Get the free t14 form

Show details

NOTE: USE BALLPOINT PEN AND ENSURE THAT ALL COPIES PRINT CLEARLY UNDERNEATH ISLE OF MAN TIP AND NATIONAL INSURANCE DEDUCTION CARD EMPLOYEES N.I. No. 2010/2011 EMPLOYEES PAYROLL/WORKS No. EMPLOYEES

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t14 isle of man form

Edit your what is a t14 isle of man form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your isle of man t14 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit t14 form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t14 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t14 form

How to fill out t14 form:

01

Start by carefully reading the instructions provided with the t14 form. It is important to understand all the requirements and information needed before filling out the form.

02

Gather all the necessary documents, such as identification proof, supporting documents, and any other required materials mentioned in the instructions.

03

Begin filling out the t14 form by entering your personal information accurately. This may include your name, address, contact details, and any other relevant information as required.

04

Provide the specific details or information requested in each section of the form. Be thorough and ensure all information is correct and up to date.

05

Pay close attention to any special instructions or additional documents requested. Attach any necessary documents securely to the form and make sure they are properly organized.

06

Review the completed t14 form multiple times to double-check for any errors or omissions. It is crucial to ensure the accuracy of all the information provided before submitting the form.

07

Once you are confident that the t14 form is correctly filled out, follow the submission instructions provided in the form or its accompanying instructions. This may involve mailing the form to a specific address or submitting it online through a designated platform.

Who needs t14 form:

01

Individuals who are required to report certain financial transactions or activities to the relevant authorities may need the t14 form. These transactions or activities might include large cash transactions, suspicious activities, or other events specified by the applicable regulations or laws.

02

Businesses or organizations that deal with significant financial transactions or have legal obligations to report certain activities may also require the t14 form.

03

Financial institutions, such as banks or credit unions, may use the t14 form to comply with regulatory requirements and report certain transactions or suspicious activities to the appropriate authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is T1 Canada?

The T1 General or T1 (entitled Income Tax and Benefit Return) is the form used in Canada by individuals to file their personal income tax return.

What is the format of tax number in Isle of Man?

Tax Reference Number or Company Reference Number Consists of a letter followed by six numbers, a hyphen and then a further 2 numbers – e.g. C123456-78.

What is the T1 summary?

The T1 General form is the primary document used to file personal income taxes in Canada. It captures everything from total income to net income to taxable income and lets you know whether you'll have a balance owing on your taxes or be due to receive a refund.

What is the Isle of Man tax year?

The tax year runs from 6 April to 5 April. Tax returns are required to be submitted by 6 October each year, unless you leave the Island or are otherwise advised. All income is assessed on a current year basis.

How do I get my T1 General?

Where can I find my T1 General? You can find your T1 General on your CRA My Account by going into the tax section and clicking “Proof of income.” You can also sign in to the tax software you used to submit your taxes last year, if applicable.

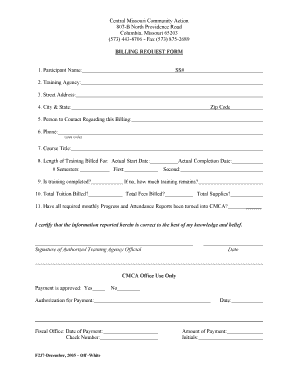

What is a T14 Isle of Man?

Form T14 is a two-part certificate of earnings in respect of each employee which includes details of gross remuneration, ITIP deductions, National Insurance deductions, etc. The forms can be downloaded from the Forms page or obtained from the Division at any time during the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my t14 form directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign t14 form and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How can I edit t14 form on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing t14 form.

How do I complete t14 form on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your t14 form from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is t14 form?

The T14 form is a tax document used in Canada for reporting income from certain sources, including but not limited to partnerships, trusts, and other entities that require special tax treatment.

Who is required to file t14 form?

Individuals or entities that receive income from partnerships, trusts, or similar arrangements that necessitate reporting under the T14 requirements must file this form.

How to fill out t14 form?

To fill out the T14 form, taxpayers must provide identification information, report the income received, detail any relevant deductions, and comply with the specific instructions provided by the Canada Revenue Agency (CRA).

What is the purpose of t14 form?

The purpose of the T14 form is to ensure that income from specific sources is accurately reported to the Canada Revenue Agency, allowing for proper taxation and compliance with Canadian tax laws.

What information must be reported on t14 form?

The T14 form must report identification information of the taxpayer, details of income received from partnerships or trusts, any deductions applicable, and other relevant financial data as required by the CRA.

Fill out your t14 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

t14 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.