KY DoR Inheritance & Estate Tax Forms Instr 2016 free printable template

Show details

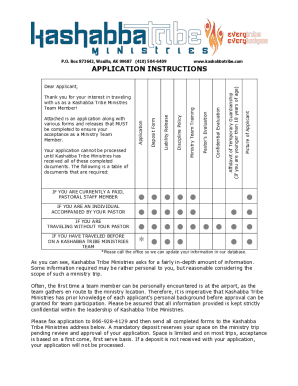

Kentucky Inheritance and Estate Tax Forms and Instructions COMMONWEALTH OF KENTUCKY DEPARTMENT OF REVENUE For Dates of Death on or After January 1, 2005 (Revised for Website November 2016) Kentucky

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR Inheritance Estate Tax Forms

Edit your KY DoR Inheritance Estate Tax Forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR Inheritance Estate Tax Forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY DoR Inheritance Estate Tax Forms online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit KY DoR Inheritance Estate Tax Forms. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR Inheritance & Estate Tax Forms Instr Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR Inheritance Estate Tax Forms

How to fill out KY DoR Inheritance & Estate Tax Forms

01

Obtain the KY DoR Inheritance & Estate Tax Forms from the Kentucky Department of Revenue website or local office.

02

Gather necessary documentation, such as the death certificate, property deeds, and asset valuations.

03

Complete the personal information section, including the decedent's full name, date of death, and social security number.

04

List all assets owned by the decedent at the time of death, including real estate, bank accounts, and personal belongings.

05

Detail any debts or liabilities that were outstanding at the time of death.

06

Calculate the total taxable value of the estate by subtracting liabilities from total assets.

07

Determine the applicable tax rate based on the total taxable value using the tax brackets provided by the KY DoR.

08

Fill out the tax calculation section, inputting the taxable amount and calculating the total inheritance tax owed.

09

Review all completed forms for accuracy and completeness.

10

Submit the forms and any required payment to the Kentucky Department of Revenue by the deadline.

Who needs KY DoR Inheritance & Estate Tax Forms?

01

Any individual or executor of an estate in Kentucky where the decedent's estate exceeds the exemption limits set by the state.

02

Anyone who is responsible for settling the estate of a deceased person in Kentucky.

03

Heirs or beneficiaries who may be affected by the inheritance tax on the estate.

Fill

form

: Try Risk Free

People Also Ask about

Who files Kentucky inheritance tax return?

Inheritance Tax All property belonging to a resident of Kentucky is subject to the tax except for real estate located in another state. Also, real estate and personal property located in Kentucky and owned by a nonresident is subject to being taxed.

What tax form do I need for inheritance income?

Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc. Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc., on your Form 1040, U.S. Individual Income Tax Return.

What is the form for inheritance tax in Kentucky?

If inheritance tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used. The affidavit of exemption is to be filed only with the court. Do not send a copy of the affidavit to the Kentucky Department of Revenue.

What form is used for inheritance?

Form 8971, along with a copy of every Schedule A, is used to report values to the IRS. One Schedule A is provided to each beneficiary receiving property from an estate. Form 8971 InstructionsPDF.

What IRS form do I use for inheritance?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Do I need a k1 for inheritance?

Schedule K-1 (Form 1041) is used to report a beneficiary's share of an estate, including income, credits, deductions and profits. Beneficiaries of an inheritance should have received a K-1 tax form inheritance statement for the 2022 tax year by the end of 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the KY DoR Inheritance Estate Tax Forms electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I edit KY DoR Inheritance Estate Tax Forms on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit KY DoR Inheritance Estate Tax Forms.

How do I edit KY DoR Inheritance Estate Tax Forms on an Android device?

You can make any changes to PDF files, like KY DoR Inheritance Estate Tax Forms, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is KY DoR Inheritance & Estate Tax Forms?

KY DoR Inheritance & Estate Tax Forms are official documents used to report and assess inheritance and estate taxes in the state of Kentucky.

Who is required to file KY DoR Inheritance & Estate Tax Forms?

Individuals or entities that inherit assets or property from a deceased person whose estate is subject to Kentucky inheritance taxes are required to file these forms.

How to fill out KY DoR Inheritance & Estate Tax Forms?

To fill out the KY DoR Inheritance & Estate Tax Forms, you must provide information about the deceased, list all assets and their values, and calculate the applicable taxes based on Kentucky tax laws.

What is the purpose of KY DoR Inheritance & Estate Tax Forms?

The purpose of these forms is to ensure compliance with Kentucky tax laws by properly reporting inheritance and estate taxes owed on assets transferred after death.

What information must be reported on KY DoR Inheritance & Estate Tax Forms?

The forms must report the decedent's details, the beneficiaries' information, a detailed listing of all assets and their values, deductions, and the calculated tax liability.

Fill out your KY DoR Inheritance Estate Tax Forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR Inheritance Estate Tax Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.