IRS Instructions 1065 2021 free printable template

Show details

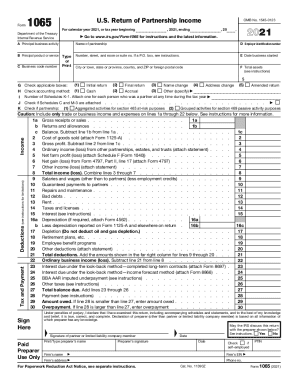

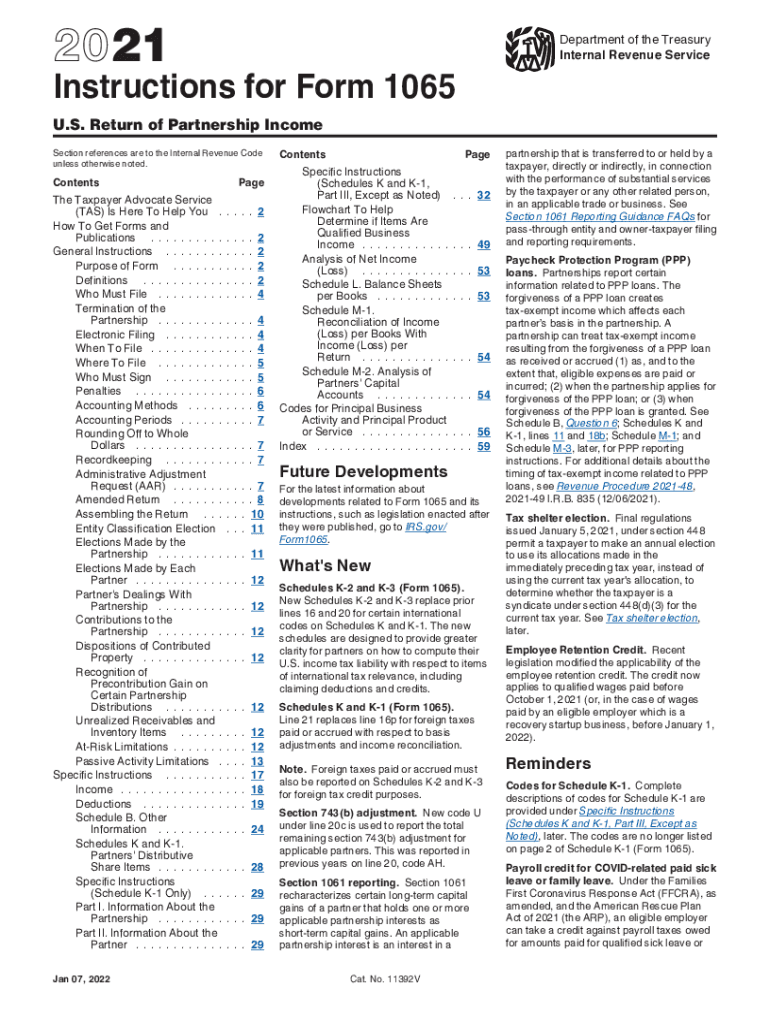

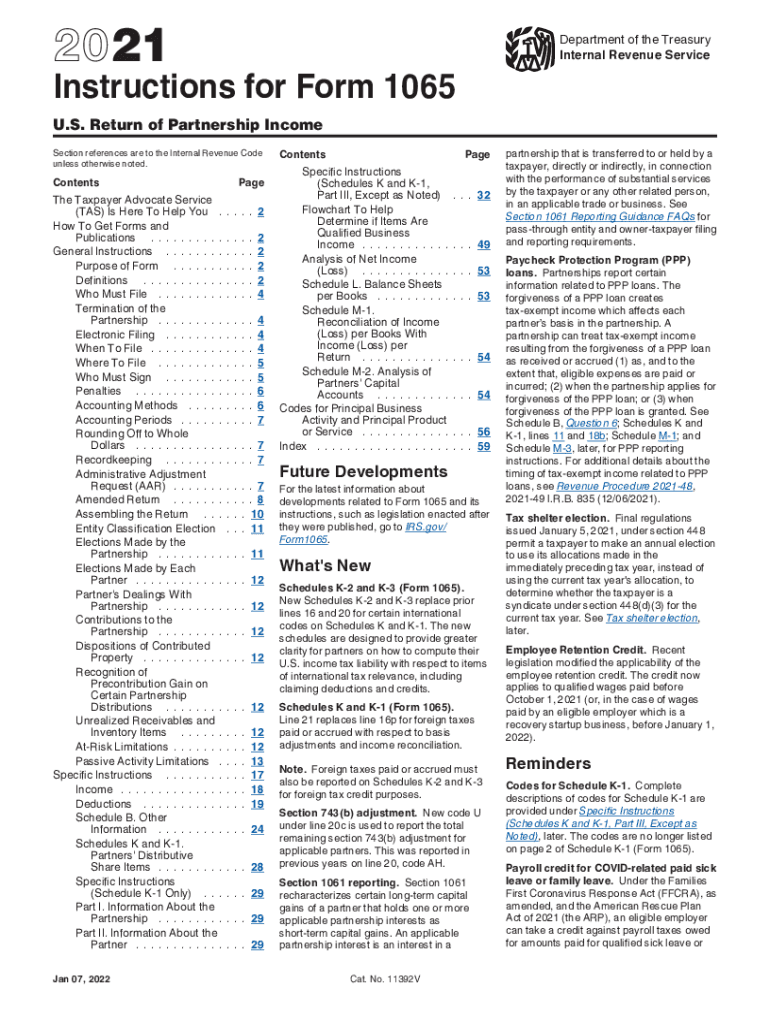

2021Department of the Treasury Internal Revenue ServiceInstructions for Form 1065 U.S. Return of Partnership Income Section references are to the Internal Revenue Code unless otherwise noted. Contents

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Instructions 1065

Edit your IRS Instructions 1065 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Instructions 1065 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Instructions 1065 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IRS Instructions 1065. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Instructions 1065 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Instructions 1065

How to fill out IRS Instructions 1065

01

Gather all necessary financial documents, including income statements, expense receipts, and balances sheets for the tax year.

02

Download the IRS Instructions 1065 from the IRS website or obtain a physical copy.

03

Fill out the identifying information at the top, including the partnership name, address, and Employer Identification Number (EIN).

04

Complete Schedule B to provide information on the partnership’s income, deductions, and other relevant items.

05

Use Schedule K to report the partnership's income, deductions, credits, and other items that are passed through to partners.

06

Fill out Schedule K-1 for each partner to show their share of income, deductions, and credits for the year.

07

Review the form for accuracy and completeness before signing.

08

File the completed Form 1065 with the IRS by the due date, typically March 15th.

Who needs IRS Instructions 1065?

01

Businesses that operate as partnerships.

02

Limited liability companies (LLCs) taxed as partnerships.

03

Tax professionals who prepare tax returns for partnerships.

04

Partners of a partnership who need to report their share of income and deductions.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Schedule B 1?

It is only required when the total exceeds certain thresholds. In 2022 for example, a Schedule B is only necessary when you receive more than $1,500 of taxable interest or dividends.

Do you have to fill out balance sheet on 1065?

To file Form 1065, you'll need all of your partnership's important year-end financial statements, including a profit and loss statement that shows net income and revenues along with all the partnership's deductible expenses, and a balance sheet for the beginning and end of the year.

Is Schedule B required for 1065?

Partnerships use Schedule B-1 (Form 1065) to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

What is Schedule B used for?

Use Schedule B (Form 1040) if any of the following applies: You had over $1,500 of taxable interest or ordinary dividends. You received interest from a seller-financed mortgage and the buyer used the property as a personal residence. You have accrued interest from a bond.

What is Schedule B on Form 1065?

Partnerships use Schedule B-1 (Form 1065) to provide information applicable to certain entities, individuals, and estates that own, directly or indirectly, an interest of 50% or more in the profit, loss, or capital of the partnership.

What do I include with form 1065?

This form requires significant information about the partnership's annual financial status. This includes income information such as gross receipts or sales. Deductions and operating expenses such as rent, employee wages, bad debts, interest on business loans, and other costs are also included.

What is Schedule B 2 form 1065?

Schedule B-2 was created for the purpose of allowing certain partnerships with 100 or less partners to elect out of the centralized partnership audit regime. The election occurs on the main 1065 form on Schedule B, line 25 (if answered “Yes”).

How do I prepare a 1065 tax return?

Form 1065 instructions Gather relevant financial documents and IRS forms. Fill in IRS Form 1065 A-K. Fill in the remainder of IRS Form 1065 (page 1) Fill in IRS Form 1065 Schedule B (page 2) Complete IRS Form 1065 Schedule B (page 3) Complete IRS Form 1065 Schedule K (page 4) Complete IRS Form 1065 Schedule L (page 5)

How do I prepare Form 1065?

Fill in Boxes A Through J Principal business activity, principal product or service, and business code number. Employer Identification Number (EIN). Date your business started. Total assets as shown by your books. Type of tax return. Accounting method. The amount of Schedule K-1s you're attaching.

What does B mean in taxes?

IRS Schedule B is a tax schedule that helps American taxpayers compute income tax due on interest and dividends earned. 1 This schedule uses information from Forms 1099-INT and 1099-DIV to populate the correct figures into your 1040 tax return.

How do I file a 1065 partnership?

5 Steps to Filing Partnership Taxes Prepare Form 1065, U.S. Return of Partnership Income. Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065. Prepare Schedule K-1. File Form 1065 and Copies of the K-1 Forms. File State Tax Returns. File Personal Tax Returns.

Do partnerships have to file Schedule L?

If the partnership does NOT meet the four requirements set forth in Schedule B (Form 1065), Line 4, the partnership is required to complete Schedule L and enter the balance sheet as reflected on the partnership's books and records.

Can I do my own partnership tax return?

Partnerships with 100 or less partners (Schedules K-1) may voluntarily file their return using the MeF Platform. This page provides an overview of electronic filing and more detailed information for those partnerships that prepare and transmit their own income tax returns using MeF.

Where do I put charitable contributions on 1065?

Click the three dots at the top of the screen and select Lines 12-19. Scroll down to the Other Deductions (13) section. Locate the Charitable Contributions (8) subsection. Enter the contributions in the appropriate fields under Cash or Noncash.

What are Question 4 Requirements 1065?

What are the requirements for Question 4? The partnership's total receipts for the tax year were less than $250,000. The partnership's total assets at the end of the tax year were less than $1 million.

How much does it cost to prepare a partnership tax return?

Typical fee range is $1,500 to $1,800 for partnership and corporate tax returns depending on the quality of your accounting records. S Corp Election. We can have your entity taxed as an S corporation for $450. Online Accountant. Consultation.

Is Schedule L required for 1065?

When Schedule L is required: If the partnership does NOT meet the four requirements set forth in Schedule B (Form 1065), Line 4, the partnership is required to complete Schedule L and enter the balance sheet as reflected on the partnership's books and records.

Can I prepare my own 1065?

You can find the 1065 tax form on the IRS website. You can fill out the form using tax software or print it to complete it by hand. If your partnership has more than 100 partners, you're required to file Form 1065 online. Other partnerships may be able to file by mail.

How do I prepare a partnership tax return?

5 Steps to Filing Partnership Taxes Prepare Form 1065, U.S. Return of Partnership Income. Every partnership must prepare a federal partnership tax return on Internal Revenue Servicer Form 1065. Prepare Schedule K-1. File Form 1065 and Copies of the K-1 Forms. File State Tax Returns. File Personal Tax Returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IRS Instructions 1065 to be eSigned by others?

To distribute your IRS Instructions 1065, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I sign the IRS Instructions 1065 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IRS Instructions 1065 in seconds.

Can I edit IRS Instructions 1065 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign IRS Instructions 1065 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is IRS Instructions 1065?

IRS Instructions 1065 are the guidelines provided by the Internal Revenue Service for partnership tax returns. They provide detailed information on how to complete Form 1065, which is used by partnerships to report income, deductions, gains, losses, and other tax-related information.

Who is required to file IRS Instructions 1065?

Partnerships that have two or more members are required to file Form 1065. This includes general partnerships, limited partnerships, and limited liability companies (LLCs) that are classified as partnerships for tax purposes.

How to fill out IRS Instructions 1065?

To fill out IRS Instructions 1065, partnerships should gather financial information related to income, expenses, and deductions. They should then complete the form by following the step-by-step instructions provided, ensuring all necessary schedules and attachments are included before submitting to the IRS.

What is the purpose of IRS Instructions 1065?

The purpose of IRS Instructions 1065 is to provide a clear framework for partnership reporting to ensure compliance with federal tax laws. It helps partnerships accurately report their business income and expenses, allocate profits or losses among partners, and compute tax obligations.

What information must be reported on IRS Instructions 1065?

Partnerships must report various types of information on IRS Instructions 1065, including the partnership's income, deductions, credits, and specific details about each partner's share of income and losses, as well as other financial information relevant to the partnership's activities.

Fill out your IRS Instructions 1065 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Instructions 1065 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.