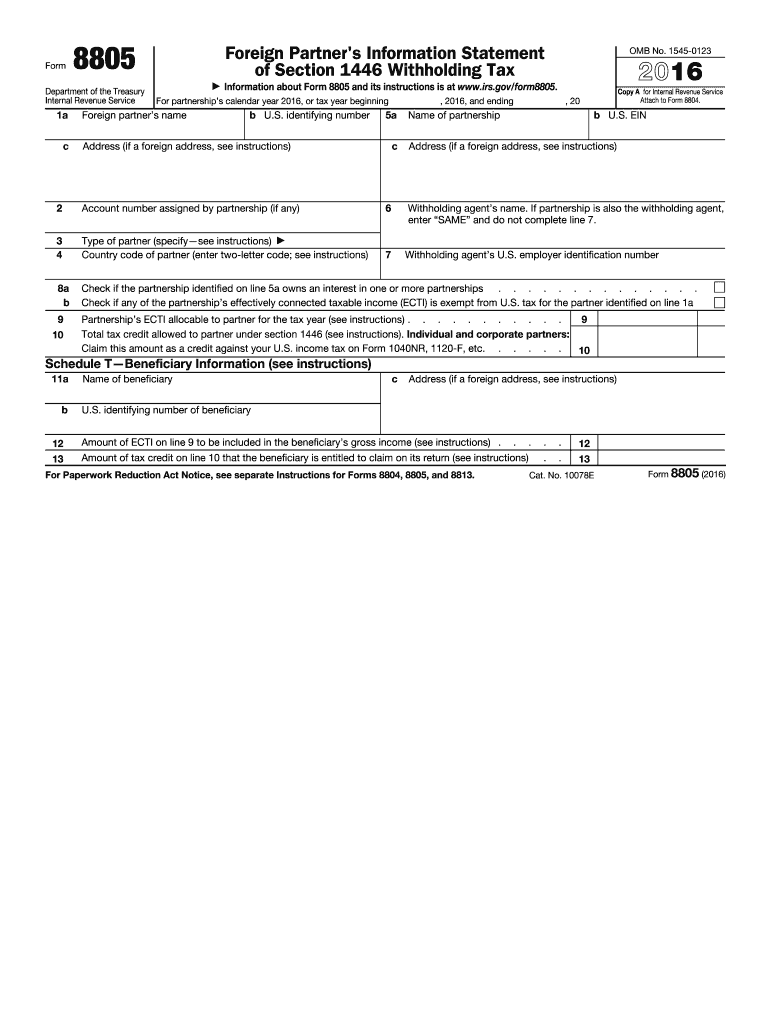

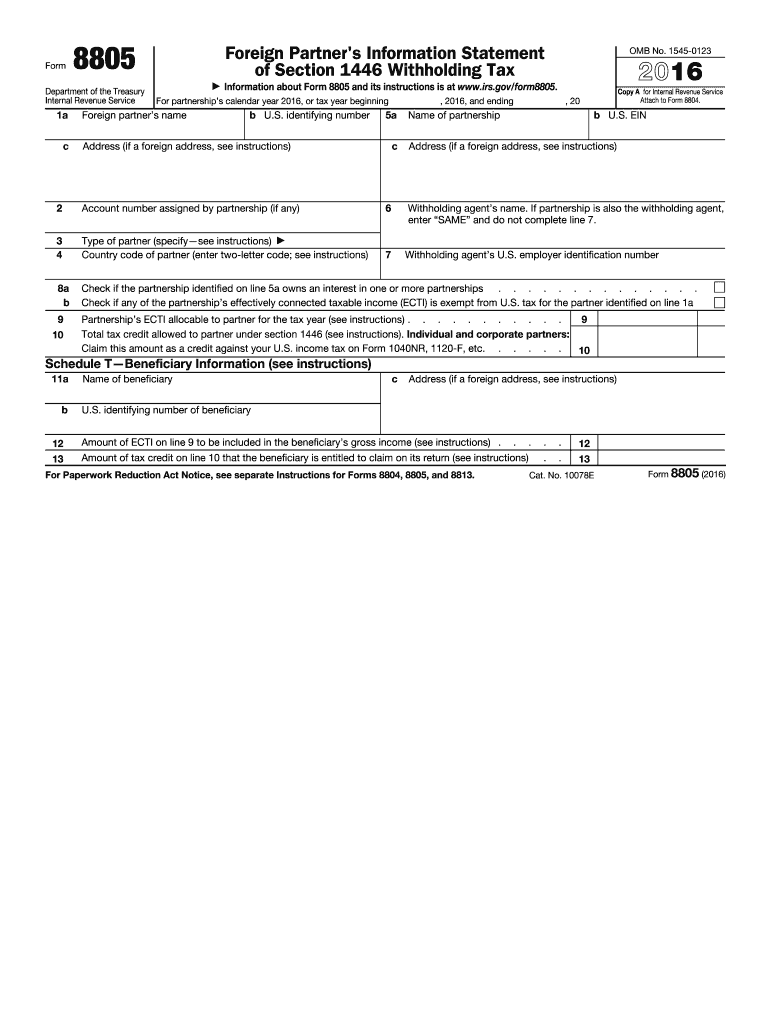

IRS 8805 2016 free printable template

Get, Create, Make and Sign IRS 8805

How to edit IRS 8805 online

Uncompromising security for your PDF editing and eSignature needs

IRS 8805 Form Versions

How to fill out IRS 8805

How to fill out IRS 8805

Who needs IRS 8805?

Instructions and Help about IRS 8805

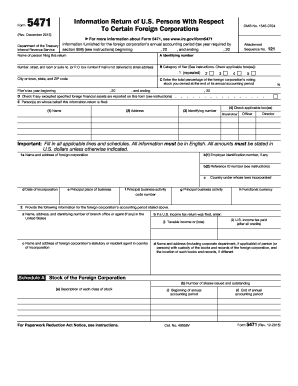

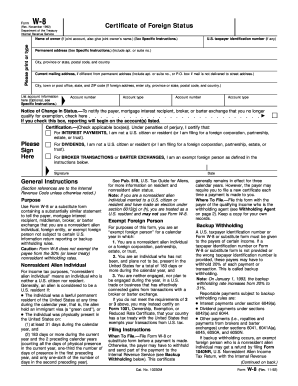

Okay for this video I wanted to go over the IRS form 8804 and 88.05 the 8804 and 5s are filed by partnerships when they have U.S. source effectively connected income that is being allocated to foreign partners and when they do that they need to withhold tax on those allocations and submit the tax to the IRS so for this video I've got a couple pieces in front of us I've got the 804 and fives I've also got a sample 1065 partnership return that we can look at, and then I've also got a slide here which outlines some rules and other information we need to consider, and then I've got a fact pattern that we'll look at which will help us complete the 8804 fives and the 1065 return okay so for starting at the top here who needs to file this well every partnership whether it's domestic or foreign that has U.S. source effectively connected gross income allocated to a foreign partner must file the 8804 report the allocation and the withholding tax now every foreign partner within that 1065 they get a k1, and they'll also get a form 8804 if they have...

People Also Ask about

Who gets form 8805?

What type of partner is form 8805?

Can form 8805 be filed electronically?

What is IRS form 8805 for?

Who is required to file form 8805?

What is the 1040 form 8805?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the IRS 8805 in Chrome?

Can I edit IRS 8805 on an iOS device?

Can I edit IRS 8805 on an Android device?

What is IRS 8805?

Who is required to file IRS 8805?

How to fill out IRS 8805?

What is the purpose of IRS 8805?

What information must be reported on IRS 8805?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.