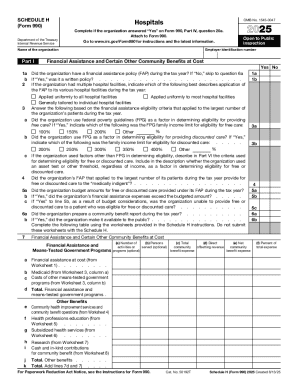

IRS 990 - Schedule H 2016 free printable template

Instructions and Help about IRS 990 - Schedule H

How to edit IRS 990 - Schedule H

How to fill out IRS 990 - Schedule H

About IRS 990 - Schedule H 2016 previous version

What is IRS 990 - Schedule H?

Who needs the form?

Components of the form

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 990 - Schedule H

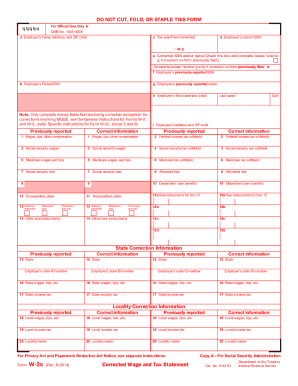

What should I do if I realize I've made an error on my filed IRS 990 - Schedule H?

If you discover an error after filing your IRS 990 - Schedule H, you should prepare to submit an amended return. This involves filling out the correct form and indicating that it's an amendment. Keep in mind that amending could draw additional scrutiny, so ensure all corrections are accurate and well-documented.

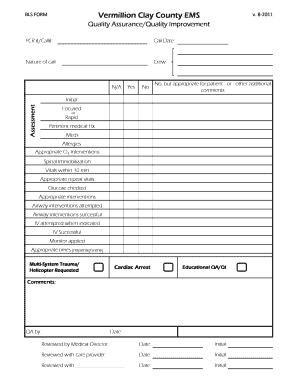

How can I track the status of my IRS 990 - Schedule H submission?

To verify the receipt and processing of your IRS 990 - Schedule H, you can use the IRS's online tracking system or contact their customer service. Be aware of common e-file rejection codes which can hinder the acceptance of your file. Promptly addressing these codes can help you avoid delays.

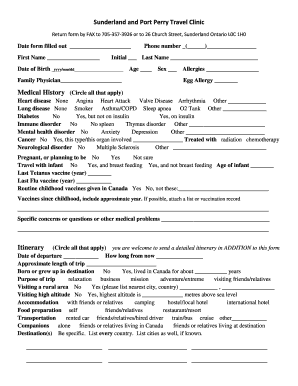

What is the appropriate record retention period for IRS 990 - Schedule H?

It's essential to retain records related to your IRS 990 - Schedule H for at least three years after the submission date. These documents should include financial statements, supporting schedules, and any correspondence related to the form. Proper records ensure compliance and facilitate quick responses to any future inquiries.

Are there service fees for e-filing the IRS 990 - Schedule H?

Yes, some e-filing services charge fees for submitting your IRS 990 - Schedule H electronically. These fees can vary based on the provider you choose. It's advisable to compare different options to find a service that meets your needs without incurring excessive costs.

What should I do if I receive an audit notice regarding my IRS 990 - Schedule H?

If you receive an audit notice related to your IRS 990 - Schedule H, it's crucial to respond promptly and prepare the necessary documentation as requested. Stay organized and consult a tax professional if you're unsure how to respond. Thorough preparation can help clarify your position and support your case.