NY DTF NYC-204EZ 2022 free printable template

Show details

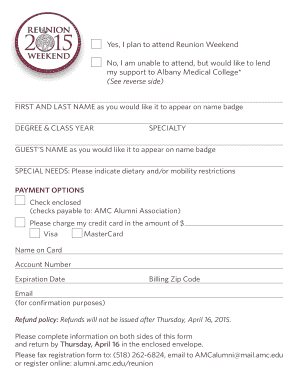

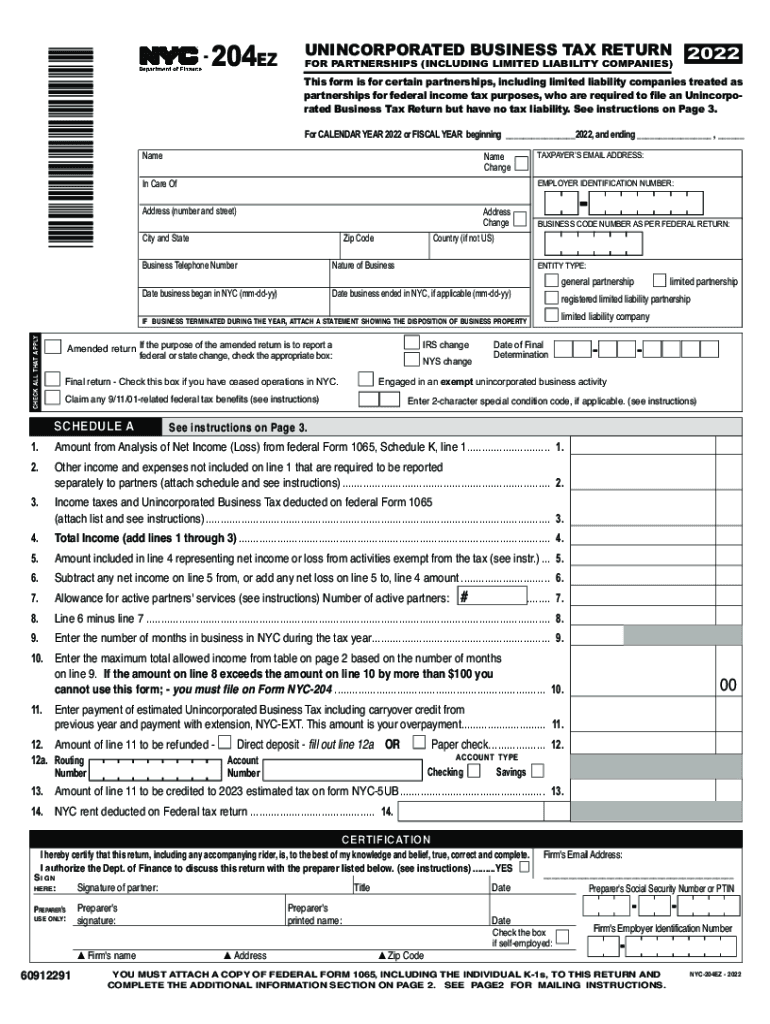

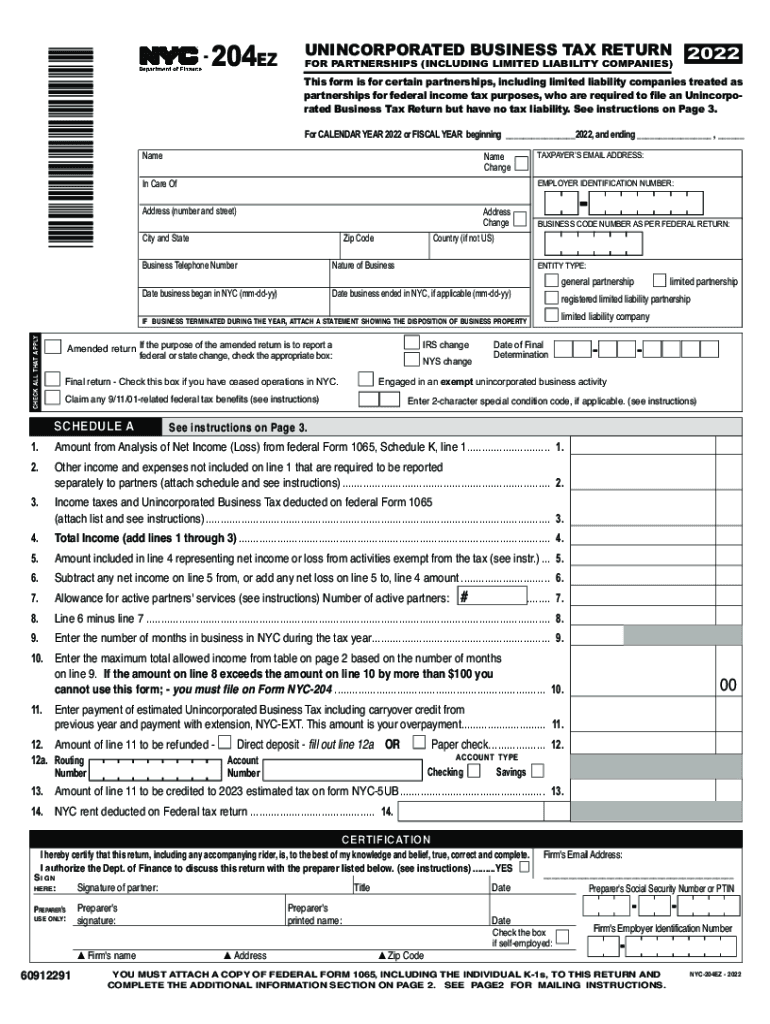

*60912291×204EZUNINCORPORATED BUSINESS TAX RETURN 2022 FOR PARTNERSHIPS (INCLUDING LIMITED LIABILITY COMPANIES)This form is for certain partnerships, including limited liability companies treated

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 204 instructions form

Edit your nyc240ez return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nyc finance return partnerships form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nyc240ez tax create online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nyc240ez limited search form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF NYC-204EZ Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out nyc240ez return fillable form

How to fill out NY DTF NYC-204EZ

01

Begin by downloading the NY DTF NYC-204EZ form from the official New York State Department of Taxation and Finance website.

02

Read the instructions carefully to understand the eligibility requirements and necessary documents.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Indicate your filing status (e.g., single, married) and complete any necessary sections related to your dependents.

05

Enter your total income earned and any applicable deductions.

06

Calculate your tax liability according to the provided tables or formulas.

07

Review the form for accuracy and completeness.

08

Sign and date the form.

09

Submit the completed form by mailing it to the appropriate address provided in the instructions or file electronically if allowed.

Who needs NY DTF NYC-204EZ?

01

Individuals residing in New York City who are eligible to file a simplified tax return.

02

Taxpayers with no or limited sources of income.

03

Those who don't have complex tax situations, such as multiple streams of income or extensive deductions.

Fill

nyc return limited

: Try Risk Free

People Also Ask about 240ez liability search

Who is required to file a partnership return?

Filing requirements You must file a Partnership Return of Income (Form 565) if you're: Engaged in a trade or business in California. Have income from California sources. Use a Pass-Through Entity Ownership (Schedule EO 568) to report any ownership interest in other partnerships or limited liability companies.

Is NYC UBT deductible on Schedule C?

Yes, New York state income taxes that are specific to the business would be deducted on line 23 of Schedule C on your federal form 1040.

Who can file NYC 204 EZ?

Taxpayers that are required to file an Unincorporated Business Tax Return but have no tax liability may be eligible to file a Form NYC- 204 EZ.

Who is required to file NYC UBT?

If you have two or more Unincorporated Businesses, all are treated as one for the purpose of this tax. Tax Rates A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT.

What is an Article 22 partner New York?

Line F1, Article 22: A partner that is an individual, partnership or LLC treated as partnership for federal purposes, a trust, or estate.

What is NYC 204EZ?

This form is for certain partnerships, including limited liability companies treated as partnerships for federal income tax purposes, who are required to file an Unincorpo- rated Business Tax Return but have no tax liability. See instructions on Page 3. Page 2. Form NYC-204EZ - 2021.

Who Must File NYC Partnership Return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Who must file nyc partnership tax return?

Income tax responsibilities must file Form IT-204, Partnership Return if it has either (1) at least one partner who is an individual, estate, or trust that is a resident of New York State, or (2) any income, gain, loss, or deduction from New York sources (see instructions).

Who Must File Form NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

Who is required to file NYC 204?

Any partnership that carries on or liquidates any trade, business, profession or occupation wholly or partly within New York City and has a total gross income from all business regardless of where carried on of more than $25,000 (prior to any deduction for cost of goods sold or services performed) must file an

Who must file NYC 4S?

S CORPORATIONS An S Corporation is subject to the General Corporation Tax and must file either Form NYC- 4S, NYC-4S-EZ or NYC-3L, whichever is appli- cable. Under certain limited circumstances, an S Corporation may be permitted or required to file a combined return (Form NYC-3A).

What is NYC unincorporated business tax?

A 4% tax rate is charged for taxable income allocated to New York City. Who is Exempt from this Tax? Performing services as an employee is not subject to UBT. An owner, lessee, or fiduciary who is engaged in holding, leasing, or managing real property for their own account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the nyc240ez unincorporated search in Gmail?

Create your eSignature using pdfFiller and then eSign your nyc 240ez unincorporated immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out NY DTF NYC-204EZ using my mobile device?

Use the pdfFiller mobile app to complete and sign NY DTF NYC-204EZ on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I fill out NY DTF NYC-204EZ on an Android device?

On an Android device, use the pdfFiller mobile app to finish your NY DTF NYC-204EZ. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is NY DTF NYC-204EZ?

NY DTF NYC-204EZ is a simplified tax form used by certain taxpayers in New York State for reporting their personal income tax and calculating the amount of tax owed or refund expected.

Who is required to file NY DTF NYC-204EZ?

Individuals who meet specific criteria, such as having a simple tax situation without complex income sources or significant deductions, are required to file NY DTF NYC-204EZ.

How to fill out NY DTF NYC-204EZ?

To fill out NY DTF NYC-204EZ, taxpayers should gather their income documents, enter their income, adjust for any deductions or credits, and then calculate their tax liability using the provided instructions and tables.

What is the purpose of NY DTF NYC-204EZ?

The purpose of NY DTF NYC-204EZ is to simplify the filing process for eligible taxpayers, making it easier to report income and calculate tax liabilities without the need for more complex forms.

What information must be reported on NY DTF NYC-204EZ?

The information that must be reported on NY DTF NYC-204EZ includes total income, adjustments to income, credits, and the calculation of tax owed or refund due.

Fill out your NY DTF NYC-204EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF NYC-204ez is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.