Sample Collection Letter From Attorney

What is sample collection letter from attorney?

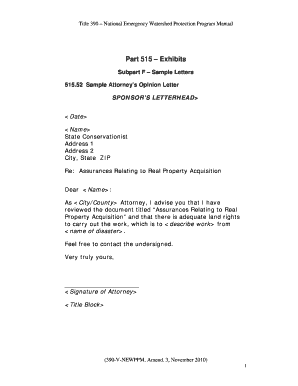

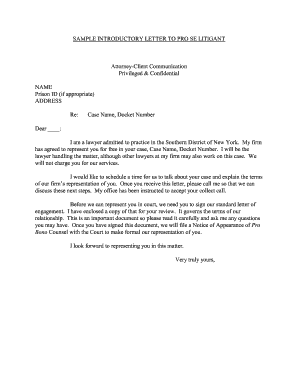

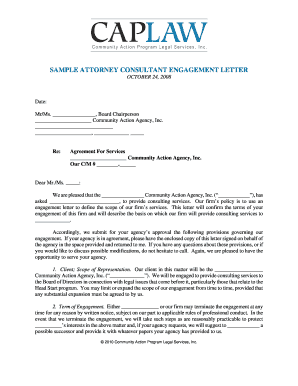

A sample collection letter from attorney is a formal letter sent by an attorney or law firm on behalf of a client to request payment for an outstanding debt. It is often used when other attempts to collect the debt have been unsuccessful. The letter typically outlines the amount owed, the reason for the debt, and provides a deadline for payment. It may also include legal consequences if the debt is not paid.

What are the types of sample collection letter from attorney?

There are several types of sample collection letters from attorney that may be used depending on the specific situation. Some common types include:

How to complete sample collection letter from attorney

Completing a sample collection letter from attorney requires careful attention to detail and a professional approach. Here are some steps to follow:

With the help of pdfFiller, users can easily create, edit, and share their sample collection letters from attorney online. pdfFiller offers unlimited fillable templates and powerful editing tools, making it the go-to PDF editor for getting documents done efficiently.