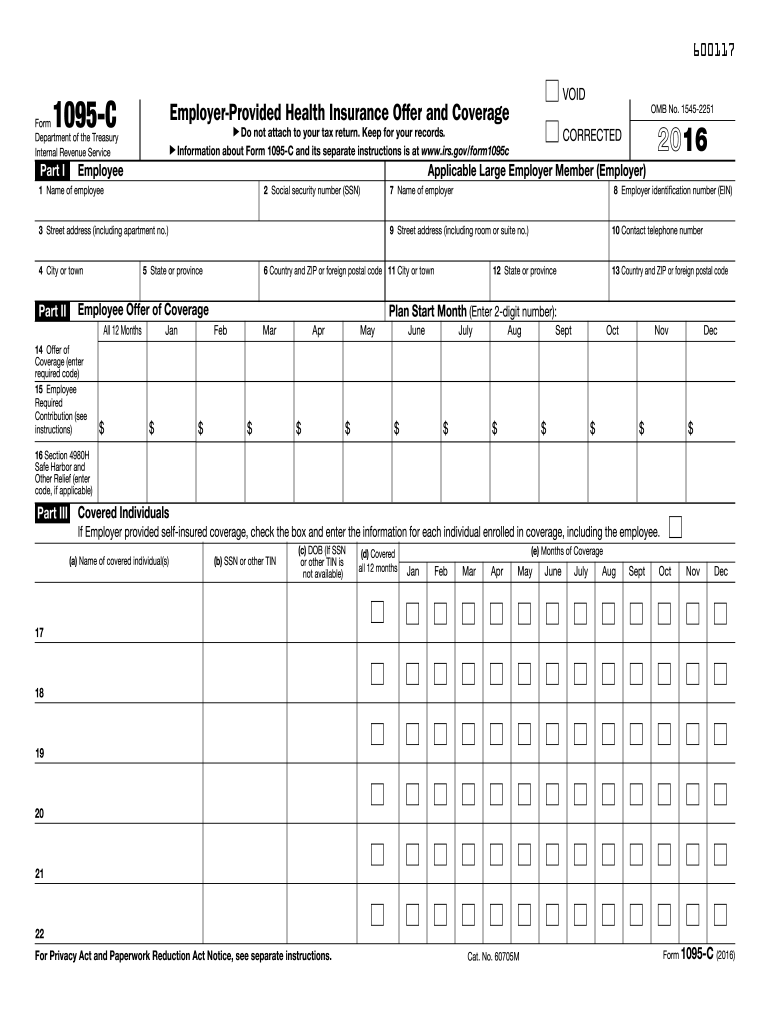

What is form 1095-C?

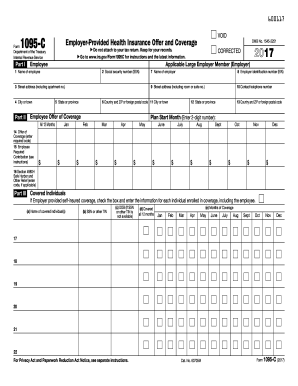

The IRS form 1095 C is an Employer-Provided Health Insurance Offer and Coverage report. The IRS uses information from the form to ensure large employers offer insurance to their employees and that employees receive at least minimum coverage.

Who should file form 1095-C 2016?

The Internal Revenue Service requires applicable large employers (employers with 50 or more employees) to provide insurance coverage to full-time workers and their dependant family members. Employers must report insurance coverage to the IRS yearly and include the previous year. An employer must file 1095-C forms for every employee they have.

What information do you need when you file form 1095-C?

Provide the following information for form 1095-C:

- Employee details (name, SSN, address)

- Employer details (name, address, EIN)

- Insurance coverage details

- Covered individuals (employee’s covered family members)

How do I fill out form 1095-C in 2017?

If you file less than 250 returns, you can fill out the forms online, print them out, and mail them to the IRS. Or you can use pdfFiller to fill out your 1095-C forms online and have them delivered to the USPS office for you. To do that, follow the instructions below:

- Click Get Form in pdfFiller

- Fill out the document providing the required information

- Date and eSign the form

- Click Done to complete

- Select the document and click Send via USPS

- Fill in the mailing details

- Select delivery terms

- Click Send

pdfFiller will print and deliver your completed 1095-C to the post office promptly.

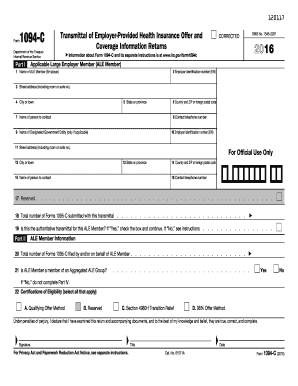

Is 1095 C form accompanied by other forms?

For copies delivered to the IRS, form 1095-C must be supported by form 1094-C. When sending the completed form to an employee, it is unnecessary to accompany it with any other form.

When is form 1095-C due?

The copy designated to the IRS must be filed by the end of February (if sent by mail) or by March 31 (if delivered electronically). Also, the employer is obligated to provide employees with copies of form 1095-C by March 31. Please note the form must include information for the previous year.

Where do I send form 1095-C?

The Employer-Provided Health Insurance Offer and Coverage form should be filed in two copies for every employee. One copy is sent to the IRS local office (see the address relevant for your state on the IRS website), and the other copy is given to the employee. Employers filing 250 or more returns to the IRS must file them electronically.