AZ Form 835 2017 free printable template

Show details

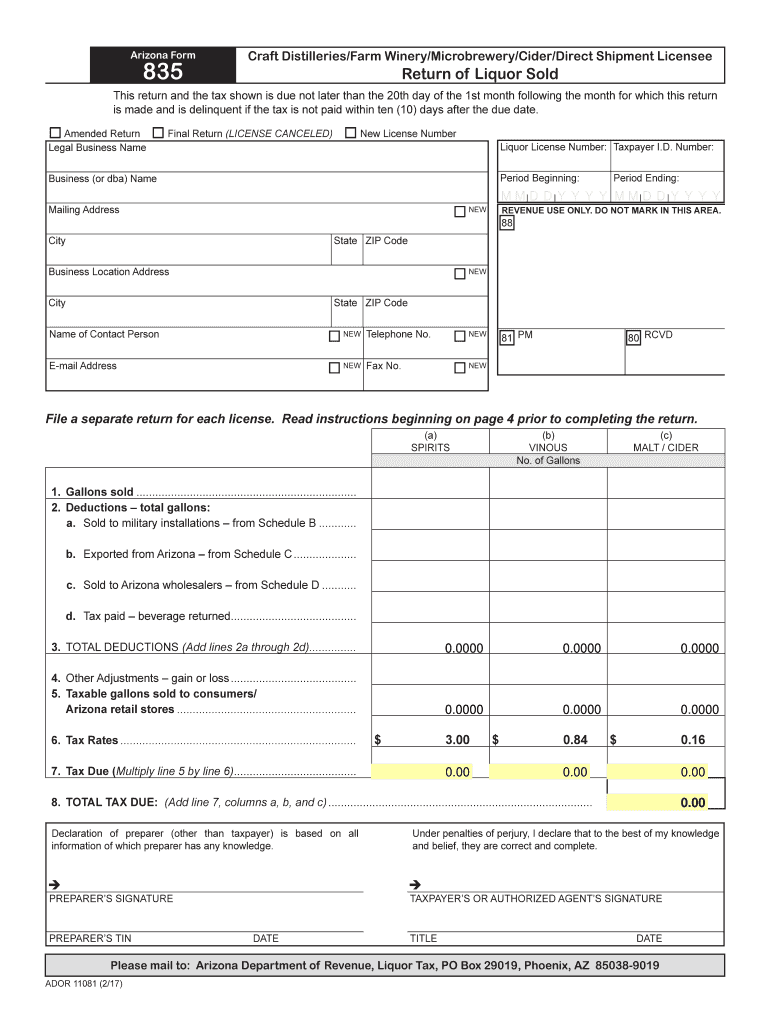

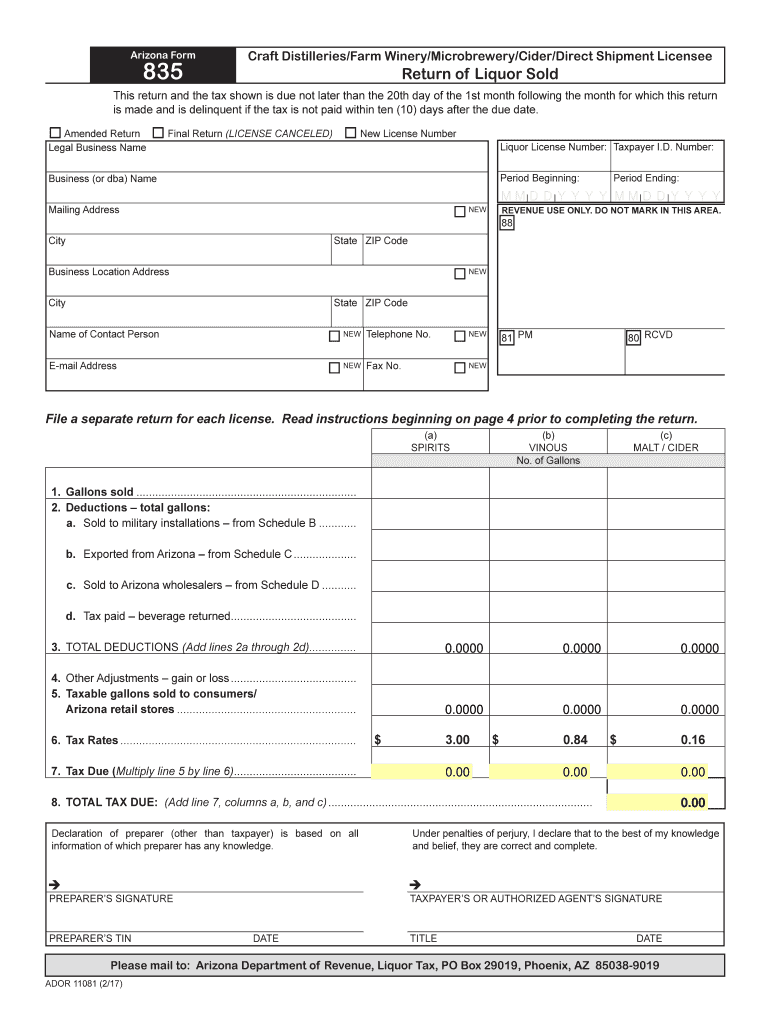

Arizona Form835Craft Distilleries/Farm Winery/Microbrewery/Cider/Direct Shipment LicenseeReturn of Liquor Soldiers return and the tax shown is due not later than the 20th day of the 1st month following

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 835 farm microbrewery liquor fillable form

Edit your arizona 835 winery return form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 835 domestic return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing az 835 domestic liquor pdf online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 835 domestic return form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ Form 835 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out az 835 return form

How to fill out AZ Form 835

01

Obtain a copy of the AZ Form 835 from the Arizona Department of Revenue website or local office.

02

Gather all necessary financial information and documentation required for the form.

03

Begin filling out the form by entering your personal information, including name, address, and tax identification number.

04

If applicable, complete the sections related to any specific tax types you are reporting.

05

Carefully review each section to ensure that all information is accurate and complete.

06

Calculate any amounts due or refunds based on the information you have provided.

07

Sign and date the form to certify that the information is correct to the best of your knowledge.

08

Submit the completed form according to the instructions provided, either electronically or by mail.

Who needs AZ Form 835?

01

Individuals or businesses in Arizona who are required to report and pay various state taxes.

02

Tax professionals assisting clients with tax reporting and compliance in Arizona.

03

Businesses claiming a refund or making adjustments related to previously filed tax returns.

Fill

az winery cider return

: Try Risk Free

People Also Ask about az 835 microbrewery form

What is considered an excise tax?

Excise taxes are taxes imposed on certain goods, services, and activities. Taxpayers include importers, manufacturers, retailers, and consumers, and vary depending on the specific tax. Excise taxes may be imposed at the time of: Entry into the United States, or sale or use after importation.

What are the taxes on liquor in Arizona?

Arizona Liquor Tax - $3.00 / gallon ✔ Arizona's general sales tax of 5.6% also applies to the purchase of liquor. In Arizona, liquor vendors are responsible for paying a state excise tax of $3.00 per gallon, plus Federal excise taxes, for all liquor sold.

How much is luxury tax in Arizona?

Arizona Luxury Taxes Arizona's luxury tax rates include: $0.029/cigarette. $0.129/small cigars. $0.065/ounce of chewing, snuff, and fine cut tobacco products.

What is the county excise tax in Arizona?

County excise taxes apply to any transactions that are subject to the state's transaction privilege tax. What is the Tax Rate and How Do I Pay? Most county excise taxes are imposed at a rate of ten percent of the Arizona transaction privilege tax rate.

What is the state excise tax in Arizona?

Arizona has a 4.90 percent corporate income tax rate, a 5.60 percent state sales tax rate, a max local sales tax rate of 5.30 percent, and a 8.37 percent combined state and local sales tax rate. Arizona's tax system ranks 19th overall on our 2023 State Business Tax Climate Index.

Can you have a still in Arizona?

State Overview state laws Owning a still and operating one is legal in Arizona if the still is registered. Also the production of spirits for personal and home use is legal if you have a permit. The selling of non-taxed moonshine is illegal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit az 835 domestic template from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your 835 domestic return sample into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit az 835 domestic liquor printable straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing arizona 835 winery return print right away.

How do I complete arizona 835 return sold blank on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your arizona 835 farm winery. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is AZ Form 835?

AZ Form 835 is a form used for the reporting of payment and other financial information by providers and health care organizations in Arizona.

Who is required to file AZ Form 835?

Providers and organizations that receive reimbursements from Arizona's Medicaid system or other health care payment systems are required to file AZ Form 835.

How to fill out AZ Form 835?

To fill out AZ Form 835, gather the required financial data, complete each section accurately according to the provided instructions, and ensure that all necessary signatures and information are included before submission.

What is the purpose of AZ Form 835?

The purpose of AZ Form 835 is to facilitate the reporting of financial transactions and reimbursements, helping to maintain transparency and compliance in the state's healthcare reimbursement process.

What information must be reported on AZ Form 835?

AZ Form 835 requires reporting details such as provider identification, payment amounts, service dates, types of services rendered, and any adjustments or denied claims.

Fill out your AZ Form 835 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Domestic Cider Return Fillable is not the form you're looking for?Search for another form here.

Keywords relevant to az 835 domestic pdf

Related to 835 domestic return pdf

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.