CT DRS Schedule CT-SI 2016 free printable template

Show details

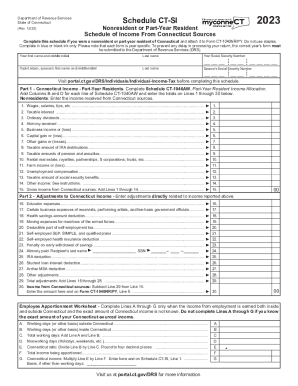

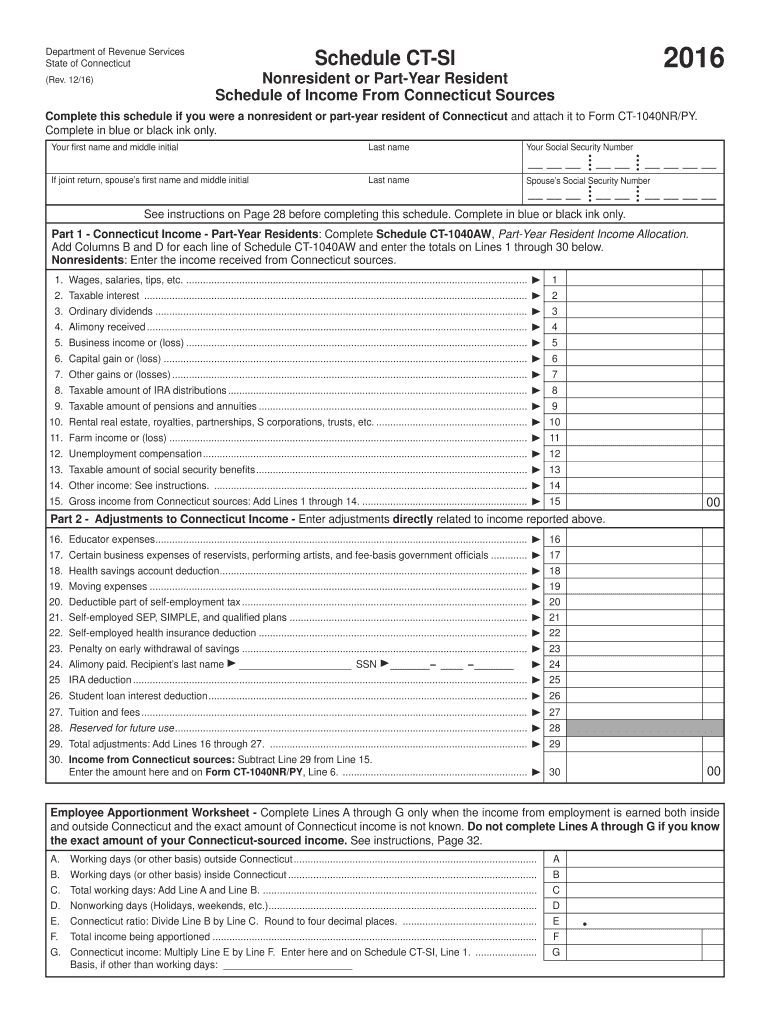

Total income being apportioned. Connecticut income Multiply Line E by Line F. Enter here and on Schedule CT-SI Line 1. Complete in blue or black ink only. Part 1 - Connecticut Income - Part-Year Residents Complete Schedule CT-1040AW Part-Year Resident Income Allocation. Add Columns B and D for each line of Schedule CT-1040AW and enter the totals on Lines 1 through 30 below. Department of Revenue Services State of Connecticut Schedule CT-SI Nonresident or Part-Year Resident Schedule of Income...From Connecticut Sources Rev. 12/16 Complete this schedule if you were a nonresident or part-year resident of Connecticut and attach it to Form CT-1040NR/PY. Complete in blue or black ink only. Your rst name and middle initial Last name If joint return spouse s rst name and middle initial Your Social Security Number Spouse s Social Security Number See instructions on Page 28 before completing this schedule. Nonresidents Enter the income received from Connecticut sources. 1. Wages salaries tips...etc*. 2. Taxable interest. 3. Ordinary dividends. 4. Alimony received. 5. Business income or loss. 6. Capital gain or loss. 7. Other gains or losses. 8. Taxable amount of IRA distributions. 10. Rental real estate royalties partnerships S corporations trusts etc*. 10 11. Farm income or loss. 11 12. Unemployment compensation. 12 14. Other income See instructions. 14 15. Gross income from Connecticut sources Add Lines 1 through 14. 15 Part 2 - Adjustments to Connecticut Income - Enter adjustments...directly related to income reported above. 16. Educator expenses. 16 17. Certain business expenses of reservists performing artists and fee-basis government of cials. 17 Health savings account deduction*. Moving expenses. Deductible part of self-employment tax. Self-employed SEP SIMPLE and quali ed plans. 23. Penalty on early withdrawal of savings. 23 24. Alimony paid* Recipient s last name SSN 25 IRA deduction. 25 26. Student loan interest deduction. 26 27. Tuition and fees. 27 28. Reserved...for future use. 28 29. Total adjustments Add Lines 16 through 27. 29 30. Income from Connecticut sources Subtract Line 29 from Line 15. Enter the amount here and on Form CT-1040NR/PY Line 6. 30 Employee Apportionment Worksheet - Complete Lines A through G only when the income from employment is earned both inside and outside Connecticut and the exact amount of Connecticut income is not known* Do not complete Lines A through G if you know the exact amount of your Connecticut-sourced income. See...instructions Page 32. A. B. C. D. E* F* G* Working days or other basis outside Connecticut. Total working days Add Line A and Line B. Nonworking days Holidays weekends etc*. Connecticut ratio Divide Line B by Line C. Round to four decimal places. Nonresidents Enter the income received from Connecticut sources. 1. Wages salaries tips etc*. 2. Taxable interest. 3. Ordinary dividends. 4. Alimony received. 5. Business income or loss. 6. Capital gain or loss. 7. 3. Ordinary dividends. 4. Alimony...received. 5. Business income or loss. 6. Capital gain or loss. 7. Other gains or losses. 8. Taxable amount of IRA distributions. 10. Rental real estate royalties partnerships S corporations trusts etc*.

pdfFiller is not affiliated with any government organization

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

How to fill out CT DRS Schedule CT-SI

Instructions and Help about CT DRS Schedule CT-SI

How to edit CT DRS Schedule CT-SI

To edit the CT DRS Schedule CT-SI, you can use pdfFiller for seamless corrections. Start by uploading the existing form to the pdfFiller platform. Once uploaded, you can easily make changes using the editing tools available. After completing your edits, save your changes and ensure that all information is accurate before submission.

How to fill out CT DRS Schedule CT-SI

Filling out the CT DRS Schedule CT-SI requires attention to detail. Begin by gathering all necessary documentation that pertains to your tax situation. Fill in the form with accurate data, ensuring that you follow the instructions provided for each section. Double-check all entries and review the form for any potential errors or omissions before submitting it.

About CT DRS Schedule CT-SI 2016 previous version

What is CT DRS Schedule CT-SI?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About CT DRS Schedule CT-SI 2016 previous version

What is CT DRS Schedule CT-SI?

CT DRS Schedule CT-SI is a tax form used by Connecticut for reporting certain state income tax credits. This form must be submitted as part of the Connecticut income tax return. It is specifically designed for individuals and businesses who qualify for specific tax incentives under state law.

What is the purpose of this form?

The purpose of the CT DRS Schedule CT-SI is to allow taxpayers to report income that is eligible for specific deductions or credits. By utilizing this form, taxpayers ensure they are compliant with Connecticut tax regulations and can potentially reduce their overall tax liability based on the credits claimed.

Who needs the form?

Individuals or businesses that claim specific tax credits in Connecticut need to complete the CT DRS Schedule CT-SI. This includes those who have qualified for incentives such as educational expense credits or earned income tax credits. It is essential for anyone who seeks to take advantage of these state-specific tax benefits.

When am I exempt from filling out this form?

Taxpayers may be exempt from filling out the CT DRS Schedule CT-SI if they do not qualify for any state income tax credits or if their income does not meet the threshold for credit eligibility. Additionally, taxpayers who do not have any income reportable under the provisions of this form may also skip its completion.

Components of the form

The CT DRS Schedule CT-SI consists of various sections where taxpayers must provide personal information, income details, and the specific credits being claimed. Each section is clearly labeled, guiding users through the process of accurately reporting their financial situation as it pertains to the state's tax regulations.

What are the penalties for not issuing the form?

Failure to issue the CT DRS Schedule CT-SI when required can result in financial penalties imposed by the Connecticut Department of Revenue Services. Taxpayers may face fines, interest on unpaid taxes, and potential legal repercussions. It is crucial to file the form on time to avoid these penalties.

What information do you need when you file the form?

When filing the CT DRS Schedule CT-SI, you will need your Social Security number or Employer Identification Number, income statements, and supporting documentation for the credits being claimed. This may include W-2 forms, 1099 forms, and receipts for qualified expenses that support your claims.

Is the form accompanied by other forms?

The CT DRS Schedule CT-SI is often submitted alongside the Connecticut income tax return. Depending on the specific circumstances of the taxpayer, additional forms or schedules may be required to fully report all income and claim applicable credits.

Where do I send the form?

The completed CT DRS Schedule CT-SI should be sent to the Connecticut Department of Revenue Services. It is typically included with your Connecticut personal income tax return and should be mailed to the appropriate address specified for tax filings. Ensure to check the latest mailing instructions on the official DRS website.

See what our users say