AZ Form 835 2007 free printable template

Show details

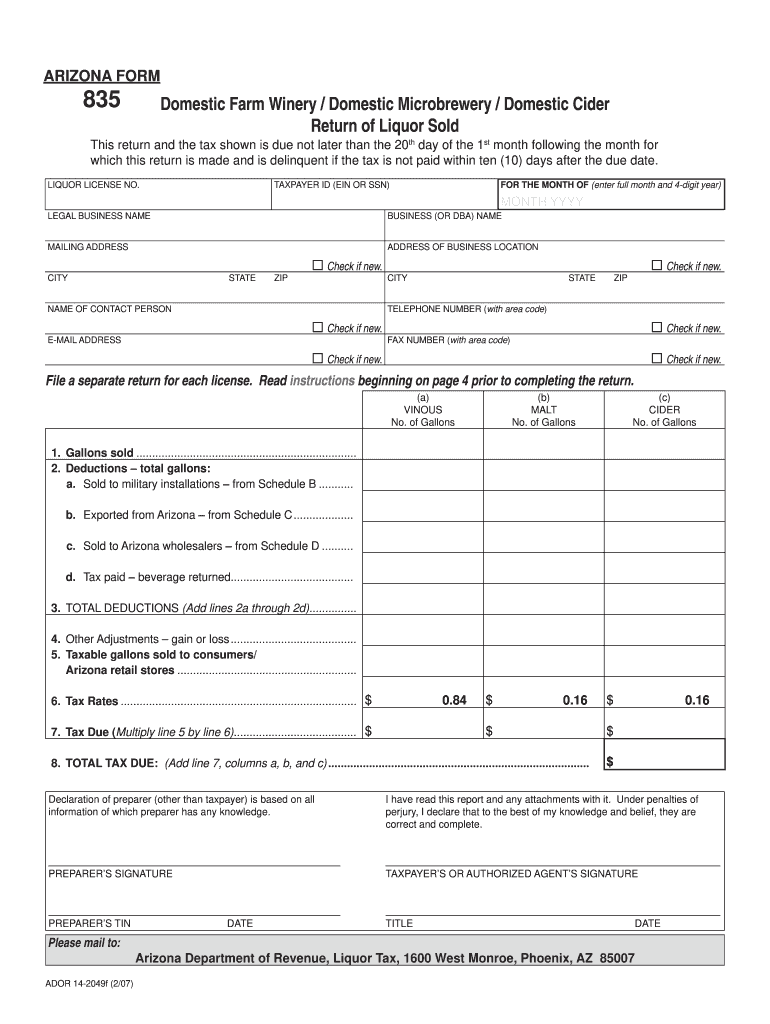

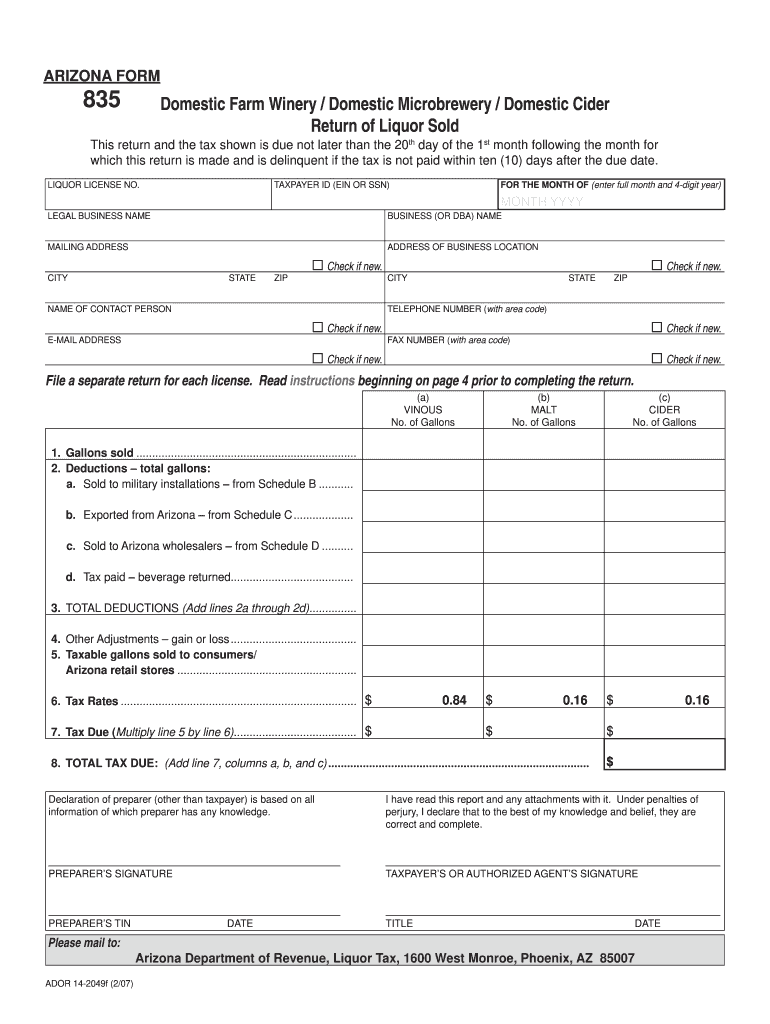

Definitions ARIZONA FORM 835 Domestic Farm Winery / Domestic Microbrewery / Domestic Cider Return of Liquor Sold This return and the tax shown is due not later than the 20th day of the 1st month following

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ Form 835

Edit your AZ Form 835 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ Form 835 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ Form 835 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AZ Form 835. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ Form 835 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ Form 835

How to fill out AZ Form 835

01

Obtain the AZ Form 835 from the appropriate state website or office.

02

Read the instructions provided at the top of the form carefully to understand the requirements.

03

Fill out the identifying information, including your name, address, and account number.

04

Specify the reporting period for which you are submitting the form.

05

Enter the total amount due, including any applicable penalties or interest.

06

Provide details about any adjustments or disputes, if applicable.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form to the designated agency, either by mail or electronically, as instructed.

Who needs AZ Form 835?

01

Individuals or businesses who need to report tax payments or settle outstanding tax liabilities in Arizona.

02

Tax professionals or accountants managing tax documents for clients in Arizona.

03

Anyone who has received a notice or request from the Arizona Department of Revenue regarding unpaid taxes.

Fill

form

: Try Risk Free

People Also Ask about

What are the taxes on liquor in Arizona?

Arizona Liquor Tax - $3.00 / gallon ✔ Arizona's general sales tax of 5.6% also applies to the purchase of liquor. In Arizona, liquor vendors are responsible for paying a state excise tax of $3.00 per gallon, plus Federal excise taxes, for all liquor sold.

What is the county excise tax in Arizona?

County excise taxes apply to any transactions that are subject to the state's transaction privilege tax. What is the Tax Rate and How Do I Pay? Most county excise taxes are imposed at a rate of ten percent of the Arizona transaction privilege tax rate.

What is a state and local excise tax?

Excise taxes are special taxes on specific goods or activities—such as gasoline, tobacco or gambling—rather than general tax bases such as income or consumption. Excise taxes are often included in the final price of products and services, and are often hidden to consumers.

What is considered an excise tax?

Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers, and vary depending on the specific tax. Excise taxes may be imposed at the time of: Entry into the United States, or sale or use after importation.

What is the Arizona excise tax credit?

The goal of the credit is to provide disabled and low-income individuals with financial assistance in the form of tax relief. Please note: Arizona excise taxes are imposed by all counties except Pima County. It provides revenue to pay for county services, including public transportation and county facilities.

What is the state excise tax in Arizona?

Arizona has a 4.90 percent corporate income tax rate, a 5.60 percent state sales tax rate, a max local sales tax rate of 5.30 percent, and a 8.37 percent combined state and local sales tax rate. Arizona's tax system ranks 19th overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AZ Form 835 to be eSigned by others?

To distribute your AZ Form 835, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in AZ Form 835?

The editing procedure is simple with pdfFiller. Open your AZ Form 835 in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my AZ Form 835 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your AZ Form 835 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is AZ Form 835?

AZ Form 835 is a tax form used by Arizona taxpayers to report and remit transaction privilege tax (TPT) and any applicable local taxes.

Who is required to file AZ Form 835?

Businesses and individuals who are subject to transaction privilege tax in Arizona are required to file AZ Form 835.

How to fill out AZ Form 835?

To fill out AZ Form 835, taxpayers must provide their business information, including name, address, account number, the reporting period, and the amount of tax due. Additionally, they must detail the taxable transactions and any exemptions.

What is the purpose of AZ Form 835?

The purpose of AZ Form 835 is to facilitate the reporting and payment of transaction privilege tax owed to the state of Arizona.

What information must be reported on AZ Form 835?

AZ Form 835 requires taxpayers to report information such as gross income from business activities, deductions, exemptions, and the total tax due.

Fill out your AZ Form 835 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ Form 835 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.