CA FTB 592 2023 free printable template

Show details

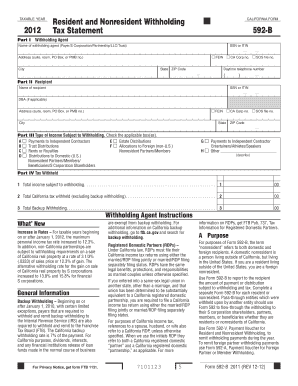

7 Total Withholding Amount Due. Subtract line 6 from line 3. Remit the withholding payment with Form 592-V along with Form 592. Sign Here Preparer s Use Only Print or type withholding agent s name Withholding agent s signature Date Print or type preparer s name Preparer s signature Preparer s address 7081233 Form 592 2022 Side 1 Schedule of Payees Enter business or individual name not both. Resident and Nonresident Withholding Statement TAXABLE YEAR Amended Due Date Prior Year Distribution...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA FTB 592

Edit your CA FTB 592 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA FTB 592 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA FTB 592 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA FTB 592. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 592 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA FTB 592

How to fill out CA FTB 592

01

Obtain the CA FTB 592 form from the California Franchise Tax Board website.

02

Fill in the payer’s information, including name, address, and taxpayer identification number.

03

Enter the payee's information, including the name, address, and taxpayer identification number.

04

Indicate the total amount of California source income paid to the payee during the year.

05

Provide any applicable withholding amounts that were withheld from the payee's income.

06

Review all information for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the Franchise Tax Board by the required deadline.

Who needs CA FTB 592?

01

Individuals or businesses that make payments subject to California withholding.

02

Payors who are required to report California source income payments to the Franchise Tax Board.

03

Recipients of income who may be subject to California income tax withholding.

Fill

form

: Try Risk Free

People Also Ask about

Who provides form 593?

The Settlement Agent must provide Seller the 593 form to be reviewed, completed and signed. If the Seller can check any one of the boxes on Part III or IV, under penalty of perjury, then the transaction is exempt.

Who is subject to California withholding?

Payments subject to withholding include: Payments to nonresident independent contractors or consultants who provide services in California. Other non-wage payments of California source income to nonresidents such as leases, rents, royalties, winnings and payouts.

Who must file CA Form 592?

You are reporting withholding on foreign partners or members. Use Form 592-F, Foreign Partner or Member Annual Withholding Return. You are reporting real estate withholding as the buyer or real estate escrow person withholding on the sale of real estate.

Who is the withholding agent on Form 592 PTE?

For the purpose of this form, a PTE is an entity that has paid withholding on behalf of a nonresident owner or has had its income withheld upon. Each of these PTEs is a withholding agent and is required to file Form 592-PTE on an annual basis to allocate withholding.

What are the three types of withholding taxes?

Three key types of withholding tax are imposed at various levels in the United States: Wage withholding taxes, Withholding tax on payments to foreign persons, and. Backup withholding on dividends and interest.

What is California Form 592 for?

Tax withheld on California source income is reported to the Franchise Tax Board (FTB) using Form 592. Form 592 includes a Schedule of Payees section, on Side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts.

Who is exempt from California tax withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

Who needs to file 592-B?

Form 592-B must be completed by the withholding agent, including any person or entity who: Has withheld on payments to residents or nonresidents.

What is withholding tax at source requirements?

Your payer must withhold 7% from your CA source income that exceeds $1,500 in a calendar year.

Who is not subject to California withholding?

You may not have to withhold if: Total payments or distributions are $1,500 or less. Paying for goods. Paying for services performed outside of California.

Who must file CA 592-PTE?

For the purpose of this form, a PTE is an entity that has paid withholding on behalf of a nonresident owner or has had its income withheld upon. Each of these PTEs is a withholding agent and is required to file Form 592-PTE on an annual basis to allocate withholding.

What is a California withholding agent?

A withholding agent is any person or entity with the control, receipt, custody, disposal, or payment of California source income. We also refer to withholding agents as “payers.”

Does form 593 need to be attached to tax return?

To claim the withholding credit, report the sale or transfer as required and enter the amount from line 5 on the withholding line on your tax return, Withholding (Form 592-B and/or 593). Attach one copy of Form(s) 593, to the lower front of your California tax return.

What is California Form 592-B?

California Revenue and Taxation Code (R&TC) Sections 18662 and 18664 require the withholding agent to provide a completed Form 592-B, Resident and Nonresident Withholding Tax Statement, to the payee to report the amount of payment or distribution subject to withholding and tax.

What is 592 withholding?

General Information. Tax withheld on California source income is reported to the Franchise Tax Board (FTB) using Form 592. Form 592 includes a Schedule of Payees section, on Side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding amounts.

How do you know if you are subject to California withholding?

Your payer must take 7% from your CA income that exceeds $1,500 in a calendar year.You may need to prepay tax if you receive a non-wage payment, such as: Trust distributions. Partnership and LLC distributions. Rents. Royalties. Gambling winnings.

Who is required to withhold tax on the California real estate sale?

Real estate withholding is required on the sale of CA real property held by a trust unless the trust can qualify for an exemption on Form 593. There are two types of trusts; a grantor and a nongrantor trust.

What are the three 3 types of tax that are typically withheld from a worker's paycheck?

Depositing Employment Taxes In general, you must deposit federal income tax withheld as well as the employer and employee social security and Medicare taxes and FUTA taxes. The requirements for depositing, as explained in Publication 15, vary based on your business and the amount you withhold.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the CA FTB 592 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your CA FTB 592 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit CA FTB 592 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing CA FTB 592 right away.

How do I fill out CA FTB 592 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign CA FTB 592 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is CA FTB 592?

CA FTB 592 is a form used by the California Franchise Tax Board (FTB) to report California source income paid to non-residents, and to withhold taxes on that income.

Who is required to file CA FTB 592?

Any person or business entity that pays California source income to a non-resident is required to file CA FTB 592.

How to fill out CA FTB 592?

To fill out CA FTB 592, you need to provide information about the payer, the recipient, the type of income, the amount paid, and the amount withheld, following the instructions provided by the FTB.

What is the purpose of CA FTB 592?

The purpose of CA FTB 592 is to report and remit taxes withheld on California source income paid to non-residents, ensuring compliance with California state tax laws.

What information must be reported on CA FTB 592?

The information that must be reported on CA FTB 592 includes the payer's name and address, the payee's name and address, the type of income, total amount paid, and total tax withheld.

Fill out your CA FTB 592 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA FTB 592 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.