Friendly Collection Letter

What is a friendly collection letter?

A friendly collection letter is a communication sent to a debtor in a courteous and non-confrontational manner. It is used to remind the debtor about an outstanding payment or debt in a way that maintains a positive relationship and encourages prompt payment. Unlike traditional collection letters, friendly collection letters focus on maintaining good customer relations while still recovering the debt.

What are the types of friendly collection letters?

There are several types of friendly collection letters that can be used depending on the situation. These include: 1. Reminder Letters: Sent as a gentle reminder to the debtor that a payment is due or overdue. 2. Thank You Letters: Sent after receiving a partial payment or a payment commitment from the debtor, expressing gratitude for their cooperation. 3. Payment Plan Offer Letters: Sent when offering the debtor a structured payment plan to help them repay the debt in manageable installments. 4. Account Statement Letters: Sent along with an updated account statement, highlighting the outstanding balance and encouraging the debtor to take action. Each type of friendly collection letter serves a specific purpose and is designed to maintain a positive relationship with the debtor while still being effective in collecting the debt.

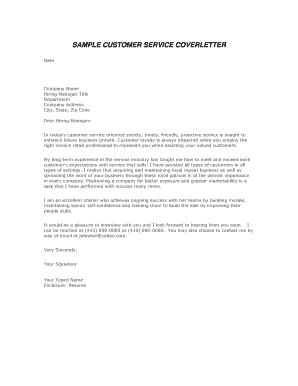

How to complete a friendly collection letter?

Completing a friendly collection letter involves several key steps: 1. Personalize the letter: Address the debtor by name and include any relevant details to make the letter more personalized. 2. Be clear and concise: Clearly state the purpose of the letter and the specific amount owed. Use a polite tone and avoid any language that may be interpreted as threatening or confrontational. 3. Offer assistance: Provide information on how the debtor can make the payment, such as accepted payment methods and contact information for any questions or concerns. 4. Set a deadline: Clearly communicate a deadline for the payment or response to the letter. 5. Express willingness to work together: Show empathy towards the debtor's situation and express a willingness to work together to find a solution. By following these steps, you can create a friendly collection letter that is effective in recovering the debt while maintaining a positive relationship with the debtor.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.