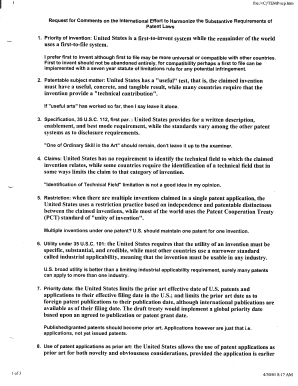

Get the free 403(b) and 457(b) Plan

Show details

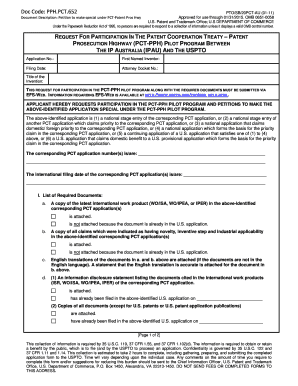

403(b) and 457(b) Plan Salary Reduction Agreement New Agreement Change to Current Agreement Terminate Agreement Section I: Personal Information incomplete information will delay processing of request

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b and 457b plan

Edit your 403b and 457b plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b and 457b plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 403b and 457b plan online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 403b and 457b plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b and 457b plan

How to fill out 403b and 457b plan:

01

Gather necessary information: Before filling out the forms for a 403b and 457b plan, you will need to collect some important details. This includes your personal information such as your full name, date of birth, and social security number. Additionally, you may need information about your employment, such as your employer's name, address, and contact information.

02

Obtain the required forms: To enroll in a 403b or 457b plan, you will need to obtain the appropriate forms from your employer or the plan administrator. These forms may be available online or through your HR department. Make sure to get the most up-to-date versions of the forms to ensure accuracy.

03

Complete the forms accurately: Carefully read and follow the instructions provided with the forms. Fill in your personal information, employment details, and any other required information accurately and legibly. Double-check each section before submitting the forms to avoid any errors.

04

Choose your contribution amount: Decide how much you want to contribute to your 403b and 457b plans. The contribution limits for these plans can vary, so it's important to understand the maximum amount you can contribute per year. Consider your financial situation, goals, and any employer matching contributions available to determine the most suitable contribution amount for you.

05

Designate your investments: Within your 403b and 457b plans, you will have various investment options to choose from. Consider your risk tolerance, time horizon, and investment knowledge when selecting the investment funds or options that best align with your financial goals. It may be helpful to seek advice from a financial advisor if you are unsure about the investment decisions.

Who needs 403b and 457b plans:

01

Non-profit organizations and educational institutions: 403b plans are typically offered to employees of non-profit organizations, such as schools, hospitals, and charitable organizations. These plans provide a tax-efficient way for employees to save for retirement while working for these organizations.

02

Government employees: 457b plans are commonly offered to government employees, including state, local, and municipal workers. These plans serve as a retirement savings vehicle for employees in the public sector.

03

Employees looking for tax advantages: Both 403b and 457b plans offer tax advantages. Contributions to these plans are often made on a pre-tax basis, which means they are deducted from your taxable income. This can result in lower tax liability in the year contributions are made.

04

Individuals seeking long-term retirement savings: If you are looking to save for retirement and have a long-term investment horizon, 403b and 457b plans can be beneficial. These plans allow for consistent contributions over time, potentially growing your retirement savings significantly.

05

Those interested in employer matching contributions: In some cases, employers may provide matching contributions to their employees' 403b or 457b plans. This means that for each dollar you contribute, your employer may also contribute a certain percentage, effectively increasing your retirement savings at no additional cost to you.

Remember, it's important to consult with a financial advisor or tax professional for personalized advice regarding the specifics of your financial situation and retirement goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 403b and 457b plan from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 403b and 457b plan. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I edit 403b and 457b plan on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 403b and 457b plan.

How do I complete 403b and 457b plan on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your 403b and 457b plan. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your 403b and 457b plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403b And 457b Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.