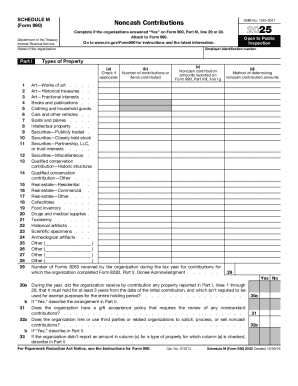

IRS 990 - Schedule M 2024 free printable template

Instructions and Help about IRS 990 - Schedule M

How to edit IRS 990 - Schedule M

How to fill out IRS 990 - Schedule M

Latest updates to IRS 990 - Schedule M

About IRS 990 - Schedule M 2024 previous version

What is IRS 990 - Schedule M?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 990 - Schedule M

What should I do if I realize I've made a mistake on my IRS 990 - Schedule M after submission?

If you discover an error on your IRS 990 - Schedule M after submitting it, you can correct it by filing an amended return. Make sure to clearly label the new submission as an amended return and include the correct information. This method ensures that any discrepancies are properly documented and corrected in the IRS records.

How can I track the status of my filed IRS 990 - Schedule M?

To verify the receipt and processing of your filed IRS 990 - Schedule M, you can use the IRS online tracking system or contact them directly. Common e-file rejection codes will be communicated if your submission was not successful, along with guidance on how to rectify the issues. Keep a record of your submission confirmation for reference.

Are there privacy concerns related to filing IRS 990 - Schedule M?

When filing IRS 990 - Schedule M, it's crucial to ensure compliance with data privacy standards. Record retention periods for documents should be adhered to, and understanding e-signature acceptability will further secure the confidentiality of your data. Maintaining stringent privacy practices protects both the organization and its stakeholders.

What steps should I take if I receive a notice or audit regarding my IRS 990 - Schedule M?

If you receive a notice or are selected for an audit concerning your IRS 990 - Schedule M, it’s essential to respond promptly. Gather the necessary documentation that supports your filings, and consider consulting a tax professional to assist you in understanding the notice and ensuring compliance with the IRS's requirements during the audit process.

What technical requirements should I consider for e-filing my IRS 990 - Schedule M?

When e-filing your IRS 990 - Schedule M, ensure that your software is compatible with IRS e-filing standards. Use updated browsers and devices that meet the technical specifications required for electronic submissions. This compatibility minimizes issues during submission and ensures a smoother e-filing experience.