Canada B232 E 2016-2025 free printable template

Show details

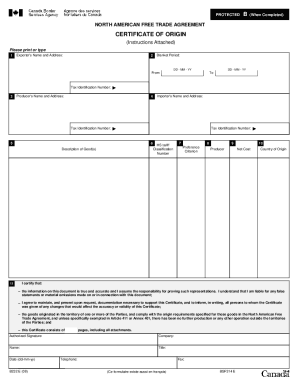

Authorized Signature Company Name Title Date dd-mm-yy B232 E 16 Telephone Fax Ce formulaire existe aussi en fran ais BSF314 E Back to page 1 For purposes of obtaining preferential tariff treatment this document must be completed legibly and in full by the exporter and be in the possession of the importer at the time the declaration is made. Restore Help PROTECTED Instruction B when completed NORTH AMERICAN FREE TRADE AGREEMENT CERTIFICATE OF ORIGIN Please print or type Exporter s Name and...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1998 b232 e edit form

Edit your 1998 ca b232 certificate online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1998 b232 e certificate online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1998 ca b232 certificate print online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1998 b232 e certificate print form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada B232 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 1998 ca b232 certificate create form

How to fill out Canada B232 E

01

Obtain the Canada B232 E form from the official Canada Revenue Agency (CRA) website.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information including your name, address, and contact details in the designated fields.

04

Provide your tax identification number or social insurance number as required.

05

Complete the sections that are relevant to your situation, such as income sources and deductions.

06

Double-check all entries for accuracy to avoid any delays in processing.

07

Sign and date the form at the bottom where indicated.

08

Submit the completed form according to the submission guidelines specified by the CRA.

Who needs Canada B232 E?

01

Individuals or entities who are applying for a tax exemption or adjustment in Canada.

02

Taxpayers who need to report specific financial activities or statuses.

03

Those seeking to claim specific deductions or credits related to their taxes.

Fill

1998 canada b232 north trade form

: Try Risk Free

People Also Ask about 1998 canada b232 american fill

Can I create my own certificate of origin?

The shipper can create their own Declaration of Origin template to make a declaration on behalf of their company. This document will state the country in which the goods were made (usually the country of export).

What is form of certificate of origin?

The Certificate of Origin Form A is presented in the import customs but must issued within a maximum period of ten months from its issuance by a competent institution (chamber of commerce, consular office) in the country of origin, i.e the country from which the product is manufactured and exported.

What is certificate of origin with example?

A certificate of origin (CO) is a document declaring in which country a commodity or good was manufactured. The certificate of origin contains information regarding the product, its destination, and the country of export. For example, a good may be marked "Made in the USA" or "Made in China".

What details are on certificate of origin?

A Certificate of Origin (CO) is an important international trade document that certifies that goods in a particular export shipment are wholly obtained, produced, manufactured or processed in a particular country.

What is an example of certificate of origin?

A certificate of origin (CO) is a document declaring in which country a commodity or good was manufactured. The certificate of origin contains information regarding the product, its destination, and the country of export. For example, a good may be marked "Made in the USA" or "Made in China".

What is simplified certificate of origin?

The EAC Simplified Certificate of Origin (SCO) allows customs officials in the destination country not to charge import duty on exports that are accompanied by the SCO.

Can you make your own certificate of origin UK?

Origin declaration. You can make an origin declaration (also known as an 'invoice declaration' or 'statement on origin') on a commercial document that has enough detail in it to identify the origin of the goods.

What is a certificate of origin PDF?

This document certifies the country of origin of the goods, that is to say, it proves that the goods have been manufactured in that country.

What are certificates of origin for import?

A COO must be issued by an authorised body in the country of origin and may need to be provided, on request, to customs officials in the importing country. A COO applies to a single shipment. It may cover one or more goods, but must not exceed 20 items (that is, 20 unique goods) and may be valid for up to one year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my certificate of origin for canada in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your 1998 b232 origin trade search and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get 1998 canada b232 american template?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific 1998 canada b232 origin agreement printable and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out 1998 canada b232 e certificate north american get using my mobile device?

Use the pdfFiller mobile app to fill out and sign 1998 canada b232 origin trade agreement printable on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is Canada B232 E?

Canada B232 E is a form used by certain businesses to report specific financial information to the Canada Revenue Agency, often relating to the use of their tax credits.

Who is required to file Canada B232 E?

Businesses that are utilizing certain tax credits or claiming specific deductions as stipulated by the Canada Revenue Agency must file the Canada B232 E.

How to fill out Canada B232 E?

To fill out Canada B232 E, businesses need to provide accurate financial details, including income, expenses, and any applicable tax credits. The instructions provided by the CRA should be followed closely to ensure compliance.

What is the purpose of Canada B232 E?

The purpose of Canada B232 E is to gather information from businesses regarding their claim for certain tax incentives, ensuring that they comply with tax regulations and accurately report their financial activity.

What information must be reported on Canada B232 E?

Information required on Canada B232 E includes business income, expenses, applicable tax credits claimed, and any other financial details that may be relevant to the tax credit or deduction being claimed.

Fill out your b232 certificate north trade online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1998 Canada b232 American Trade Form Online is not the form you're looking for?Search for another form here.

Keywords relevant to 1998 canada b232 certificate american agreement form

Related to 1998 canada b232 e north agreement form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.