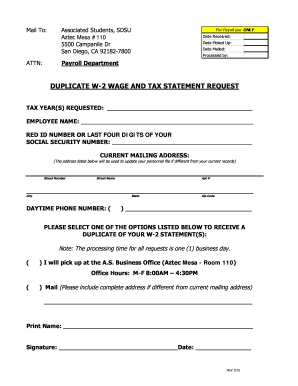

San Diego State University Duplicate W-2 Wage and Tax Statement Request 2015-2026 free printable template

Show details

Completed in January 2016, Line's new 1,000,000 sf facility known as W2 is astateoftheart distribution center that is the best organized of all of Line'facilities. Since building on experience is

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sdsu san diego duplicate w statement form

Edit your sdsu duplicate 2 wage tax template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your diego duplicate 2 request edit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sdsu san w2 tax request make online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit san duplicate w2 tax request print form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

San Diego State University Duplicate W-2 Wage and Tax Statement Request Form Versions

Version

Form Popularity

Fillable & printabley

4.2 Satisfied (33 Votes)

4.6 Satisfied (65 Votes)

How to fill out sdsu san state duplicate create form

How to fill out duplicate W2EPS - AS:

01

Obtain the duplicate copy: Contact the relevant authority or your employer to request a duplicate W2EPS form. Provide them with the necessary details such as your name, Social Security number, and the tax year for which you need the duplicate.

02

Review the form: Once you receive the duplicate W2EPS - AS form, carefully review it to ensure that all the information is accurate and matches your records. Check for any discrepancies in your name, Social Security number, or other relevant details.

03

Update any necessary information: If you identify any incorrect or outdated information on the duplicate form, make sure to correct it by providing the accurate details. This may include changes in your name, address, or other personal information.

04

Fill in the income details: In the relevant sections of the duplicate W2EPS - AS form, provide the accurate information about your income for the tax year. This includes wages, tips, bonuses, and other forms of income that need to be reported for tax purposes.

05

Report any deductions or credits: If you qualify for any deductions or credits, make sure to accurately report them on the duplicate W2EPS - AS form. This may include deductions for retirement contributions, health savings accounts, or education expenses, among others.

06

Sign and date the form: Once you have filled out all the necessary sections of the duplicate W2EPS - AS form, sign and date it to certify that the information provided is accurate to the best of your knowledge. This signature confirms that you are responsible for the accuracy of the reported information.

07

Retain a copy for your records: Before submitting the duplicate W2EPS - AS form, make a copy of it for your own records. This will help you have a reference in case any discrepancies or questions arise in the future.

08

Submit the form: Send the completed duplicate W2EPS - AS form to the appropriate authority or your employer, following their specified instructions for submission. Ensure that you meet any deadlines for filing to avoid penalties or delays in processing your tax return.

Who needs duplicate W2EPS - AS:

01

Individuals with lost or misplaced original W2EPS forms: If you cannot locate your original W2EPS form, you will need a duplicate to accurately report your income for tax purposes.

02

Individuals with errors or discrepancies on their original W2EPS forms: If you identify any mistakes or inconsistencies on your original W2EPS form, obtaining a duplicate will allow you to correct the information and ensure accurate reporting.

03

Individuals with multiple employers: If you have worked for multiple employers during the tax year, you may need duplicate W2EPS forms from each employer to accurately report your total income.

Fill

duplicate 2 statement

: Try Risk Free

People Also Ask about sdsu state university w wage request

How can I get a copy of my W-2 form from Social Security?

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How do I get a duplicate W-2 form?

To get copies of your current tax year federal Form W-2 contact your employer; contact the Social Security Administration (SSA); or. visit the IRS at Transcript or copy of Form W-2 for information. The IRS provides the following guidance on their website:

Can I get my W-2 from Social Security online?

You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. Refer to Transcript Types and Ways to Order Them and About Tax Transcripts for more information.

How do I get my W-2 from Social Security?

Send your request with a check or money order payable to the Social Security Administration. Please include your SSN on the check or money order. You also can pay with a credit card by completing Form-714. Regular credit card rules apply.

Can I request a copy of my W-2 from my employer?

The quickest way to obtain a copy of your current year Form W-2 is through your employer.

Can I get a copy of my W-2 from Social Security online?

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

How can I get a copy of my W-2 online fast?

In the event you lose your Form W–2, or require a duplicate copy you can download a copy from Cal Employee Connect under the "W-2" tab. You also can request one from the State Controller's Office.

Do I send copy 2 of Form W-2 to the IRS?

When filing electronically: You must provide a copy of your Forms W-2 to the authorized IRS e-file provider before the provider sends the electronic return to the IRS. You don't need to send your Forms W-2 to the IRS and should keep them in a safe place with a copy of your tax return.

How can I get a copy of my W-2 from IHSS?

The State Controller's Office does not provide W-2's for IHSS employees. Please contact the social worker or the local IHSS personnel/payroll office of the county where you work or worked to request a duplicate W-2. Go online and search for the county IHSS personnel/payroll office you service to get their phone number.

How do I get a duplicate copy of my W-2?

To get copies of your current tax year federal Form W-2 contact your employer; contact the Social Security Administration (SSA); or. visit the IRS at Transcript or copy of Form W-2 for information. The IRS provides the following guidance on their website:

How do I fill out a new w4 form?

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. Step 2: Indicate Multiple Jobs or a Working Spouse. Step 3: Add Dependents. Step 4: Add Other Adjustments. Step 5: Sign and Date Form W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find sdsu duplicate w wage tax fillable?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the sdsu wage request form search in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit sdsu state university w 2 tax statement on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign sdsu san w 2 tax request edit on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I complete sdsu tax statement form printable on an Android device?

Complete your sdsu tax statement form print and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is duplicate w2eps - as?

Duplicate W2EPS-AS is a form that is used to report employment taxes that were not filed correctly on the original W2EPS form.

Who is required to file duplicate w2eps - as?

Employers who have made errors on the original W2EPS form are required to file duplicate W2EPS-AS.

How to fill out duplicate w2eps - as?

To fill out duplicate W2EPS-AS, employers must correct any errors from the original form and submit the corrected information to the IRS.

What is the purpose of duplicate w2eps - as?

The purpose of duplicate W2EPS-AS is to ensure that employment taxes are reported accurately to the IRS and that employees receive the correct information for tax purposes.

What information must be reported on duplicate w2eps - as?

Duplicate W2EPS-AS must include corrected information such as wages, taxes withheld, and other employment-related information.

Fill out your San Diego State University Duplicate W-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Duplicate 2 Wage Form Get is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.