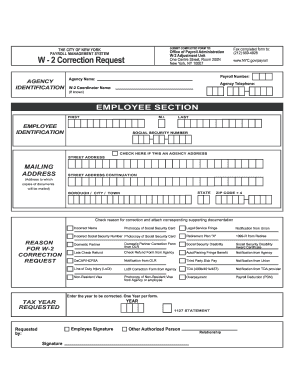

W2 Form Online

What is w2 form online?

The w2 form online is a digital version of the standard W-2 form, which is used for reporting an employee's wages and taxes withheld by their employer. It is an important document for both employees and employers as it provides information necessary for filing income tax returns.

What are the types of w2 form online?

There are two common types of W-2 forms that can be completed online: 1. Employee W-2: This type of W-2 form is issued to employees by their employers. It includes information such as the employee's name, Social Security number, wages earned, and taxes withheld. 2. Employer W-2: This type of W-2 form is used by employers to report the wages and taxes withheld for all employees collectively. It includes the employer's information, total wages paid, total taxes withheld, and other relevant details.

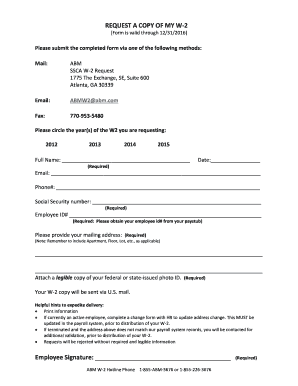

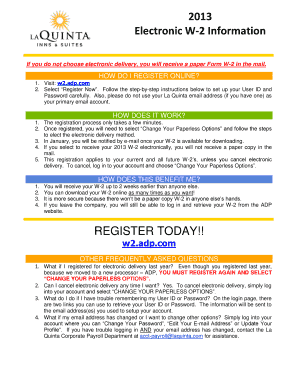

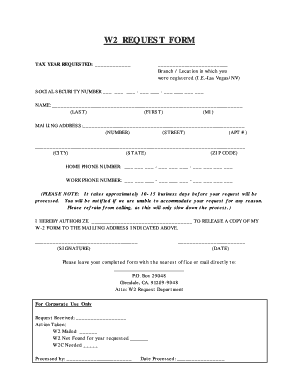

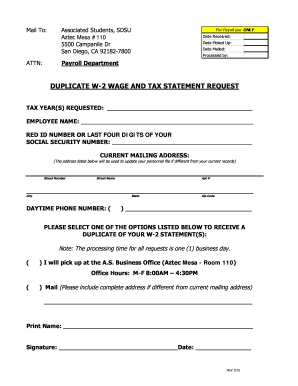

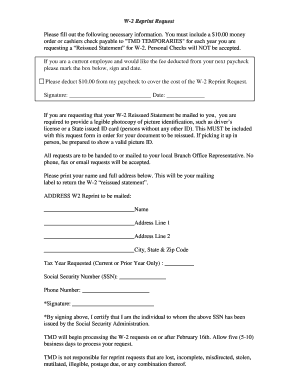

How to complete w2 form online

Completing the W-2 form online is a simple and straightforward process. Here are the steps: 1. Access a reliable online platform like pdfFiller that provides W-2 form templates. 2. Create a new document and select the appropriate type of W-2 form (employee or employer). 3. Fill in the required information accurately, including the employee's personal details, wages, and taxes withheld. 4. Review the form for any errors or omissions. 5. Save the completed form and either print it or send it electronically to the necessary parties.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.