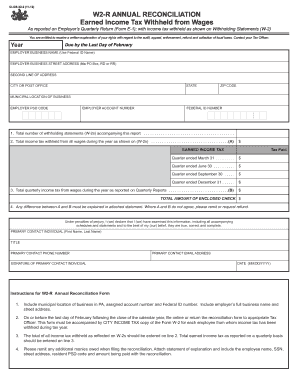

W2 Form 2017

What is w2 form 2017?

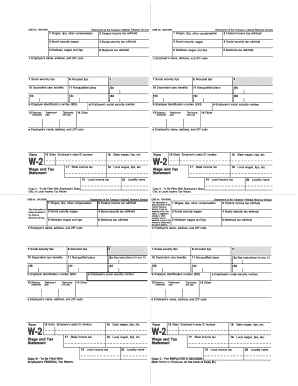

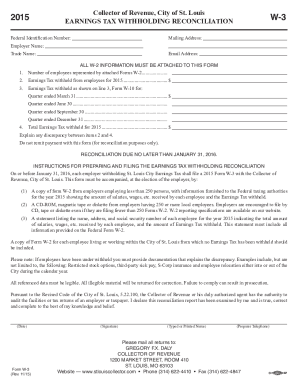

The W-2 form for the year 2017 is a tax document that employers provide to their employees. It summarizes the employee's earnings, withholdings, and other vital information necessary for filing their tax returns. It is an essential form that ensures accurate reporting of income and helps calculate the correct amount of taxes owed or refunded.

What are the types of w2 form 2017?

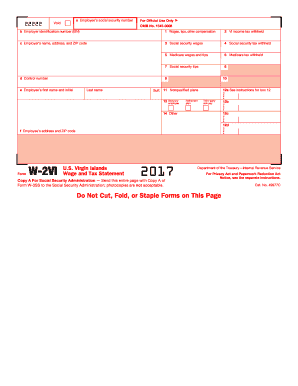

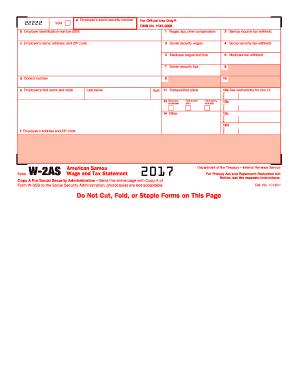

There are several types of W-2 forms for the year 2017, depending on the employee's specific situation. The most common types include: 1. W-2 Wage and Tax Statement: This form is used by employees who receive a salary or hourly wages from their employer. 2. W-2G Certain Gambling Winnings: This form is used by individuals who have won a significant amount of money from gambling activities. 3. W-2P Pension and Annuity Income: This form is used by individuals who receive income from pensions or annuities. 4. W-2VI U.S. Virgin Islands Wage and Tax Statement: This form is used by employees who work in the U.S. Virgin Islands. It's important to determine the appropriate W-2 form based on your specific circumstances to ensure accurate reporting.

How to complete w2 form 2017

Completing the W-2 form for the year 2017 is a straightforward process. Follow these steps to ensure accurate completion:

By following these steps, you can confidently complete the W-2 form for the year 2017 and ensure accurate reporting of your income and taxes. Remember, tools like pdfFiller empower users to create, edit, and share documents online, providing unlimited fillable templates and powerful editing tools. With pdfFiller as your PDF editor, getting your documents done has never been easier.