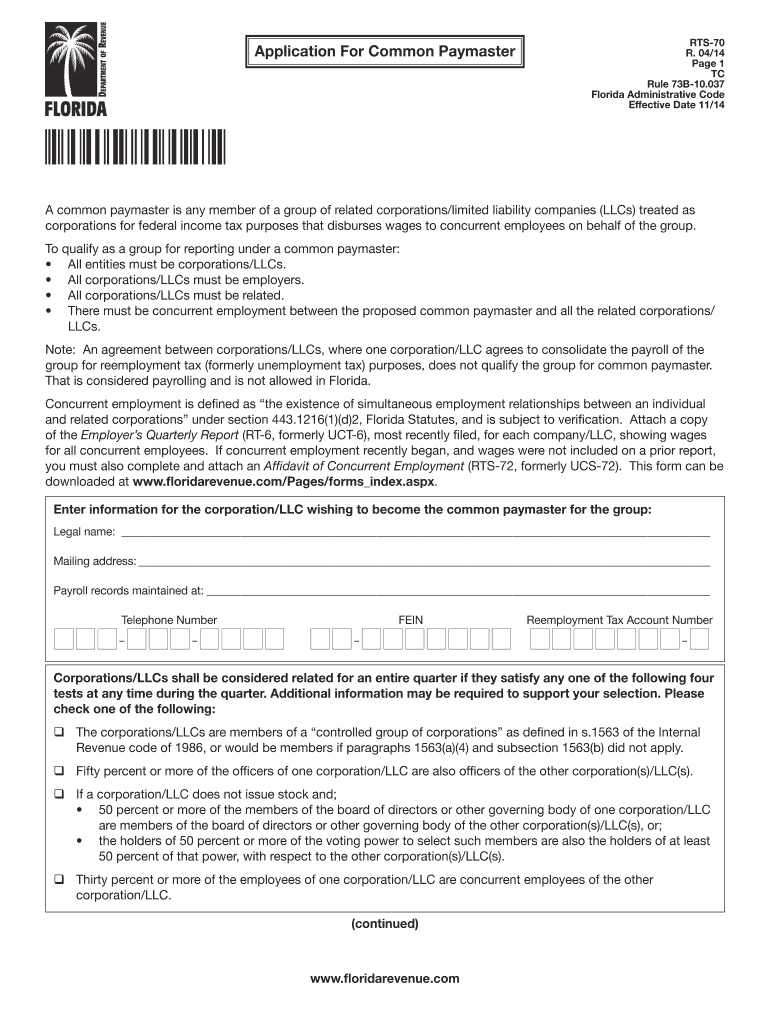

Application For Common Paymaster RTS70 R. 04/14-Page 1 TC Rule 73B10.037 Florida Administrative Code Effective Date 11/14 A common paymaster is any member of a group of related corporations/limited

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign FL RTS-70

Edit your FL RTS-70 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your FL RTS-70 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit FL RTS-70 online

Follow the steps below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit FL RTS-70. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL RTS-70 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out FL RTS-70

How to fill out FL RTS-70

01

Obtain the FL RTS-70 form from the appropriate state department website or office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Provide any required identification numbers, such as your Social Security Number or tax ID.

04

Complete the relevant sections describing your request or submission, following any instructions provided.

05

Review the form for any mistakes or missing information before submission.

06

Submit the completed FL RTS-70 form either by mail or in person to the designated agency.

Who needs FL RTS-70?

01

Individuals or businesses applying for specific state programs requiring the FL RTS-70 form.

02

Anyone filing for permits, licenses, or registrations that necessitate this documentation.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between common pay agent and common paymaster?

Unlike a Common Pay Agent, the use of a Common Paymaster is not purely for admin simplicity. Since a Common Paymaster is treated as a single employer, those employees are only subject to a single annual taxable wage base for FICA and FUTA tax purposes.

What does common paymaster mean?

Reg. Section 31.3121(s)-1(b)(2) defines “common paymaster” as a member of a group of related corporations that disburses remuneration to employees of two or more corporations on their behalf and is responsible for keeping books and records for the payroll with respect to those employees.

What is a common paymaster agreement?

The common paymaster must pay concurrently employed individuals by one combined paycheck, drawn on a single bank account, or by separate paychecks, drawn by the common paymaster on the accounts of one or more employing corporations. The final component is “concurrent employment” which is defined in Treas. Reg.

What is a common paymaster in Pennsylvania?

Common Paymaster Reporting Not Permitted Under the Pennsylvania Unemployment Compensation Law. A “common paymaster” is one employer within a group of employers that pays the wages of its own employees as well as the wages of the employees of the other members of the group.

Who qualifies for common paymaster?

What companies qualify for the common paymaster tax break? Your company must meet the following requirements to be eligible for this tax break: A minimum of 30% of the employees of one company must work for the other company. At least 50% of the officers of one company must be officers of the other entity.

Can LLC be common paymaster?

If a business owner operates more than one C and/or S corporation (or LLC taxed as such), he/she may be able to avoid overpaying FICA taxes by utilizing a Common Paymaster.

What is a common paymaster agent?

Reg. Section 31.3121(s)-1(b)(2) defines “common paymaster” as a member of a group of related corporations that disburses remuneration to employees of two or more corporations on their behalf and is responsible for keeping books and records for the payroll with respect to those employees.

What is a common paymaster in Florida?

A common paymaster is any member of a group of related corporations/limited liability companies (LLCs) treated as corporations for federal income tax purposes that disburses wages to concurrent employees on behalf of the group.

What is the paymaster rule?

What is the Common Paymaster Rule? A solution is the common paymaster rule. The rule states that the parent entity is allowed to calculate payroll taxes for these wandering employees as though they had a single employer for the entire calendar year.

What is common paymaster Wisconsin?

The common paymaster reports the wages of the employees that work concurrently with it and one or more of the other related corporations. If any of the above conditions are not met, then each employing unit (separate corporation) must report their own employment under their own UI account.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify FL RTS-70 without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your FL RTS-70 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I get FL RTS-70?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the FL RTS-70 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make edits in FL RTS-70 without leaving Chrome?

FL RTS-70 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is FL RTS-70?

FL RTS-70 is a form used in Florida for reporting taxpayer information related to specific transactions and activities.

Who is required to file FL RTS-70?

Taxpayers who engage in certain specified transactions or activities that require reporting to the state are required to file FL RTS-70.

How to fill out FL RTS-70?

To fill out FL RTS-70, individuals must provide detailed information as specified in the form's instructions, including identifying information and specifics about the transactions.

What is the purpose of FL RTS-70?

The purpose of FL RTS-70 is to collect relevant financial information from taxpayers to ensure compliance with state tax regulations.

What information must be reported on FL RTS-70?

The information that must be reported on FL RTS-70 includes taxpayer identification data, details of the transactions being reported, and any applicable financial figures.

Fill out your FL RTS-70 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

FL RTS-70 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.