NC DoR NC-5500 2019 free printable template

Show details

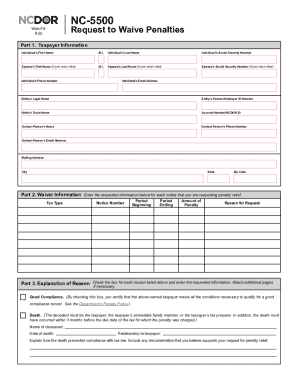

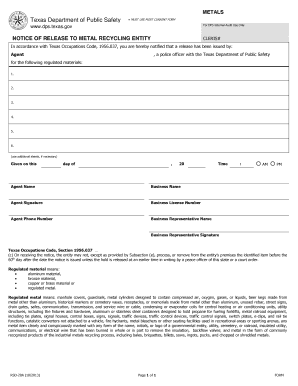

NC-5500 Request to Waive Penalties Web 10-16 Part 1. Taxpayer Information SSN or FEIN SSN of Spouse If Joint Return Account ID Number Taxpayer s Name Legal Name if Business Trade Name If Different Daytime Telephone Number Name of Contact Person Mailing Address Street or P. O. Box State City Zip Code Part 2. Penalty Information Type s of Tax Amount of Penalty Period s Notice s of Assessment Part 3. Reason for Request Place an X in any block that applies and provide the information requested*...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NC DoR NC-5500

Edit your NC DoR NC-5500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NC DoR NC-5500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NC DoR NC-5500 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NC DoR NC-5500. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NC DoR NC-5500 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NC DoR NC-5500

How to fill out NC DoR NC-5500

01

Begin by downloading the NC DoR NC-5500 form from the North Carolina Department of Revenue website.

02

Fill in your name, address, and Social Security number at the top of the form.

03

Indicate the type of return you are filing by checking the appropriate box.

04

Provide details of your income and deductions in the relevant sections.

05

Calculate your total tax liability using the tax tables provided.

06

Review the completed form for accuracy and sign at the bottom.

07

Submit the form either by mailing it to the appropriate address or by filing it electronically through the NC DoR e-file system.

Who needs NC DoR NC-5500?

01

Individuals or businesses who are required to report their income and pay taxes in North Carolina.

02

Anyone seeking to claim specific tax credits or deductions applicable in North Carolina.

03

Taxpayers who need to reconcile their tax liabilities for a given tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I request a penalty waiver in NC?

Submitting Form NC-5500, Request to Waive Penalties (the form is available by calling our toll-free taxpayer assistance line at 1-877-252-3052 and selecting the menu option for Forms, from any Department of Revenue field office, or by accessing the Department's website at Request to Waive Penalties / NC5500.

What is the NC state withholding tax rate?

North Carolina has a flat 4.75 percent individual income tax rate. North Carolina also has a 2.50 percent corporate income tax rate. North Carolina has a 4.75 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 6.99 percent.

What is the standard NC tax withholding?

For Tax Year 2023, the North Carolina individual income tax rate is 4.75% (0.0475). For Tax Year 2022, the North Carolina individual income tax rate is 4.99% (0.0499).

What percentage of my paycheck is withheld for NC state tax?

North Carolina Median Household Income Every taxpayer in North Carolina will pay 4.99% of their taxable income for state taxes.

What is the penalty and interest for NC 5?

The penalty for failure to timely file a withholding return is 5% of the tax due per month (maximum 25%). In addition, criminal penalties are provided for willful failure to comply with the withholding statutes.

What is the penalty for withholding NC taxes?

Penalty and Interest: A penalty for failure to pay (5%) will be assessed for failure to withhold the amount of North Carolina income tax required to be withheld.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NC DoR NC-5500 for eSignature?

To distribute your NC DoR NC-5500, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I edit NC DoR NC-5500 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign NC DoR NC-5500 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out NC DoR NC-5500 on an Android device?

Use the pdfFiller mobile app and complete your NC DoR NC-5500 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is NC DoR NC-5500?

NC DoR NC-5500 is a form used by the North Carolina Department of Revenue for reporting state taxes related to various business activities and financial transactions.

Who is required to file NC DoR NC-5500?

Businesses operating in North Carolina that meet certain criteria regarding income, sales, or employment are required to file the NC DoR NC-5500 form.

How to fill out NC DoR NC-5500?

To fill out NC DoR NC-5500, provide the necessary business information, specific financial details required by the form, and ensure all calculations are accurate before submission.

What is the purpose of NC DoR NC-5500?

The purpose of NC DoR NC-5500 is to ensure that businesses report their tax liabilities accurately and comply with North Carolina tax laws.

What information must be reported on NC DoR NC-5500?

The NC DoR NC-5500 requires reporting of business income, deductions, tax credits, sales information, and other relevant financial details.

Fill out your NC DoR NC-5500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NC DoR NC-5500 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.