What is Sample Collection Letters?

Sample Collection Letters are documents that are used to request payment from individuals or businesses who have outstanding debts. These letters are typically sent by creditors or collection agencies in an effort to recover the money owed. They serve as a formal notice to the debtor that immediate payment is required to avoid further actions such as legal proceedings or negative impact on their credit score.

What are the types of Sample Collection Letters?

There are different types of Sample Collection Letters that can be used depending on the specific situation. Some common types include:

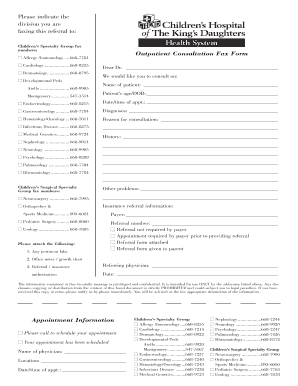

Initial Reminder Letters: These letters are sent as a gentle reminder to debtors who have missed their payment due dates. They usually provide a brief summary of the outstanding debt and request immediate payment.

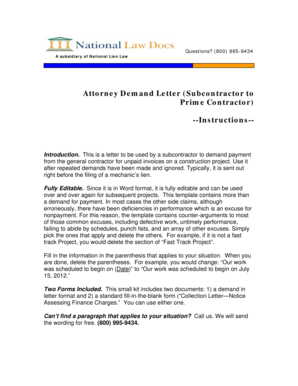

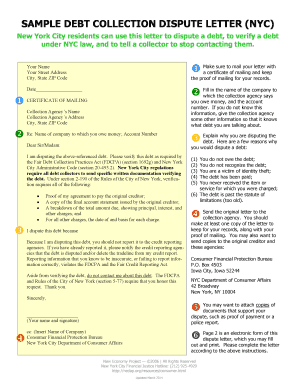

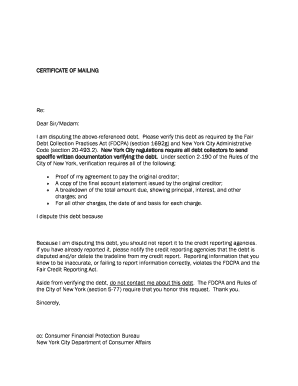

Demand Letters: These letters are more formal and assertive in nature. They clearly state the consequences of non-payment and set a final deadline for payment before further actions are taken.

Final Notice Letters: These letters are sent as a last resort before initiating legal proceedings. They inform the debtor about the impending legal action and give them a final chance to resolve the debt before facing potential consequences.

Cease and Desist Letters: These letters are used to request that collection agencies stop contacting the debtor. They are typically sent when a debtor believes they are being harassed or treated unfairly by the collection agency.

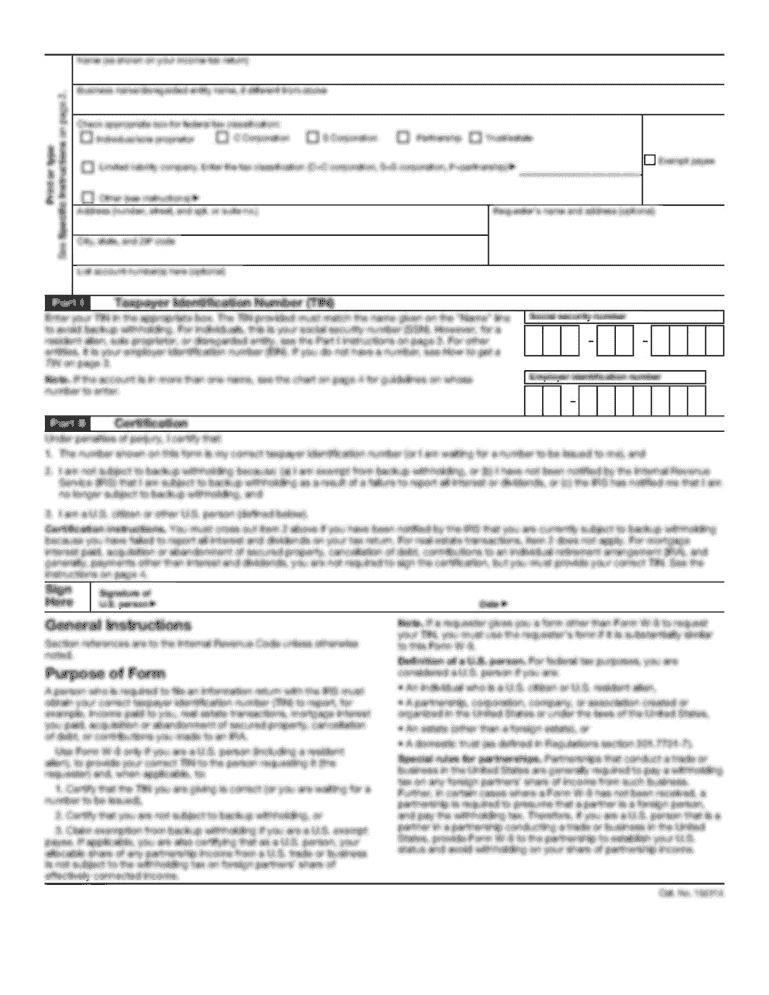

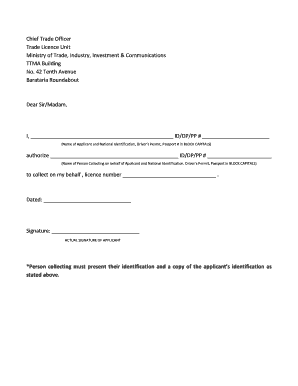

How to complete Sample Collection Letters

Completing Sample Collection Letters can be done in a few simple steps:

01

Identify the type of letter you need to send based on the specific situation.

02

Download a template or create your own letter using a word processing software.

03

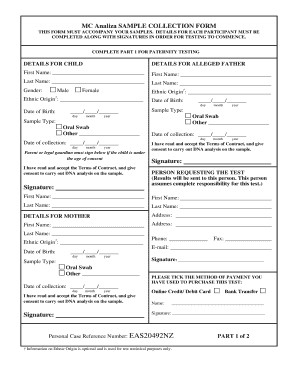

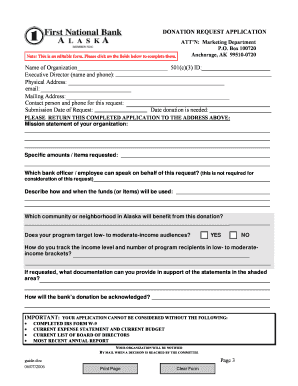

Personalize the letter by adding the debtor's name, contact information, and details of their outstanding debt.

04

Clearly state the purpose of the letter and the actions required from the debtor.

05

Set a deadline for payment and provide options for making the payment such as online portals, checks, or direct bank transfers.

06

Proofread the letter to ensure it is clear, concise, and free of any errors.

07

Send the letter via certified mail or email, making sure to keep a copy for your records.

Remember, pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your Sample Collection Letters done efficiently.