Get the free MI-1040 MICHIGAN Individual Income Tax Return 2013

Show details

Apr 15, 2014 ... Michigan Department of Treasury (Rev. ... 2013 MICHIGAN Individual Income Tax Return MI-1040 ... filing a joint return) want $3 of your taxes ..... have a copy of your MI-1040 available

We are not affiliated with any brand or entity on this form

Instructions and Help about mi-1040 michigan individual income

How to edit mi-1040 michigan individual income

How to fill out mi-1040 michigan individual income

Instructions and Help about mi-1040 michigan individual income

How to edit mi-1040 michigan individual income

To edit the mi-1040 Michigan Individual Income Tax Form, you can use pdfFiller's editing tools. Simply upload the form to the platform, utilize the available editing features to make necessary adjustments, and ensure all information is accurate before submission. The platform allows you to save changes, ensuring you have the correct version at all times.

How to fill out mi-1040 michigan individual income

To fill out the mi-1040 Michigan Individual Income Tax Form, follow these steps:

01

Gather your financial documents, including W-2s, 1099s, and any other relevant income documentation.

02

Access the mi-1040 form via the Michigan Department of Treasury website or use pdfFiller to fill it out online.

03

Complete each section of the form in accordance with provided instructions, making sure to include personal information, income details, and any applicable deductions or credits.

04

Double-check your entries for accuracy before submitting the form.

Latest updates to mi-1040 michigan individual income

Latest updates to mi-1040 michigan individual income

Stay updated on any changes to the mi-1040 Michigan Individual Income Tax Form by regularly checking the Michigan Department of Treasury's official website. Legislative updates may affect tax rates, deductions, or filing requirements.

All You Need to Know About mi-1040 michigan individual income

What is mi-1040 michigan individual income?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

All You Need to Know About mi-1040 michigan individual income

What is mi-1040 michigan individual income?

The mi-1040 Michigan Individual Income Tax Form is the state tax form used by residents of Michigan to report their income, calculate taxes due, and claim any applicable deductions or credits. This form is essential for compliance with state income tax laws.

What is the purpose of this form?

The purpose of the mi-1040 form is to allow individuals to report their earnings, determine their tax liability, and pay any taxes owed to the state of Michigan. It helps the state government collect revenue necessary for public services and infrastructure.

Who needs the form?

Individuals who are residents of Michigan and have earned income must file the mi-1040 form. This includes full-time employees, self-employed individuals, and those with investment income. Non-residents who earned income in Michigan may also need to file this form.

When am I exempt from filling out this form?

You may be exempt from filling out the mi-1040 form if your income is below the minimum filing threshold set by the state, or if you have no taxable income for the year. Additionally, certain exempt individuals include dependents and those whose income comes solely from certain tax-exempt sources.

Components of the form

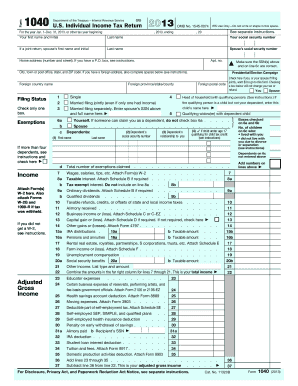

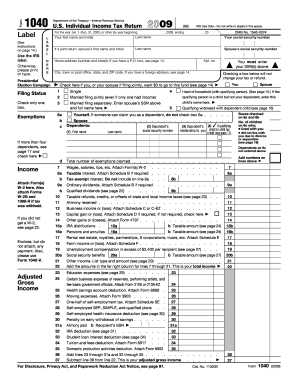

The mi-1040 form includes several main components, such as personal information sections, income reporting fields, deduction and credit claims, and a final summary of tax owed or refund due. Each component must be completed accurately to ensure correct tax calculations.

Due date

The due date for filing the mi-1040 form typically aligns with the federal tax filing deadline, which is April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Always confirm the specific filing deadline for the current tax year.

What are the penalties for not issuing the form?

Failing to file the mi-1040 form can result in penalties, including fines and interest on unpaid taxes. Additionally, the state may impose further actions, such as garnishing wages or placing liens on property, to recover owed taxes.

What information do you need when you file the form?

When filing the mi-1040 form, you need to gather the following information:

01

Personal identification details, including your driver's license number and Social Security number.

02

Income documents, such as W-2s, 1099s, and other relevant income reports.

03

Details about any deductions or credits you plan to claim, as well as supporting documentation.

Is the form accompanied by other forms?

In some cases, the mi-1040 form may need to be accompanied by additional schedules or forms, especially if you are claiming specific credits or deductions. Always check the form instructions for a complete list of any required supplementary documents.

Where do I send the form?

The completed mi-1040 form should be mailed to the address specified in the filing instructions included with the form. The mailing address may vary depending on whether you are sending a payment or filing for a refund, so verify the correct destination before sending your form.

See what our users say