IRS 1040 2009 free printable template

Show details

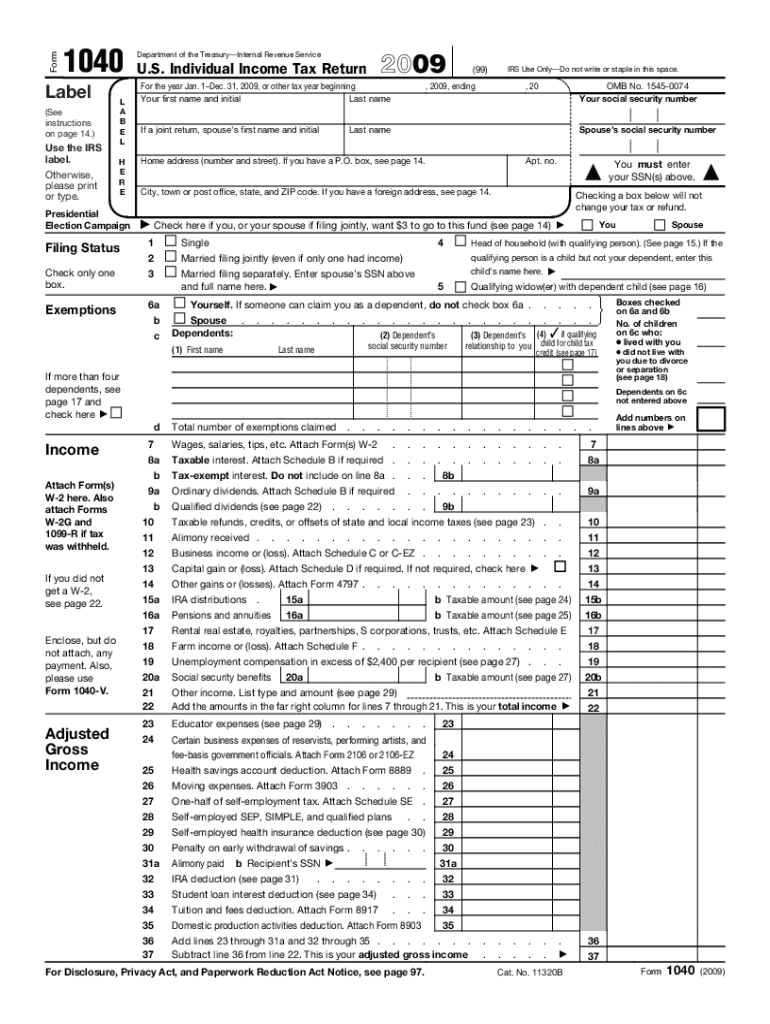

Cat. No. 11320B Page 2 Form 1040 2009 Tax and Credits 39a Standard Deduction for People who check any box on line 39a 39b or 40b or who can be claimed as a see page 35. The new law was enacted after the 2009 forms instructions and publications had already been printed. When preparing your 2009 tax return you may complete the forms as if these contributions were made on December 31 2009 instead of in 2010. To deduct your charitable contributions you must itemize deductions on Schedule A Form...1040 or Schedule A Form 1040NR. Attach Form 6251. Other Taxes Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41 enter -0-. Federal income tax withheld from Forms W-2 and 1099. 2009 estimated tax payments and amount applied from 2008 return Making work pay and government retiree credits. Federal income tax withheld from Forms W-2 and 1099. 2009 estimated tax payments and amount applied from 2008 return Making work pay and government retiree credits. Attach Schedule M...Earned income credit EIC. 64b Nontaxable combat pay election 64a Credit for child and dependent care expenses. Attach Form 2441 AEIC payments b Additional child tax credit. Attach Form 8812 Form 4972. Household employment taxes. Form Label See instructions on page 14. Use the IRS label. Otherwise please print or type. L A B E H R Presidential Election Campaign Filing Status Check only one box. Exemptions Department of the Treasury Internal Revenue Service U.S. Individual Income Tax Return For...the year Jan. 1 Dec. 31 2009 or other tax year beginning Last name Your first name and initial IRS Use Only Do not write or staple in this space. Exemptions Department of the Treasury Internal Revenue Service U.S. Individual Income Tax Return For the year Jan. 1 Dec. 31 2009 or other tax year beginning Last name Your first name and initial IRS Use Only Do not write or staple in this space. 2009 ending OMB No. 1545-0074 Your social security number If a joint return spouse s first name and initial...Spouse s social security number Apt. no. Home address number and street. If you have a P. O. box see page 14. City town or post office state and ZIP code. Certain Cash Contributions for Haiti Relief Can Be Deducted on Your 2009 Tax Return A new law allows you to choose to deduct certain charitable contributions of money on your 2009 tax return instead of your 2010 return* The contributions must have been made after January 11 2010 and before March 1 2010 for the relief of victims in areas...affected by the January 12 2010 earthquake in Haiti. Contributions of money include contributions made by cash check money order credit card charge card debit card or via cell phone. The new law was enacted after the 2009 forms instructions and publications had already been printed* When preparing your 2009 tax return you may complete the forms as if these contributions were made on December 31 2009 instead of in 2010. To deduct your charitable contributions you must itemize deductions on...Schedule A Form 1040 or Schedule A Form 1040NR.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1040

How to edit IRS 1040

How to fill out IRS 1040

Instructions and Help about IRS 1040

How to edit IRS 1040

Editing the IRS 1040 tax form can be essential if you discover errors after submission. To edit your form, you can download a blank version of the IRS 1040 from the IRS website or use pdfFiller to make electronic changes. This may involve correcting numbers, updating personal information, or adjusting deductions. Ensure you re-evaluate all relevant details before resubmitting any corrections.

How to fill out IRS 1040

Filling out the IRS 1040 form requires specific information regarding your income, deductions, and credits. Gather your W-2s, 1099s, and records of any other income sources. You will need to provide personal details, such as your Social Security number and bank information for refunds. Follow each line of the form closely, applying current tax laws to ensure accurate reporting.

About IRS previous version

What is IRS 1040?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 1040?

IRS 1040 is the U.S. federal income tax return form used by individuals to report their income, deductions, and tax liabilities. The form must be completed by eligible taxpayers annually and serves as a significant tool for determining tax obligations owed or refunds due.

What is the purpose of this form?

The purpose of the IRS 1040 form is to assess an individual's financial situation for the tax year. It facilitates tax calculations by outlining various income sources and applicable deductions, allowing the IRS to ensure compliance with federal tax law. Essentially, it is a declaration of your financial activities and tax responsibilities.

Who needs the form?

Most U.S. citizens or residents who earn income need to file an IRS 1040 form. This includes any individual receiving wages, pensions, or income from self-employment. Certain exemptions apply, such as for those earning below the threshold established by the IRS for a given tax year.

When am I exempt from filling out this form?

You may be exempt from filing the IRS 1040 if your income falls below the minimum threshold as outlined by the IRS, or if you fall into specific categories such as dependents with limited income. Additionally, some foreign income and specific retirement accounts can also exclude you from filing.

Components of the form

The IRS 1040 form consists of several key sections. These include personal information, income reporting, deductions, tax credits, and direct payment or refund details. Each section requires careful entry and validation of numbers to ensure accuracy in reporting income and tax obligations.

What are the penalties for not issuing the form?

Failure to file the IRS 1040 form can lead to substantial penalties, including fines and interest on unpaid taxes. The penalties increase the longer you delay. Additionally, your eligibility for tax credits and refunds may be affected, which can lead to uncompensated financial losses.

What information do you need when you file the form?

When filing the IRS 1040, you need your Social Security number, income documentation (such as W-2s and 1099s), personal identification details, and any records associated with deductions or credits. It’s crucial to have this data organized to avoid errors and ensure a smooth filing process.

Is the form accompanied by other forms?

The IRS 1040 form may require additional forms and schedules, depending on your financial situation. For example, if you are claiming certain deductions or credits, you may need to attach schedules like Schedule A for itemized deductions or Schedule C for business income. It is vital to review the specific requirements for your tax situation.

Where do I send the form?

Where you send the IRS 1040 form depends on your location and whether you are including a payment. Generally, you would mail your completed form and any required schedules to the address specified in the form instructions. Ensure you use the correct mailing address to avoid delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Was not satisfied with the rate of $72 charged whereas I was under the impression that %65 percent would be taken from that rate.

When trying to save a completed document to my hard drive it becomes confusing. I cannot find the saved files anywhere. Other than that the program is great.

See what our users say