NC DoR NC-5500 2016 free printable template

Show details

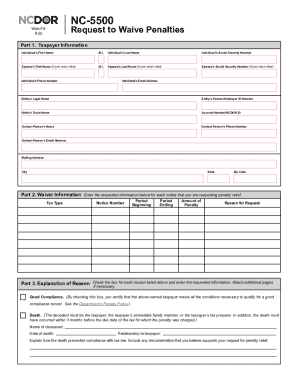

NC-5500 Request to Waive Penalties Web 10-16 Part 1. Taxpayer Information SSN or FEIN SSN of Spouse If Joint Return Account ID Number Taxpayer s Name Legal Name if Business Trade Name If Different Daytime Telephone Number Name of Contact Person Mailing Address Street or P. O. Box State City Zip Code Part 2. Penalty Information Type s of Tax Amount of Penalty Period s Notice s of Assessment Part 3. Reason for Request Place an X in any block that applies and provide the information requested*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR NC-5500

Edit your NC DoR NC-5500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR NC-5500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NC DoR NC-5500 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NC DoR NC-5500. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR NC-5500 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR NC-5500

How to fill out NC DoR NC-5500

01

Obtain the NC DoR NC-5500 form from the North Carolina Department of Revenue website or an authorized office.

02

Provide your identification information, including your name, address, and contact details.

03

Indicate the type of tax you are filing for by selecting the appropriate box.

04

Fill in the financial information required, including income, deductions, and any applicable credits.

05

Attach any necessary documentation that supports your claims or information provided.

06

Review the completed form for accuracy and ensure all sections are filled out.

07

Sign and date the form in the designated area.

08

Submit the form according to the instructions, whether electronically or by mail.

Who needs NC DoR NC-5500?

01

Individuals or businesses in North Carolina who are required to report specific tax information.

02

Anyone who has conducted business transactions subject to taxation in the state.

03

Tax professionals assisting clients with tax compliance in North Carolina.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a NC nonresident return?

Every nonresident must file a North Carolina personal income tax return if income for the taxable year is received from: the ownership of any interest in real or tangible personal property in North Carolina; a business, trade, profession, or occupation carried on in North Carolina; ( Sec.

Do I have to file NC 5?

Quarterly Filers - Employers who withhold an average of less than $250 from wages each month must file Form NC-5 and pay the withheld taxes on a quarterly basis. All quarterly returns and payments are due by the last day of the month following the end of the calendar quarter.

What percentage of my paycheck is withheld for NC State tax?

North Carolina Median Household Income Every taxpayer in North Carolina will pay 4.99% of their taxable income for state taxes.

How much NC state tax should be withheld?

The state income tax rate is 5.25%, and the sales tax rate is 4.75%. North Carolina offers tax deductions and credits to reduce your tax liability, including a standard deduction or itemized deductions.

How much NC state tax should I pay?

North Carolina has a flat 4.75 percent individual income tax rate. North Carolina also has a 2.50 percent corporate income tax rate. North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.99 percent.

What is the NC withholding tax?

Any individual or entity that fails to provide their TIN to the payer, is subject to the 4% North Carolina income tax withholding requirement from the non-wage compensation paid to the individual or entity for services performed in North Carolina.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my NC DoR NC-5500 in Gmail?

Create your eSignature using pdfFiller and then eSign your NC DoR NC-5500 immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit NC DoR NC-5500 on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share NC DoR NC-5500 from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How can I fill out NC DoR NC-5500 on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your NC DoR NC-5500 from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is NC DoR NC-5500?

NC DoR NC-5500 is a form used for reporting certain financial information to the North Carolina Department of Revenue, typically concerning tax and regulatory compliance for businesses.

Who is required to file NC DoR NC-5500?

Businesses operating in North Carolina that meet specific criteria set by the Department of Revenue are required to file NC DoR NC-5500.

How to fill out NC DoR NC-5500?

To fill out NC DoR NC-5500, gather the required financial data, complete the form with accurate information, and submit it as per the instructions provided by the North Carolina Department of Revenue.

What is the purpose of NC DoR NC-5500?

The purpose of NC DoR NC-5500 is to collect and report relevant financial information to ensure compliance with state tax laws and regulations, helping the state to administer and enforce tax obligations.

What information must be reported on NC DoR NC-5500?

The information that must be reported on NC DoR NC-5500 typically includes income, deductions, tax liabilities, and other financial data as specified by the North Carolina Department of Revenue.

Fill out your NC DoR NC-5500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR NC-5500 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.