UT TC-62M Schedule A 2008 free printable template

Show details

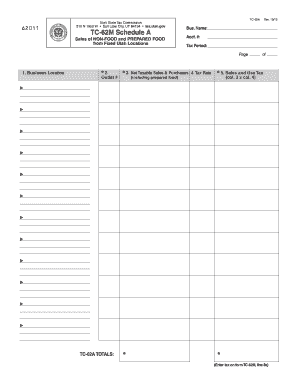

TC62A Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84134 tax.Utah.gov 62011 TC62M Schedule A Sales of NONFOOD and PREPARED FOOD from Fixed Utah Locations Print Form 1. Business Location

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-62M Schedule A

Edit your UT TC-62M Schedule A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-62M Schedule A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT TC-62M Schedule A online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT TC-62M Schedule A. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-62M Schedule A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-62M Schedule A

How to fill out UT TC-62M Schedule A

01

Obtain the UT TC-62M Schedule A form from the appropriate tax authority website.

02

Read the instructions carefully to understand what information is needed.

03

Fill in your personal details, including name, address, and identification number at the top of the form.

04

Provide details of the income sources you are reporting, ensuring you categorize them correctly.

05

List any deductions you are claiming associated with the income reported.

06

Summarize your total income and deductions in the designated sections.

07

Review the completed form to ensure accuracy and completeness.

08

Sign and date the form as required before submission.

Who needs UT TC-62M Schedule A?

01

Individuals or businesses that need to report specific income or deductions for tax purposes in the state of Utah.

Fill

form

: Try Risk Free

People Also Ask about

What is sales tax in Salt Lake City?

Sales and Use Tax Salt Lake City, Utah has a 7.75% sales and use tax for retail sales of tangible personal property and select services, which include, but are not limited to, admissions to places of amusement, intrastate transportation service, and hotel and motel accommodations.

What is TC 62M?

TC-62M, Utah Sales and Use Tax Return for Multiple Places of Business.

What is Utah sales tax 2023?

This includes the state rate of 1.75%, local option rate of 1.0% and county option rate of 0.25%. The combined sales rate for the various localities in this section applies to all taxable sales in the state.

Do I need to send a 1099 to the state of Utah?

Utah. Utah only requires you to file Form 1099-NEC with the Utah Tax Commission if state withholding is reported. Business owners in Utah can file Form 1099-NEC with the IRS with Wave Payroll.

Do I need to charge sales tax for services in Utah?

Sales tax applies to retail sales and leases of tangible personal property, products transferred electronically, and certain services purchased for storage, use or consumption in Utah.

How do I get a sales tax number in Utah?

A sales tax license can be obtained by registering through the Utah Taxpayer Access Point (TAP) or the Utah OneStop Business Registration (OSBR). Alternatively, you can mail in Form TC-69 to the Utah State Tax Commission 210 North 1950 West Salt Lake City, UT 84134-3310.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my UT TC-62M Schedule A in Gmail?

UT TC-62M Schedule A and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get UT TC-62M Schedule A?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific UT TC-62M Schedule A and other forms. Find the template you need and change it using powerful tools.

How can I edit UT TC-62M Schedule A on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing UT TC-62M Schedule A.

What is UT TC-62M Schedule A?

UT TC-62M Schedule A is a form used by taxpayers in Utah to report certain types of income or deductions as part of their state income tax return.

Who is required to file UT TC-62M Schedule A?

Taxpayers who are claiming itemized deductions instead of the standard deduction are required to file UT TC-62M Schedule A.

How to fill out UT TC-62M Schedule A?

To fill out UT TC-62M Schedule A, taxpayers should gather their expense records for the year, complete the form by providing all necessary information on income and deductions, and ensure to follow the instructions provided for each section.

What is the purpose of UT TC-62M Schedule A?

The purpose of UT TC-62M Schedule A is to allow taxpayers to itemize their deductions for state income tax purposes, which may lead to a lower tax liability compared to taking the standard deduction.

What information must be reported on UT TC-62M Schedule A?

Taxpayers must report information such as medical expenses, state and local taxes paid, mortgage interest, charitable contributions, and certain qualified expenses on UT TC-62M Schedule A.

Fill out your UT TC-62M Schedule A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-62m Schedule A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.