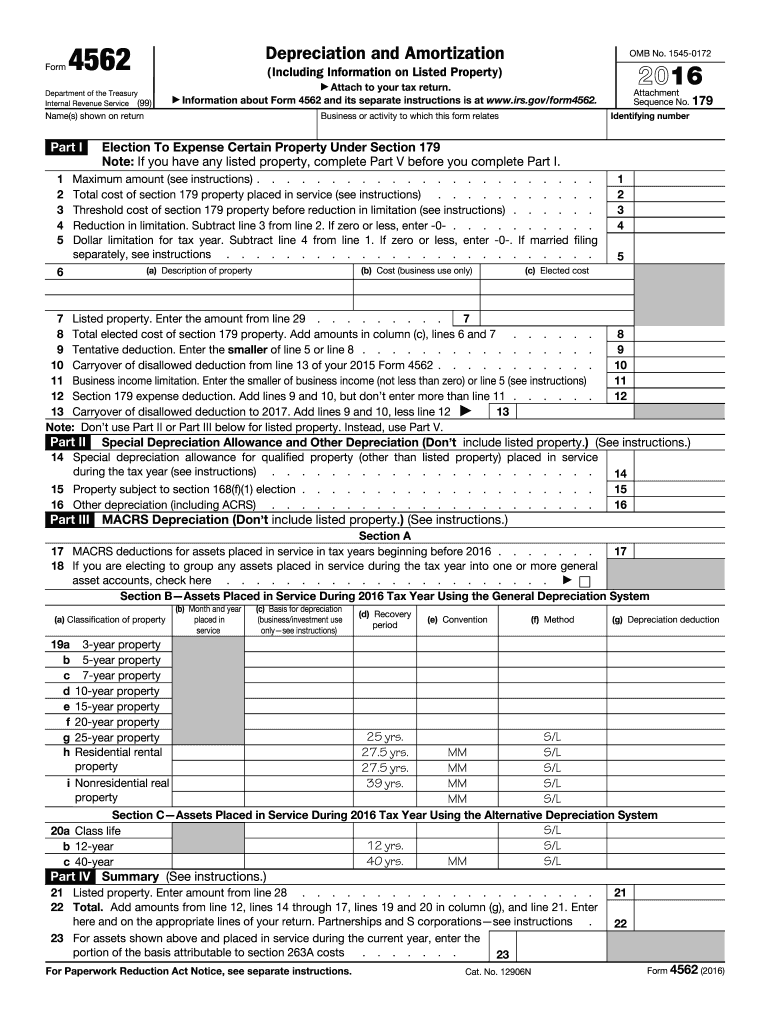

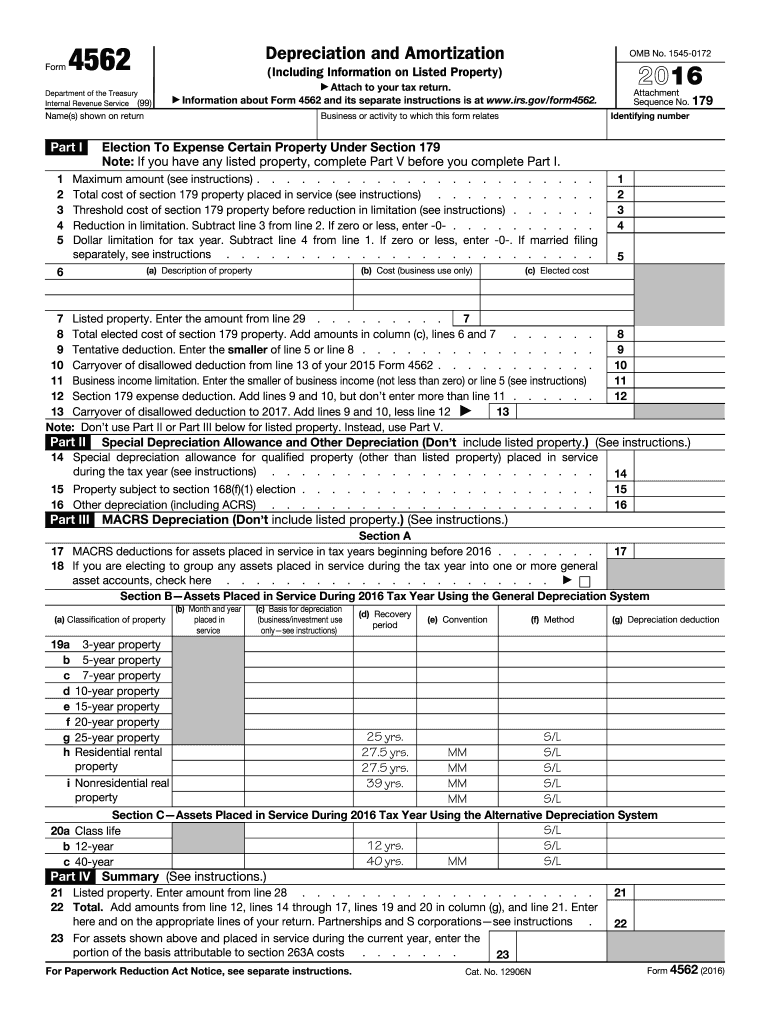

IRS 4562 2016 free printable template

Get, Create, Make and Sign IRS 4562

How to edit IRS 4562 online

Uncompromising security for your PDF editing and eSignature needs

IRS 4562 Form Versions

How to fill out IRS 4562

How to fill out IRS 4562

Who needs IRS 4562?

Instructions and Help about IRS 4562

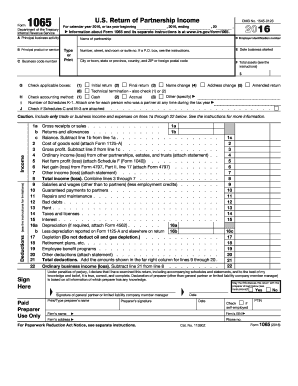

Welcome back to another video for Harbor Financial I'm calm today we're going to be talking about section 179 depreciation, and we're going to go through the form that that has to be reported on Form 4562, and I'm going to touch on all the areas you need to know with the section 179 deduction so let me get the video going here so again section the one section 179 depreciation is going to be reported on Form 4562 I'm going to take you to that form once we get to the slide real quick section 179 has to be taken the year you purchase the item or items you're going to be reporting what I mean by that is if you buy a vehicle this year you can't next year then take the 179 you have to report the vehicle that you purchased in that year and that year you bought it to qualify for section 179, section 179 depreciation is different from just expensive an item but in a way it's kind of the same, and I'll explain that to you guys, so I want to take you guys to the forum real quick let's get to the forum this is a forty-five sixty-two and this is where you're gonna you're going to report section 179 as you can as you see this forum is a pretty detailed which is why I highly recommend doing your taxes online electronically if you can this is a forum that does do pose a problem for people that don't do taxes quite a bit as far as making airs so that this is where you would record it the part one is going to be your area where you report 179 you can see here's the line to the toilet of section 179 property placed in service I'm just trying to find the lines that I think are important to you line 12 here this is um what your total 179 expense deduction after all these calculations is going to be so with 179 you need to just be worried with part 1 but again if you do this online it's automatically gonna fill in all of these boxes for you, it's just going to ask you some questions very easy very simple, and then it will populate these boxes for you so that that's why I would recommend doing it electronically if you can so let's get back to the video output I would use 179 if you purchase vehicles computers furniture any item that it's kind of a high-dollar item I would try and take advantage of this 179 we've already went through form 4562 the maximum deduction per year under the section 179 is $128,000 trust our state can't claim the 179 deduction overall I highly recommend using this deduction whenever possible and especially in a year when you made a good profit with your business, so I appreciate you watching the video I hope you check out our site Harbor financial online.com we have lots of information on that site to talk about business deductions business credits we have articles links to blogs, and you can also go back to YouTube where we have well over 100 videos on all areas of tax, so thank you for watching the video, and we'll talk to you later

People Also Ask about

What is section 179 vehicles for 2016?

What is IRS Form 4562 used for?

What type of property goes on form 4562?

Is Form 4562 required every year?

Do I need to file form 4562?

What is IRS Form 4562 2016?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS 4562 for eSignature?

Can I create an electronic signature for signing my IRS 4562 in Gmail?

How do I edit IRS 4562 on an Android device?

What is IRS 4562?

Who is required to file IRS 4562?

How to fill out IRS 4562?

What is the purpose of IRS 4562?

What information must be reported on IRS 4562?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.