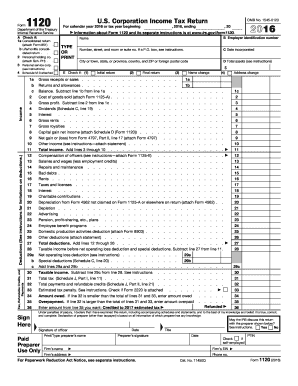

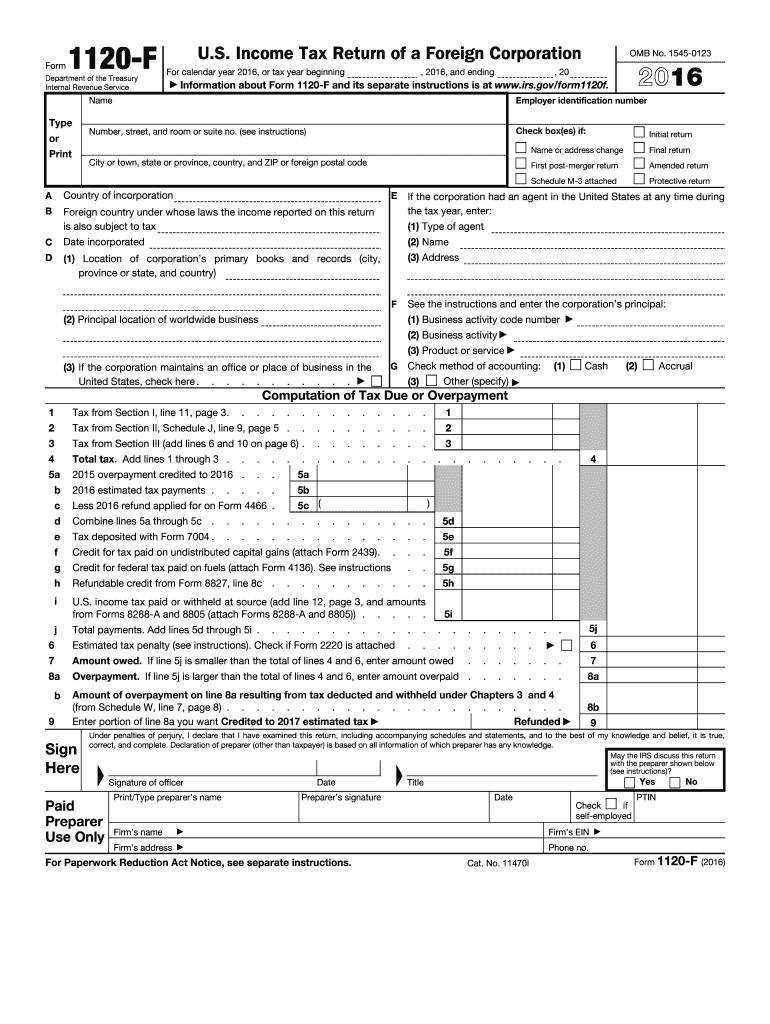

IRS 1120-F 2016 free printable template

Instructions and Help about IRS 1120-F

How to edit IRS 1120-F

How to fill out IRS 1120-F

About IRS 1120-F 2016 previous version

What is IRS 1120-F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120-F

How can I correct mistakes on my 2016 form 1120-f us after submission?

If you've already submitted your 2016 form 1120-f us and notice an error, you can file an amended return using form 1120X. Ensure that you provide accurate information reflecting the changes and clearly indicate that it's an amendment. Keep in mind that amending can affect any taxes owed, so review your figures carefully before submitting.

What steps should I take to verify the status of my 2016 form 1120-f us after filing?

To verify the receipt and processing status of your 2016 form 1120-f us, you can contact the IRS directly or check any available online tracking systems they've provided. It's important to have your submission details handy, as this will help streamline the process. Remember that processing times may vary, so patience is key.

What should I consider regarding e-signature acceptability for my 2016 form 1120-f us?

When e-filing your 2016 form 1120-f us, ensure that your e-signature complies with IRS requirements. The IRS allows electronic signatures, but they must be properly authenticated and secured to maintain the integrity of your submission. Verify that the software you use supports this capability.

What documentation should I prepare if I receive an audit notice related to my 2016 form 1120-f us?

In the case of an audit notice regarding your 2016 form 1120-f us, gather all relevant documents such as financial statements, invoices, and supporting materials that substantiate your reported figures. Organizing this documentation will be critical for your response and to support your claims during the audit.

What common errors should I avoid while filing the 2016 form 1120-f us?

While filing the 2016 form 1120-f us, common errors to watch for include incorrect taxpayer identification numbers, misreported income and deductions, and failing to include all necessary attachments. Double-check your entries against your financial records to minimize the risk of these mistakes affecting your filing.