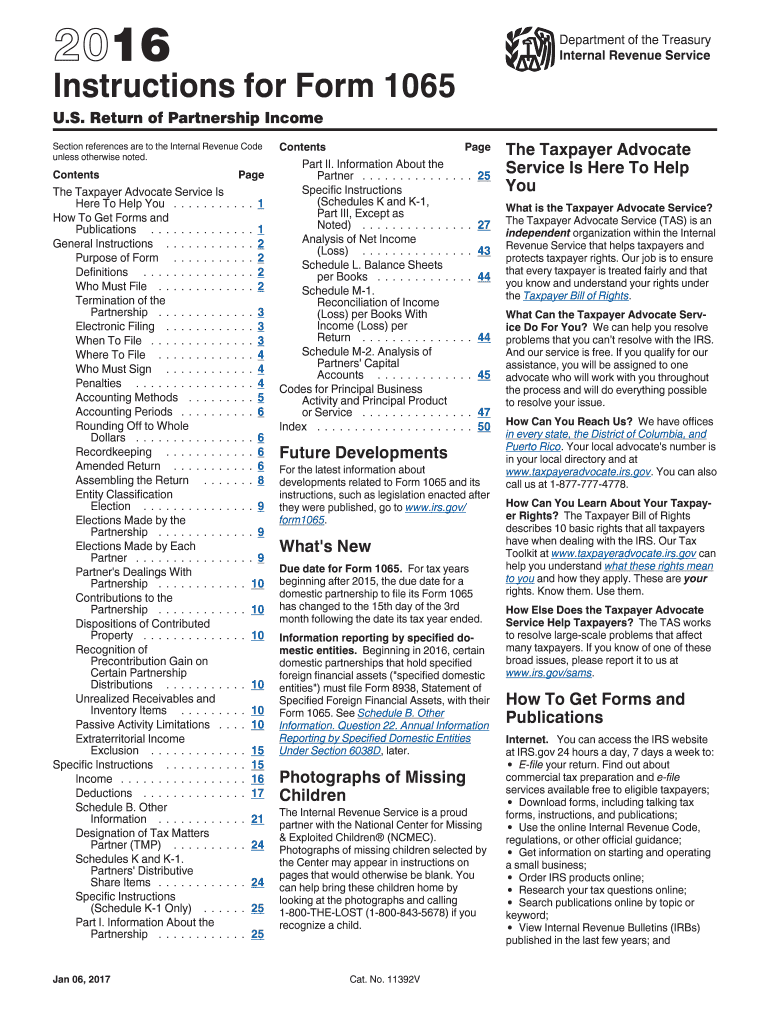

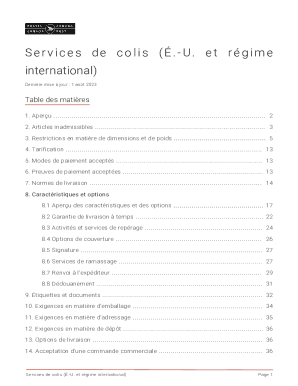

IRS Instructions 1065 2016 free printable template

Get, Create, Make and Sign IRS Instructions 1065

Editing IRS Instructions 1065 online

Uncompromising security for your PDF editing and eSignature needs

IRS Instructions 1065 Form Versions

How to fill out IRS Instructions 1065

How to fill out IRS Instructions 1065

Who needs IRS Instructions 1065?

Instructions and Help about IRS Instructions 1065

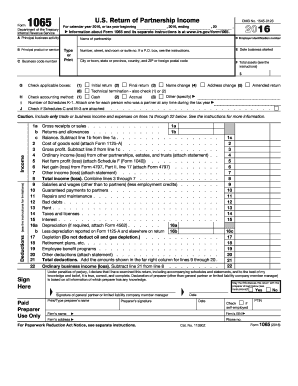

— with JD be business solutions, and today we're going to go over how to fill out the tax form 1065 which is for the income tax return for a partnership whether that's a general partnership or if you have an LLC with one or more people for most of our audience it's very small businesses it's probably you and your wife you and your husband maybe you and a friend one other person, and you have an LLC set up, and you have to file a form 1065, so before you start I'm going to give the usual caveat that I highly recommend that if you have a business you hire a qualified CPA to repair prepare that for you, they're going to save you more money than you spend on them nine times out of ten if you have a good one you're going to get yourself in trouble if you try to do this most of you but if you are brave enough to go that route you kind of do feel like you have an idea of what you're doing this will help you do that and if you won't want to help just a hire someone else to do it understanding the form will help you get your documents organized enough to help them prepare the return which will hopefully in turn lower the price that you're going to pay someone to do it having said that we are accepting new clients for this tax season you can find that on our website CPA JD be calm, or you can email us CPA JD be at gmail.com, and we can give you some pricing packages and be happy to work with you, we work with people all over the country, so we are happy to bring you on board we do have limited slots available so please contact us soon if you're interested all right so to get started we're going to go over just quickly the beginning here you have to put in your principle business activity we use my business tax prep the name of the partnership job business solutions your EIN number just make one up here the date the business started so whenever you started the business your address 5 by 5 x street city town normal stuff principal product or service tax preparation whatever it is for you if you sell real estate sales whatever business code you'll have certain ones to choose from here if you're using tax software if you're truly going to fill this out by hand just Google business code number for whatever you do so business code number for real estate sales something should come up and give you that their total assets you don't need to put anything here yet okay, so now we get into part G here we're checking the applicable and applicable boxes if it's the first return you filed for your business you're going to check initial return if it's the last return you're filing for your business if you closed it in the previous year you click that box if you're changing your name click that box changing your address click that box and if you're amending your return if you originally filed it, and now you have to change it you're going to click box five if it's a technical termination click that box that's not something really go over you'll have to worry about it at...

People Also Ask about

Do I need to file a Schedule B 1?

Do you have to fill out balance sheet on 1065?

Is Schedule B required for 1065?

What is Schedule B used for?

What is Schedule B on Form 1065?

What do I include with form 1065?

What is Schedule B 2 form 1065?

How do I prepare a 1065 tax return?

How do I prepare Form 1065?

What does B mean in taxes?

How do I file a 1065 partnership?

Do partnerships have to file Schedule L?

Can I do my own partnership tax return?

Where do I put charitable contributions on 1065?

What are Question 4 Requirements 1065?

How much does it cost to prepare a partnership tax return?

Is Schedule L required for 1065?

Can I prepare my own 1065?

How do I prepare a partnership tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in IRS Instructions 1065 without leaving Chrome?

How can I edit IRS Instructions 1065 on a smartphone?

How do I fill out IRS Instructions 1065 using my mobile device?

What is IRS Instructions 1065?

Who is required to file IRS Instructions 1065?

How to fill out IRS Instructions 1065?

What is the purpose of IRS Instructions 1065?

What information must be reported on IRS Instructions 1065?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.