CA FTB 592 2017 free printable template

Show details

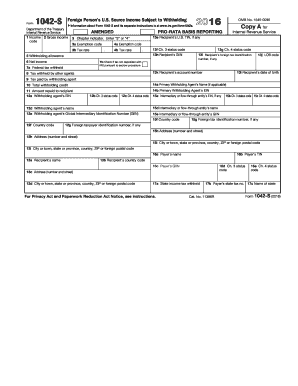

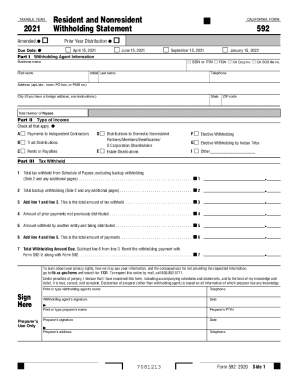

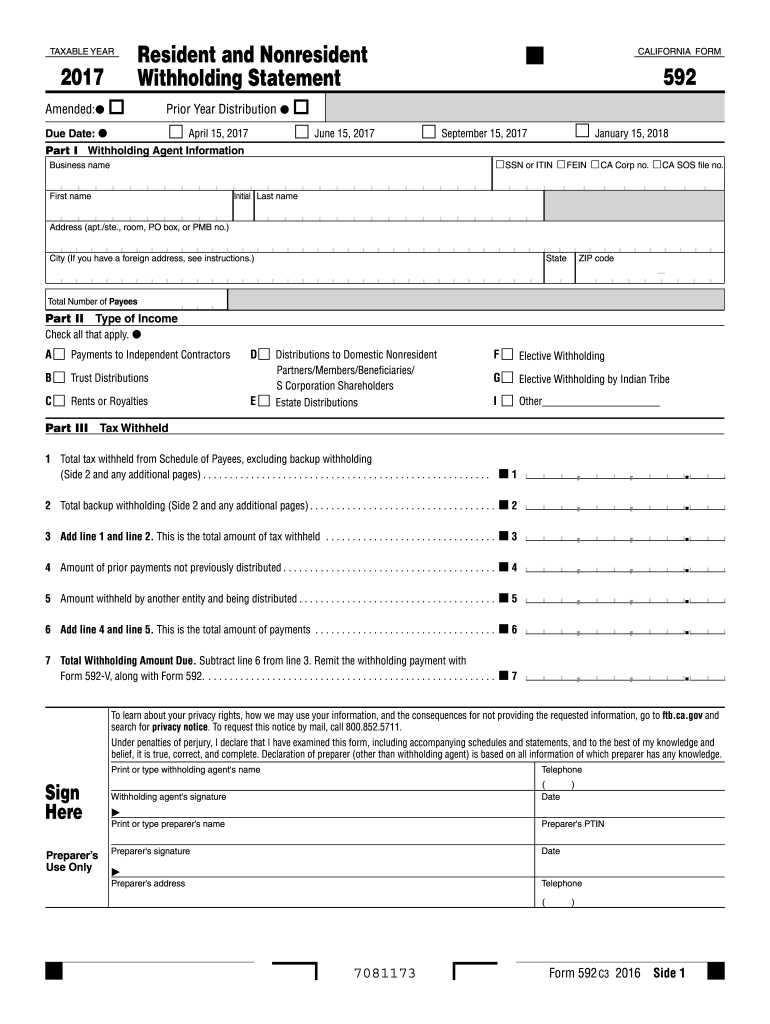

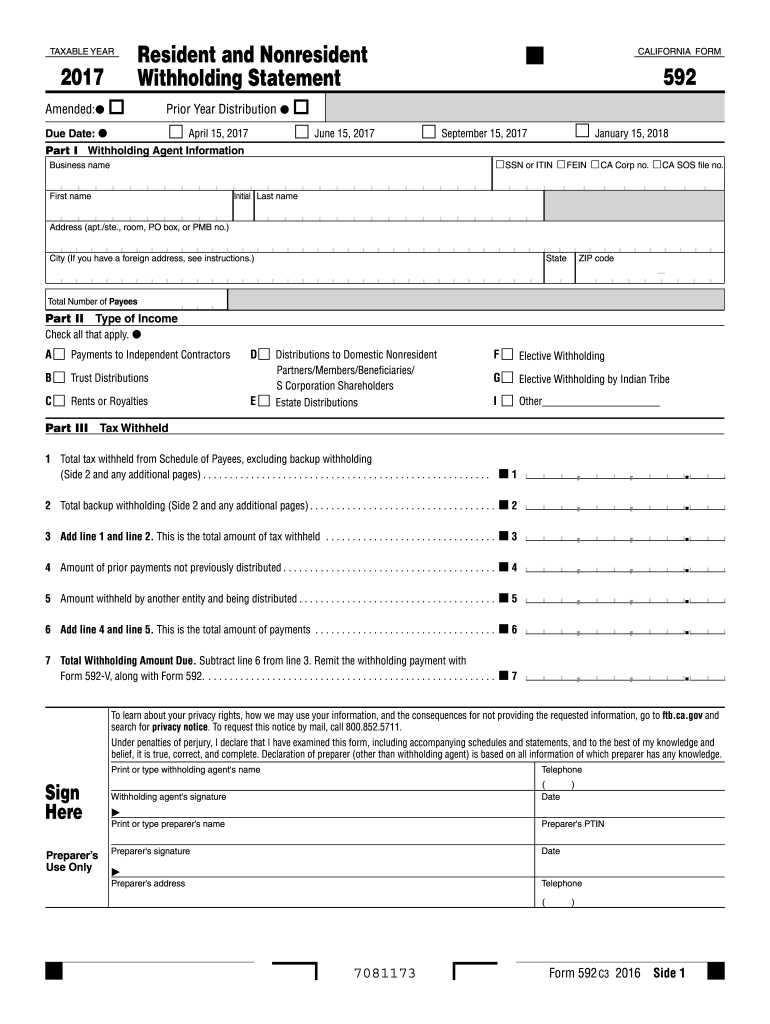

7 Total Withholding Amount Due. Subtract line 6 from line 3. Remit the withholding payment with Form 592-V along with Form 592. Print or type withholding agent s name Telephone Sign Here Withholding agent s signature Date Preparer s Use Only Preparer s signature Print or type preparer s name Preparer s address 7081173 Form 592 C3 2016 Side 1 Schedule of Payees Enter business or individual name not both. TAXABLE YEAR Amended I Due Date Resident and Nonresident Withholding Statement m Prior...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 592

Edit your CA FTB 592 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 592 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA FTB 592 online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit CA FTB 592. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 592 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 592

How to fill out CA FTB 592

01

Obtain a copy of the CA FTB 592 form, which can be downloaded from the California Franchise Tax Board website.

02

Fill in your name, address, and Social Security Number or Tax Identification Number in the designated fields.

03

Indicate the type of payment being reported (rental income, lease payments, etc.).

04

Enter the total amount of income received during the reporting period in the appropriate section.

05

Calculate the total withholding amount, based on the payment received, using the withholding tax rate for the relevant income type.

06

Provide any additional required information, such as details of the transaction or the payee's information.

07

Review the completed form for accuracy and completeness.

08

Submit the form to the California Franchise Tax Board by the specified due date.

Who needs CA FTB 592?

01

Anyone who is a payor withholding California state taxes for certain payments made to nonresidents, including payments for services, rents, or royalties.

02

Business entities or individuals who make payments to nonresidents that are subject to California withholding tax.

03

Taxpayers who are required to report and pay California withholding taxes on behalf of nonresident payees.

Instructions and Help about CA FTB 592

Fill

form

: Try Risk Free

People Also Ask about

What is Form 592 and 593?

The real estate withholding amount for California generate when withholding information are entered in the California Form 592-B/Form 593.

What is form 592 and 593?

The real estate withholding amount for California generate when withholding information are entered in the California Form 592-B/Form 593.

What is Form 592 used for?

File Form 592 to report withholding on domestic nonresident individuals. Items of income that are subject to withholding are payments to independent contractors, recipients of rents, endorsement income, royalties, etc.

Is Form 592 required?

California Revenue and Taxation Code (R&TC) Sections 18662 and 18664 require the withholding agent to provide a completed Form 592-B, Resident and Nonresident Withholding Tax Statement, to the payee to report the amount of payment or distribution subject to withholding and tax.

What is Form 592-B 2017?

Use Form 592-B, Resident and Nonresident Withholding Tax Statement, to report to the payee the amount of payment or distribution subject to withholding and tax as reported on Form 592, Resident and Nonresident Withholding Statement, or Form 592-F, Foreign Partner or Member Annual Return.

Is CA form 592 required?

Form 592‑B, Resident and Nonresident Withholding Tax Statement – The withholding agent must provide Form 592-B to each payee which shows the total amount withheld and reported for the tax year. The withholding agent does not submit Form 592-B to the FTB. For more information, get Form 592-B.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA FTB 592 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your CA FTB 592, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an electronic signature for signing my CA FTB 592 in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your CA FTB 592 right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How can I edit CA FTB 592 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing CA FTB 592 right away.

What is CA FTB 592?

CA FTB 592 is a form used by California tax entities to report amounts withheld from California source income paid to nonresidents.

Who is required to file CA FTB 592?

Entities making payments to nonresidents, including businesses and individuals, are required to file CA FTB 592 if they withhold California income tax from the payments.

How to fill out CA FTB 592?

To fill out CA FTB 592, you need to provide information about the payer, payee, the amounts paid, and the tax withheld, following the instructions provided by the California Franchise Tax Board.

What is the purpose of CA FTB 592?

The purpose of CA FTB 592 is to report and remit the California income tax withheld from payments made to nonresidents, ensuring compliance with state tax laws.

What information must be reported on CA FTB 592?

CA FTB 592 requires reporting of the payer's and payee's information, the gross amount paid, the total amount withheld, and other relevant tax details.

Fill out your CA FTB 592 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 592 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.