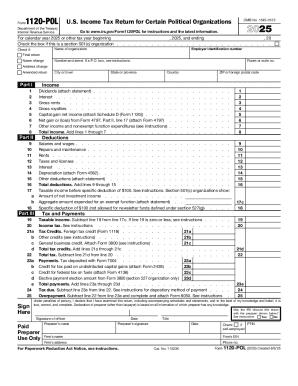

IRS 1120-POL 2024 free printable template

Instructions and Help about pol 1120s

How to edit pol 1120s

How to fill out pol 1120s

Latest updates to pol 1120s

All You Need to Know About pol 1120s

What is pol 1120s?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1120-POL

How can I submit an amended or corrected pol 1120s?

To submit an amended or corrected pol 1120s, you'll need to indicate the changes clearly on the new form. Include all relevant information and ensure it reflects the accurate data. Submit it following the same filing procedures, ensuring any accompanying documents or disclosures are also corrected.

What should I do if my pol 1120s is rejected after e-filing?

If your pol 1120s is rejected, review the rejection codes provided to identify the specific issue. Common reasons include incorrect information or formatting errors. Correct these issues promptly and resubmit your form to avoid penalties.

Are e-signatures accepted when filing pol 1120s?

Yes, e-signatures are generally accepted when filing pol 1120s electronically, provided they meet the required legal standards. Ensure that you secure approval for the use of e-signatures from all necessary parties involved in the filing.

How do I verify the status of my submitted pol 1120s?

To verify the status of your submitted pol 1120s, you can use the tracking system provided by the filing service or regional authority. Make sure to have your submission details on hand to check if it has been received and is in processing.