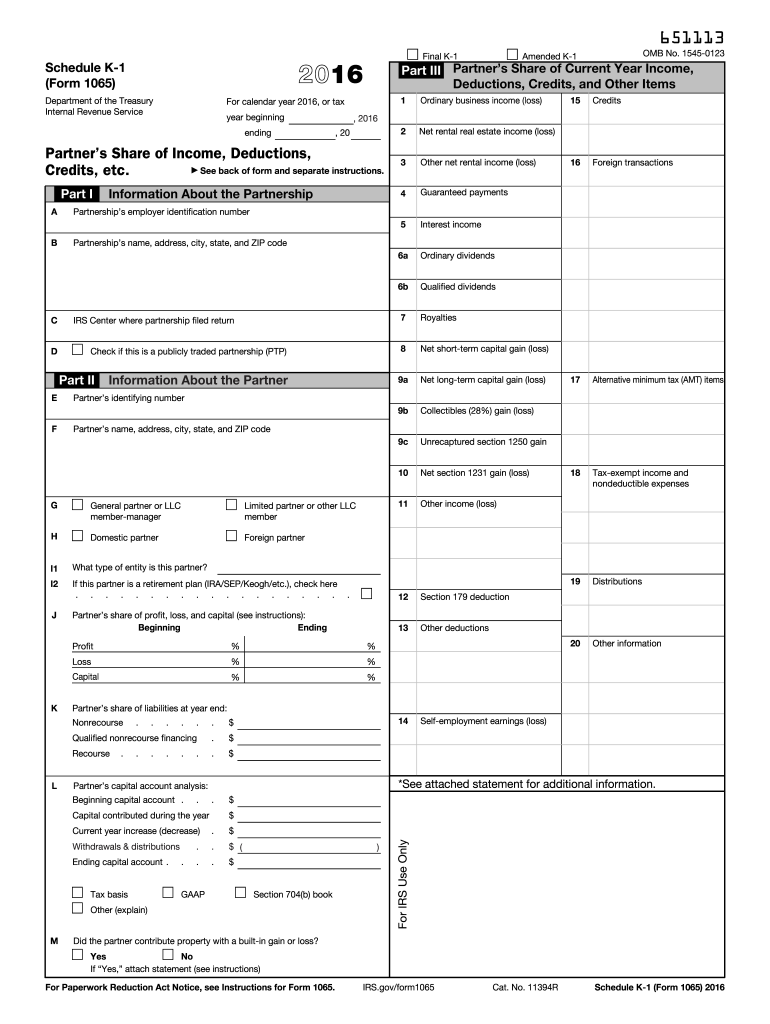

IRS 1065 - Schedule K-1 2016 free printable template

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

How to fill out IRS 1065 - Schedule K-1

About IRS 1065 - Schedule K-1 2016 previous version

What is IRS 1065 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1065 - Schedule K-1

What steps should I take to correct an error on my IRS 1065 - Schedule K-1?

If you discover an error on your IRS 1065 - Schedule K-1, you should file an amended return using the correct information. It's important to notify any recipients of the K-1 about the correction as well.

How can I verify if the IRS has received my submitted IRS 1065 - Schedule K-1?

To verify receipt of your IRS 1065 - Schedule K-1, you can use the IRS's 'Where's My Refund?' tool or contact the IRS directly. Make sure to have your information handy to facilitate the inquiry.

What should I do if I receive an audit notice related to my IRS 1065 - Schedule K-1?

Upon receiving an audit notice regarding your IRS 1065 - Schedule K-1, gather all relevant documentation and consider seeking advice from a tax professional. Respond timely to the notice with the requested information.

Are e-signatures accepted for submitting an IRS 1065 - Schedule K-1, and how does that work?

Yes, the IRS accepts e-signatures for submitting the IRS 1065 - Schedule K-1, but specific requirements must be met to ensure compliance. Consult IRS guidelines for the acceptable methods of e-signing.

What are some common mistakes to avoid when filing the IRS 1065 - Schedule K-1?

Common mistakes include incorrect taxpayer identification numbers and failing to report all income. Ensure that all information is accurate and matches the supporting documentation before submission to avoid delays.

See what our users say