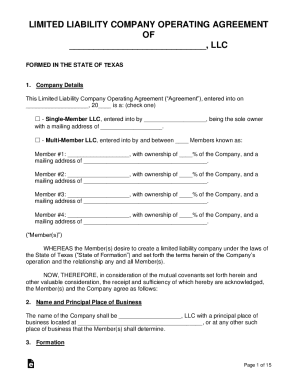

TX Limited Liability Company Operating Agreement 2014 free printable template

Get, Create, Make and Sign TX Limited Liability Company Operating Agreement

Editing TX Limited Liability Company Operating Agreement online

Uncompromising security for your PDF editing and eSignature needs

TX Limited Liability Company Operating Agreement Form Versions

How to fill out TX Limited Liability Company Operating Agreement

How to fill out TX Limited Liability Company Operating Agreement

Who needs TX Limited Liability Company Operating Agreement?

Instructions and Help about TX Limited Liability Company Operating Agreement

The following information is provided for educational purposes only and in no way constitutes legal, tax, or financial advice. For legal, tax, or financial advice specific to your business needs, we encourage you to consult with a licensed attorney and/or CPA in your state. The following information is copyright protected. No part of this lesson may be redistributed, copied, modified or adapted without prior written consent of the author. An Operating Agreement is an agreement between the members of the LLC that sets forth how the LLC will be managed both financially and operationally. Unlike your LLC Formation Documents, the Operating Agreement does not need to be mailed in to the State. It is an “internal document”, meaning you'll just need to keep a copy with your business records. The purpose of an Operating Agreement is to spell out who the members are and what percentage of the LLC they own (also known as their membership interest). It also defines how the LLC is managed, how taxes are paid, and how profits and losses are distributed amongst the members. You will find both the PDF and the Microsoft Word versions below this video in the download Section. You can print these out and fill them out by hand, or type directly in them with your computer (whatever is most convenient for you). We will show you how to complete your Operating Agreement regardless if you are a single-member LLC (with just 1 member) or if you are multi-member LLC (with 2 or more members). The Operating Agreement that is provided as a generic Operating Agreement that will work for the majority of businesses. If your business requires industry-specific management, complex ownership agreements, has multiple investors or a large amount of members, we recommend getting the help of an attorney. You can complete the Operating Agreement provided as a base for your initial conversation with your attorney. This may save you time and money. If you are single-member LLC or a family-owned LLC, this may be less of an issue for you (unless you have a crazy family)... then we recommend you seek legal advice to prepare this document. You may need to provide a copy of your Operating Agreement to: a lender if you are obtaining financing; a title company if you are purchasing real estate; accounting and tax professionals for financial assistance; lawyers for legal advice or potential investors or partners have an interest in your business. Also, if you find yourself a party to a legal action, the court will likely ask for a copy of your LLC's Operating Agreement. This can help document to the court that you have a well-organized structure for handling issues that arise in relation to your LLC. One of the benefits of forming an LLC is the flexibility of managing your business. The Operating Agreement is a working document that is meant to be fluid and allow for changes as your business grows. If you make simple changes such as a change of address for a member, or you change your Registered...

People Also Ask about

Does South Carolina require an operating agreement?

Does Texas LLC require an operating agreement?

How much is the filing fee for an LLC in Texas?

Can I make my own operating agreement?

Does create an operating agreement?

What should be included in an operating agreement?

How do you write a simple operating agreement?

Does a single member LLC need an operating agreement in Texas?

Is a company agreement required for a Texas LLC?

Does a Texas LLC have an operating agreement?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get TX Limited Liability Company Operating Agreement?

Can I create an eSignature for the TX Limited Liability Company Operating Agreement in Gmail?

Can I edit TX Limited Liability Company Operating Agreement on an iOS device?

What is TX Limited Liability Company Operating Agreement?

Who is required to file TX Limited Liability Company Operating Agreement?

How to fill out TX Limited Liability Company Operating Agreement?

What is the purpose of TX Limited Liability Company Operating Agreement?

What information must be reported on TX Limited Liability Company Operating Agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.