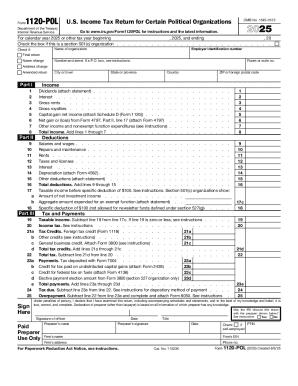

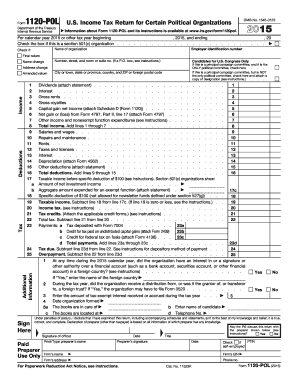

IRS 1120-POL 2016 free printable template

Instructions and Help about IRS 1120-POL

How to edit IRS 1120-POL

How to fill out IRS 1120-POL

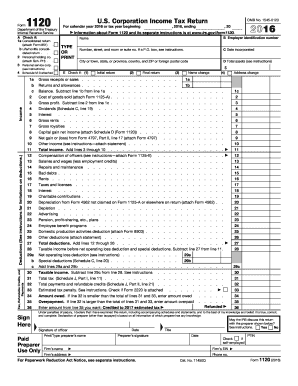

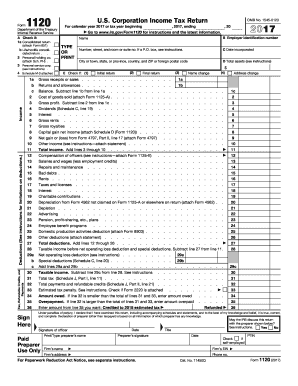

About IRS 1120-POL 2016 previous version

What is IRS 1120-POL?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1120-POL

How can I correct mistakes made on the 2016 form 1120?

To correct mistakes on your 2016 form 1120, you must file an amended return using Form 1120-X. This form allows you to indicate the specific changes and provide explanations for each correction. Ensure that you retain copies of all documents submitted for your records.

What should I do if I receive a notice from the IRS regarding my 2016 form 1120?

If you receive a notice from the IRS concerning your 2016 form 1120, read it carefully to understand the issue. Respond promptly with the necessary documentation to support your case. It’s advisable to keep copies of all correspondence and consult a tax professional if needed.

How can I verify the status of my filed 2016 form 1120?

You can verify the status of your filed 2016 form 1120 by using the IRS 'Where's My Refund?' tool or by contacting the IRS directly. Be prepared to provide your EIN and other identifying information to facilitate the inquiry.

What common errors should I avoid when filing the 2016 form 1120?

Common errors to avoid on the 2016 form 1120 include incorrect EIN, miscalculated figures, and failure to sign the form. Double-check all entries for accuracy and ensure that all required fields are completed to prevent processing delays.

Is e-signature acceptable for the 2016 form 1120?

Yes, the IRS accepts e-signatures for the 2016 form 1120 when filed electronically. Make sure you meet any specific requirements outlined by the IRS regarding e-signatures to ensure your filing is valid.