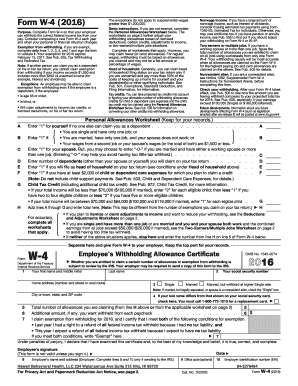

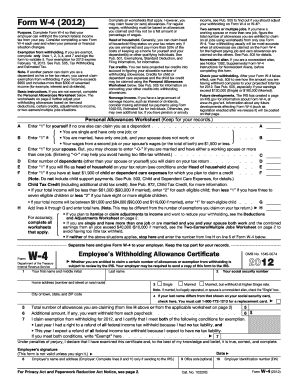

W-4 Form 2016

What is w-4 form 2016?

The w-4 form 2016 is a document used by employees to indicate their withholding allowances for federal income taxes. It is a crucial form that helps determine how much of an employee's wages should be withheld by their employer to cover their tax obligations. By accurately completing the w-4 form 2016, employees can ensure that the right amount of taxes is withheld from their paychecks throughout the year.

What are the types of w-4 form 2016?

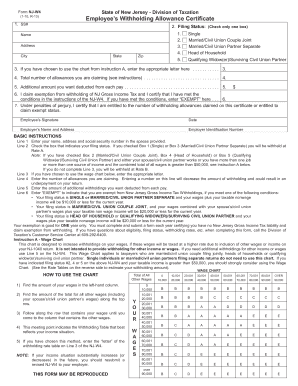

There are two main types of w-4 forms for the year 2016: the Employee's Withholding Allowance Certificate for the Federal Income Tax (Form W-4) and the Employee's Withholding Allowance Certificate for the State Income Tax (State W-4 form). The Federal W-4 form is used to determine the federal income tax withholding, while the State W-4 form is specific to each state and is used to determine the state income tax withholding.

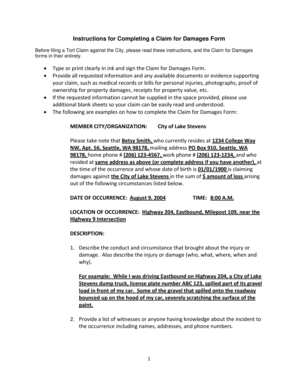

How to complete w-4 form 2016

Completing the w-4 form 2016 is a simple process. Here are the steps to follow:

By following these steps, you can ensure that your w-4 form 2016 is completed accurately and effectively.