KY DoR Inheritance & Estate Tax Forms Instr 2005 free printable template

Show details

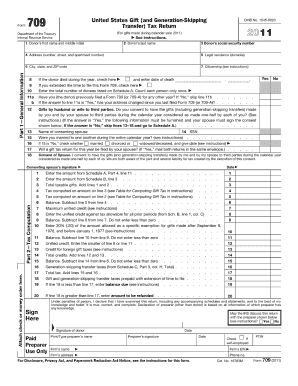

Kentucky Inheritance and Estate Tax Forms and Instructions COMMONWEALTH OF KENTUCKY DEPARTMENT OF REVENUE For Dates of Death on or After January 1 2005 Revised for Web Site July 2014 Kentucky Department of Revenue Mission Statement As part of the Finance and Administration Cabinet the mission of the Kentucky Department of Revenue is to administer tax laws collect revenue and provide services in a fair courteous and efficient manner for the benefi...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign KY DoR Inheritance Estate Tax Forms

Edit your KY DoR Inheritance Estate Tax Forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your KY DoR Inheritance Estate Tax Forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit KY DoR Inheritance Estate Tax Forms online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY DoR Inheritance Estate Tax Forms. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DoR Inheritance & Estate Tax Forms Instr Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DoR Inheritance Estate Tax Forms

How to fill out KY DoR Inheritance & Estate Tax Forms

01

Gather all necessary documentation related to the estate, including the death certificate, will, and asset information.

02

Obtain the correct KY DoR Inheritance & Estate Tax Forms from the Kentucky Department of Revenue website or their office.

03

Complete the forms by providing accurate information about the deceased, assets, beneficiaries, and the estimated value of the estate.

04

Calculate the tax due based on the current inheritance and estate tax rates, following the guidelines provided in the forms.

05

Double-check all entries for accuracy and completeness to avoid delays in processing.

06

Submit the completed forms along with any required payments to the pertinent Kentucky Department of Revenue office.

07

Keep copies of all submitted forms and documentation for your records.

Who needs KY DoR Inheritance & Estate Tax Forms?

01

Any individual or entity that inherits assets from a deceased person in Kentucky may need to complete the KY DoR Inheritance & Estate Tax Forms.

02

Executors or administrators of the estate are responsible for filling out these forms.

03

Beneficiaries who receive significant assets may also need to be involved in the process.

Fill

form

: Try Risk Free

People Also Ask about

Who files Kentucky inheritance tax return?

Inheritance Tax All property belonging to a resident of Kentucky is subject to the tax except for real estate located in another state. Also, real estate and personal property located in Kentucky and owned by a nonresident is subject to being taxed.

What tax form do I need for inheritance income?

Schedule K-1 (Form 1041), Beneficiary's Share of Income, Deductions, Credits, etc. Use Schedule K-1 to report a beneficiary's share of the estate's or trust's income, credits, deductions, etc., on your Form 1040, U.S. Individual Income Tax Return.

What is the form for inheritance tax in Kentucky?

If inheritance tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used. The affidavit of exemption is to be filed only with the court. Do not send a copy of the affidavit to the Kentucky Department of Revenue.

What form is used for inheritance?

Form 8971, along with a copy of every Schedule A, is used to report values to the IRS. One Schedule A is provided to each beneficiary receiving property from an estate. Form 8971 InstructionsPDF.

What IRS form do I use for inheritance?

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Do I need a k1 for inheritance?

Schedule K-1 (Form 1041) is used to report a beneficiary's share of an estate, including income, credits, deductions and profits. Beneficiaries of an inheritance should have received a K-1 tax form inheritance statement for the 2022 tax year by the end of 2022.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit KY DoR Inheritance Estate Tax Forms online?

With pdfFiller, it's easy to make changes. Open your KY DoR Inheritance Estate Tax Forms in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I fill out KY DoR Inheritance Estate Tax Forms using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign KY DoR Inheritance Estate Tax Forms and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete KY DoR Inheritance Estate Tax Forms on an Android device?

Use the pdfFiller app for Android to finish your KY DoR Inheritance Estate Tax Forms. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is KY DoR Inheritance & Estate Tax Forms?

KY DoR Inheritance & Estate Tax Forms are official documents used in Kentucky to report and calculate inheritance and estate taxes owed to the state after the death of an individual.

Who is required to file KY DoR Inheritance & Estate Tax Forms?

The executor or personal representative of the estate is required to file KY DoR Inheritance & Estate Tax Forms, as well as any heirs or beneficiaries who inherit taxable property.

How to fill out KY DoR Inheritance & Estate Tax Forms?

To fill out KY DoR Inheritance & Estate Tax Forms, gathered information about the deceased’s assets, liabilities, and beneficiaries must be included, followed by completing the forms according to the instructions provided, and filing them with the Kentucky Department of Revenue.

What is the purpose of KY DoR Inheritance & Estate Tax Forms?

The purpose of KY DoR Inheritance & Estate Tax Forms is to facilitate the reporting and payment of state inheritance taxes to ensure compliance with Kentucky tax laws after an individual's death.

What information must be reported on KY DoR Inheritance & Estate Tax Forms?

Information that must be reported includes the deceased's assets, debts, the value of inheritances, and the identities of the beneficiaries.

Fill out your KY DoR Inheritance Estate Tax Forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DoR Inheritance Estate Tax Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.