Get the free Arizona Form 321. Credit for Contributions to Qualifying Charitable Organizations 2016

Show details

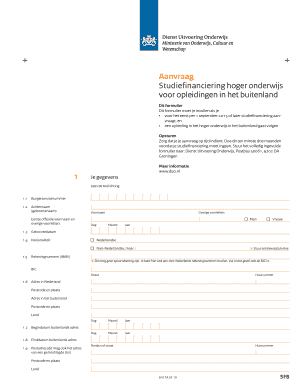

Arizona Form 321 Credit for Contributions to Qualifying Charitable Organizations 2016 Include with your return. For the calendar year 2016 or fiscal year beginning M D 2 0 1 6 and ending M D D Y Y

We are not affiliated with any brand or entity on this form

Instructions and Help about arizona form 321 credit

How to edit arizona form 321 credit

How to fill out arizona form 321 credit

Instructions and Help about arizona form 321 credit

How to edit arizona form 321 credit

To edit the Arizona Form 321 Credit, you can utilize pdfFiller's online platform. This tool allows you to easily modify the text fields, add your information, and make any necessary adjustments before submission. Simply upload your form to pdfFiller, use the editing tools provided, and save your changes.

How to fill out arizona form 321 credit

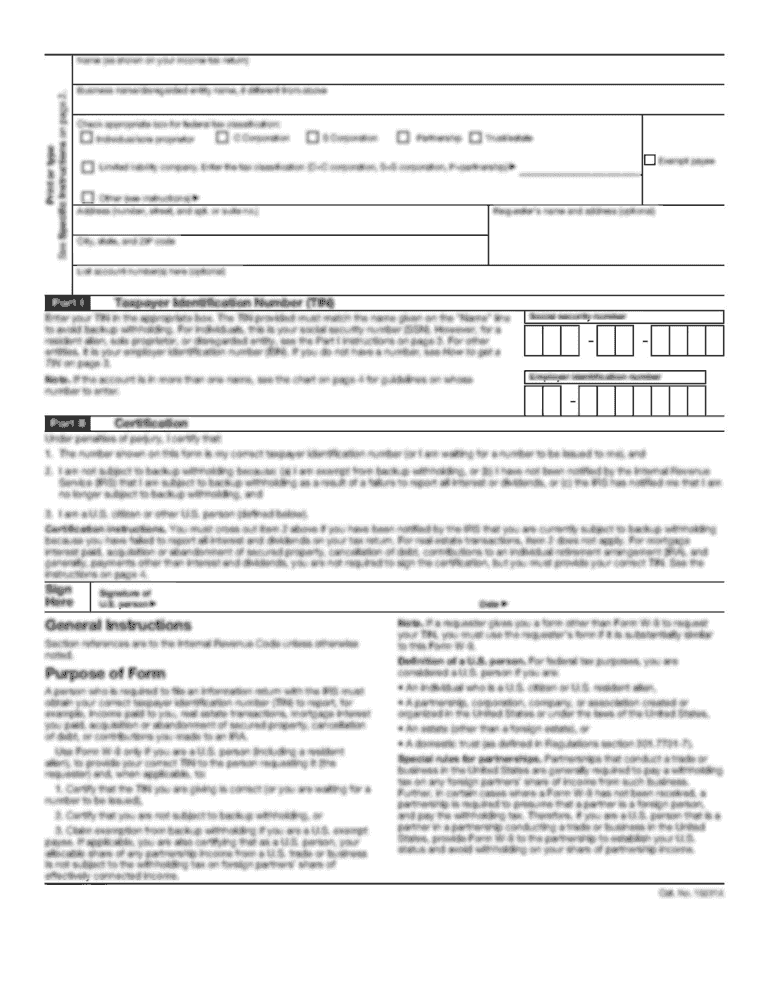

Filling out the Arizona Form 321 Credit requires the following steps:

01

Download the latest version of the form from the Arizona Department of Revenue website.

02

Gather all necessary documentation to support your credit claim, including income statements and receipts.

03

Enter your personal information, including your name, address, and social security number.

04

Complete the sections pertaining to the specific credit you are claiming.

05

Review the form for accuracy and completeness before submitting.

Latest updates to arizona form 321 credit

Latest updates to arizona form 321 credit

Stay informed of any changes to the Arizona Form 321 Credit by checking the Arizona Department of Revenue's official website. Updates may include changes to credit eligibility, revised deadlines, or adjustments to the form structure that could affect filing procedures.

All You Need to Know About arizona form 321 credit

What is arizona form 321 credit?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About arizona form 321 credit

What is arizona form 321 credit?

The Arizona Form 321 Credit is an income tax credit form used to claim specific credits allowed under Arizona state law. This form is designed for individual taxpayers who meet the eligibility criteria outlined by the Arizona Department of Revenue.

What is the purpose of this form?

The primary purpose of the Arizona Form 321 Credit is to allow taxpayers to reduce their overall tax liability through specified credits. These credits may include, but are not limited to, various incentives for specific actions or investments recognized by the state.

Who needs the form?

Any individual taxpayer who qualifies for a credit under Arizona tax law must complete the Arizona Form 321 Credit. This includes individuals who have made eligible purchases or investments that meet the criteria established by the state.

When am I exempt from filling out this form?

You are exempt from filling out the Arizona Form 321 Credit if you do not qualify for any of the specific credits available or if your total tax liability does not warrant claiming any credits. It is advisable to review eligibility requirements to confirm exemption status.

Components of the form

The components of the Arizona Form 321 Credit include various sections where you are required to input your personal data, specify the type of credit being claimed, and provide supporting documentation, if necessary. Each section must be completed accurately to ensure proper processing by the Arizona Department of Revenue.

Due date

The due date for submitting the Arizona Form 321 Credit typically aligns with the state tax return filing deadline. Taxpayers should ensure that they file the form alongside their annual Arizona state income tax return or by any extended deadline applicable to their filing status.

What payments and purchases are reported?

The Arizona Form 321 Credit must report specific purchases or payments that are eligible for tax credits. Taxpayers should compile documentation of these expenditures to support their claims, which may include purchases related to certain industries or qualifying investments.

How many copies of the form should I complete?

Generally, you should complete one copy of the Arizona Form 321 Credit to submit with your tax return. It is prudent to retain a copy for your records along with any supporting documents submitted, in case of future inquiries or audits.

What are the penalties for not issuing the form?

Failing to file the Arizona Form 321 Credit when required may result in penalties, which could include late fees or a reduction in potential credits. It is essential to adhere to deadlines and filing guidelines to avoid any financial repercussions.

What information do you need when you file the form?

When filing the Arizona Form 321 Credit, ensure you have the following information on hand:

01

Your complete name, address, and social security number.

02

Details regarding the specific credit being claimed.

03

Documentation supporting any claims made on the form, including receipts or income statements.

04

Any additional forms or schedules required by the Arizona Department of Revenue.

Is the form accompanied by other forms?

The Arizona Form 321 Credit may need to be accompanied by other forms, depending on the type of credit being claimed. Taxpayers should check the official guidelines for any supplementary paperwork that may be necessary to validate their claims.

Where do I send the form?

The completed Arizona Form 321 Credit should be sent to the address specified by the Arizona Department of Revenue for tax filings. Be sure to review current mailing instructions to ensure timely and accurate submission of your tax documents.

See what our users say