NY DTF NYC-204EZ 2016 free printable template

Show details

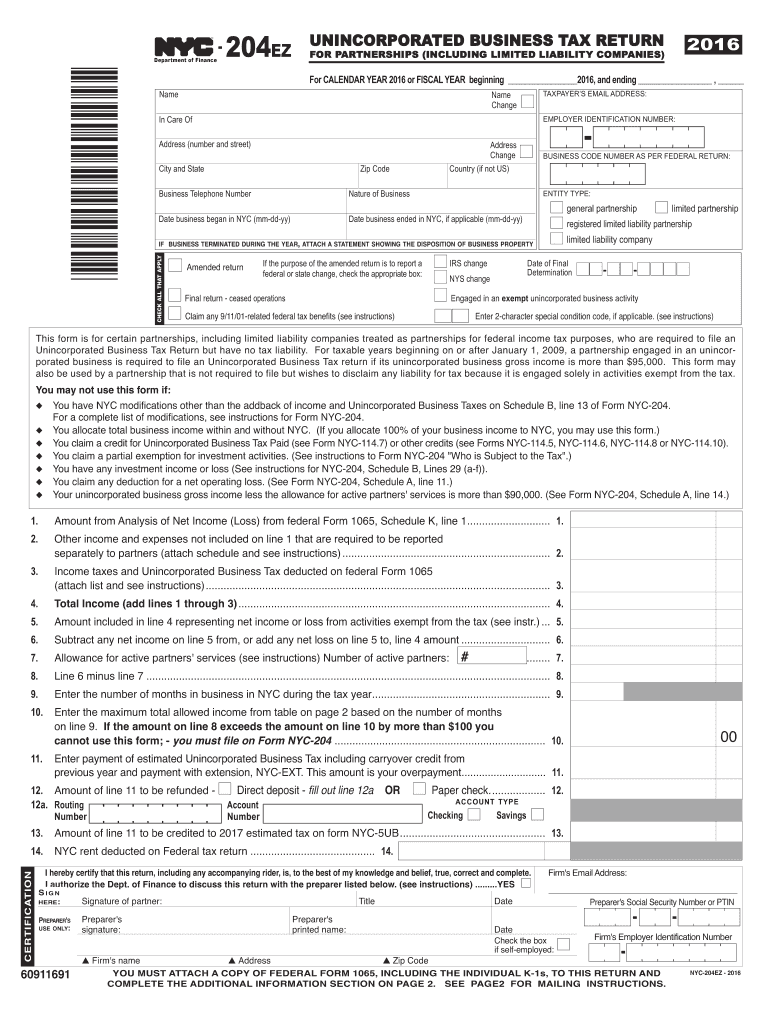

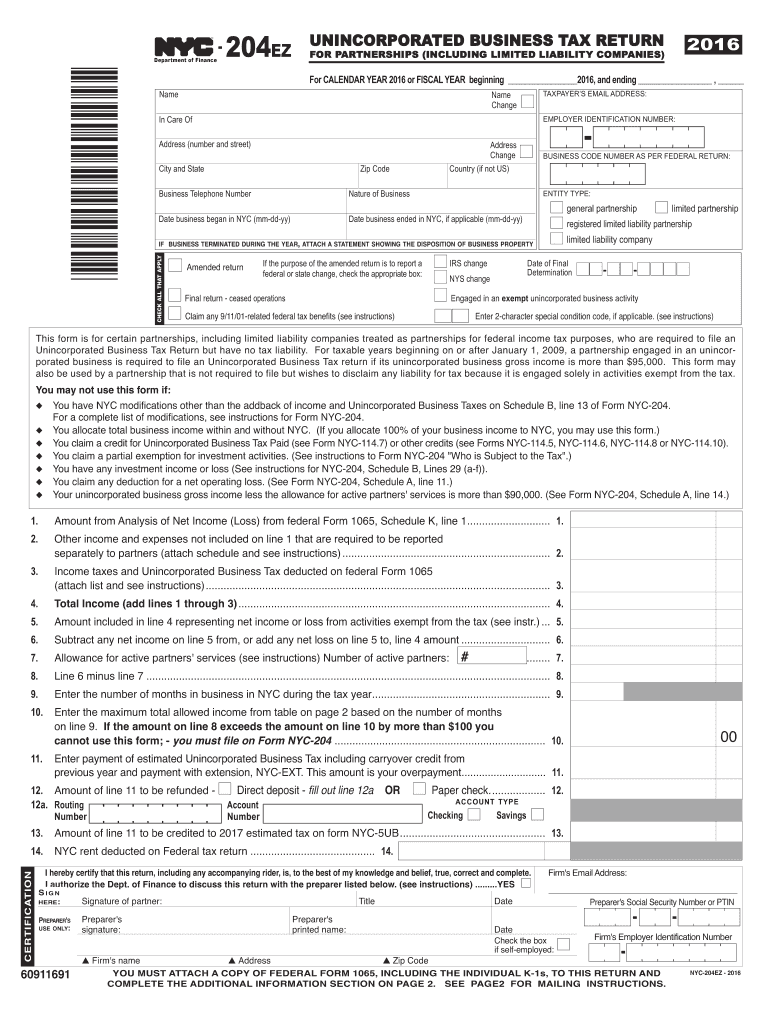

TM 204EZ Name UNINCORPORATED BUSINESS TAX RETURN FOR PARTNERSHIPS (INCLUDING LIMITED LIABILITY COMPANIES) Name Change Address (number and street) City and State Nature of Business Date business began

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF NYC-204EZ

Edit your NY DTF NYC-204EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF NYC-204EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF NYC-204EZ online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY DTF NYC-204EZ. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF NYC-204EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF NYC-204EZ

How to fill out NY DTF NYC-204EZ

01

Gather your financial documents including income statements and tax documents.

02

Download the NY DTF NYC-204EZ form from the New York State Department of Taxation and Finance website.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

Report your total income from all sources in the designated section.

05

Enter any applicable tax credits and deductions that you qualify for.

06

Calculate your total tax liability based on the provided tables and instructions.

07

Review the form for accuracy, ensuring all sections are completed correctly.

08

Sign and date the form at the bottom.

09

Submit the completed form electronically or by mail according to the instructions provided.

Who needs NY DTF NYC-204EZ?

01

Individuals who are residents of New York City and who meet certain income qualifications.

02

Self-employed individuals needing to report income on their personal tax return.

03

Taxpayers looking for a simplified method to file their New York City personal income tax.

Fill

form

: Try Risk Free

People Also Ask about

Who is required to file a partnership return?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Is NYC UBT deductible on Schedule C?

Yes, New York state income taxes that are specific to the business would be deducted on line 23 of Schedule C on your federal form 1040.

Who can file NYC 204 EZ?

Taxpayers that are required to file an Unincorporated Business Tax Return but have no tax liability may be eligible to file a Form NYC- 204 EZ.

Who is required to file NYC UBT?

If you have two or more Unincorporated Businesses, all are treated as one for the purpose of this tax. Tax Rates A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT.

What is an Article 22 partner New York?

Line F1, Article 22: A partner that is an individual, partnership or LLC treated as partnership for federal purposes, a trust, or estate.

What is NYC 204EZ?

This form is for certain partnerships, including limited liability companies treated as partnerships for federal income tax purposes, who are required to file an Unincorpo- rated Business Tax Return but have no tax liability. See instructions on Page 3. Page 2. Form NYC-204EZ - 2021.

Who Must File NYC Partnership Return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Who must file nyc partnership tax return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Who Must File Form NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

Who is required to file NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

Who must file NYC 4S?

S CORPORATIONS An S Corporation is subject to the General Corporation Tax and must file either Form NYC- 4S, NYC-4S-EZ or NYC-3L, whichever is appli- cable. Under certain limited circumstances, an S Corporation may be permitted or required to file a combined return (Form NYC-3A).

What is NYC unincorporated business tax?

A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT. An owner, lessee, or fiduciary who is engaged in holding, leasing, or managing real property for their own account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY DTF NYC-204EZ in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your NY DTF NYC-204EZ and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I send NY DTF NYC-204EZ to be eSigned by others?

To distribute your NY DTF NYC-204EZ, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get NY DTF NYC-204EZ?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the NY DTF NYC-204EZ in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

What is NY DTF NYC-204EZ?

NY DTF NYC-204EZ is a simplified tax form used by New York State for reporting income and calculating the tax liability for certain types of pass-through entities such as partnerships and S corporations.

Who is required to file NY DTF NYC-204EZ?

Entities that qualify as partnerships or S corporations, which meet specific criteria for eligibility and prefer a simplified reporting process, are required to file NY DTF NYC-204EZ.

How to fill out NY DTF NYC-204EZ?

To fill out NY DTF NYC-204EZ, follow the instructions provided on the form, ensuring to enter the entity's basic information, report the income, deductions, and calculate the tax due, while ensuring that all required sections are completed accurately.

What is the purpose of NY DTF NYC-204EZ?

The purpose of NY DTF NYC-204EZ is to provide a streamlined process for qualifying entities to report their income and tax obligations, simplifying the filing procedure for those eligible.

What information must be reported on NY DTF NYC-204EZ?

Information that must be reported on NY DTF NYC-204EZ includes the entity's name, address, identification number, income, deductions, and any applicable tax credits.

Fill out your NY DTF NYC-204EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF NYC-204ez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.