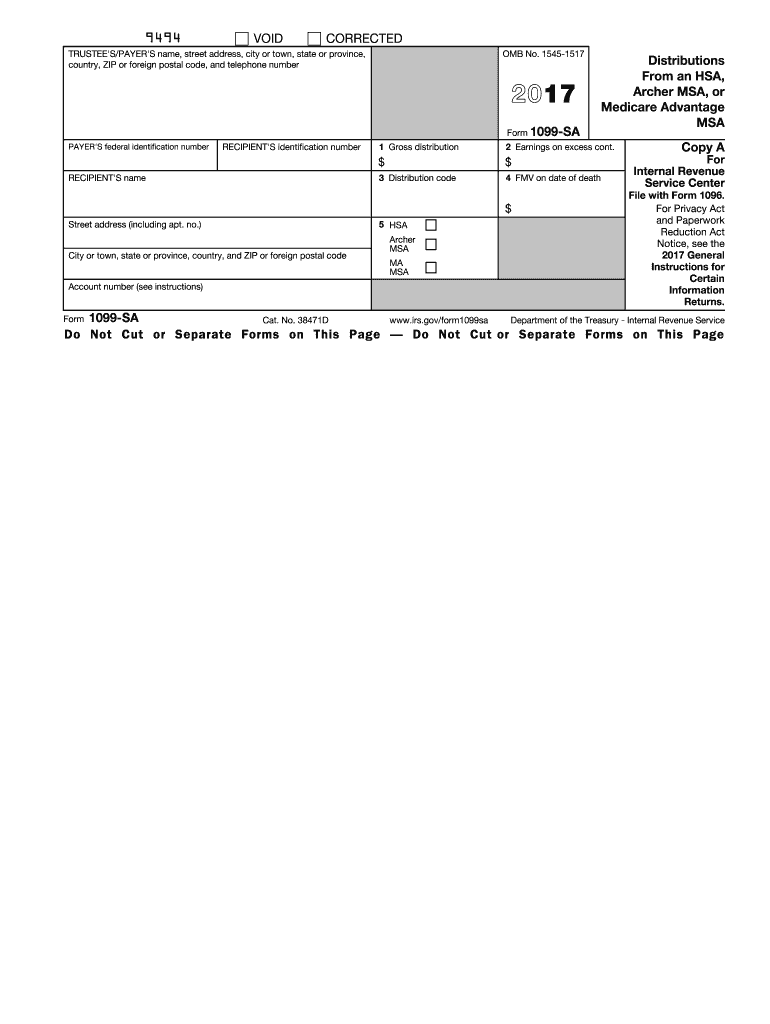

Get the free 1099 sapdffillercom 2017 form - irs

Instructions and Help about IRS 1099-SA

How to edit IRS 1099-SA

How to fill out IRS 1099-SA

About IRS 1099-SA 2017 previous version

What is IRS 1099-SA?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 1099 sapdffillercom 2017 form

What should I do if I need to correct a mistake after filing my 1099 sapdffillercom 2017 form?

If you realize there is an error on your 1099 sapdffillercom 2017 form after submission, you need to file an amended form. Make sure to use the correct form with a checkbox indicating it's an amended return, provide the correct information, and include any necessary explanations for the changes. This ensures that the IRS and the payee have the right information.

How can I verify the status of my submitted 1099 sapdffillercom 2017 form?

To track the status of your submitted 1099 sapdffillercom 2017 form, you can use the IRS's e-file tracking system, if you submitted electronically. You may also receive acknowledgments from the IRS confirming receipt, or you can contact the IRS for specific inquiries regarding processing timelines and possible rejections.

What are the common errors I should watch out for when filing the 1099 sapdffillercom 2017 form?

Common errors when completing the 1099 sapdffillercom 2017 form include incorrect taxpayer identification numbers (TIN), mismatches between the name and TIN, and failure to check the right box for the type of payment made. Double-check all entries for accuracy before submitting to avoid delays or issues.

What steps should I take if I receive an audit notice related to my 1099 sapdffillercom 2017 form?

If you receive an audit notice concerning your 1099 sapdffillercom 2017 form, gather all supporting documents related to the reported payments, including invoices and correspondence with recipients. Respond promptly to the notice with the requested information and consider consulting a tax professional for guidance on how to navigate the audit.