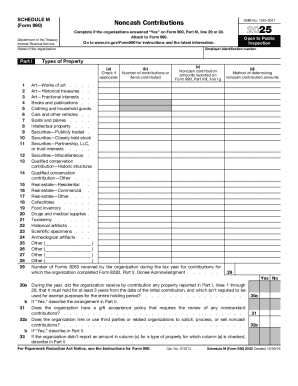

IRS 990 - Schedule M 2016 free printable template

Instructions and Help about IRS 990 - Schedule M

How to edit IRS 990 - Schedule M

How to fill out IRS 990 - Schedule M

About IRS 990 - Schedule M 2016 previous version

What is IRS 990 - Schedule M?

Who needs the form?

Components of the form

What information do you need when you file the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule M

What should I do if I realize there's a mistake on my schedule m 2016 form after submission?

If you discover an error on your schedule m 2016 form after filing, you need to submit an amended version. This will correct the mistakes and ensure that the IRS has accurate information. It's essential to indicate on the amended form that it is a correction and provide an explanation for the changes made.

How can I track the status of my schedule m 2016 form submission?

To track the status of your schedule m 2016 form submission, you can use the IRS online tools designed for this purpose. They provide updates on whether your form has been processed or if there were any issues, such as e-file rejection codes that you may need to address.

What are some common errors I should be cautious of when submitting the schedule m 2016 form?

Common errors when submitting the schedule m 2016 form include incorrect calculations, mismatched information with other documents, and not signing the form if required. Double-checking all entries and ensuring consistency with previous filings can help avoid these pitfalls.

Are there any legal or operational nuances involved in filing the schedule m 2016 form for foreign payees?

Yes, there are specific rules for filing the schedule m 2016 form when dealing with foreign payees. It's crucial to ensure that proper documentation is in place and to consider any treaties that may affect tax withholdings or reporting obligations for nonresidents.

What steps should I take if I receive a notice from the IRS regarding my schedule m 2016 form?

If you receive a notice from the IRS regarding your schedule m 2016 form, first carefully read the notice to understand what actions are required. You may need to gather supporting documents and respond promptly within the specified timeframe to resolve any issues raised.