IRS 1040-C 2022 free printable template

Show details

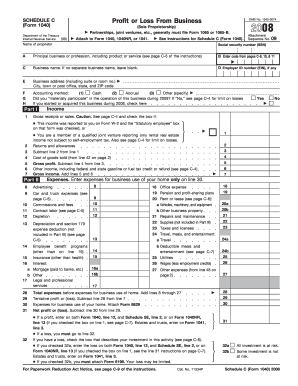

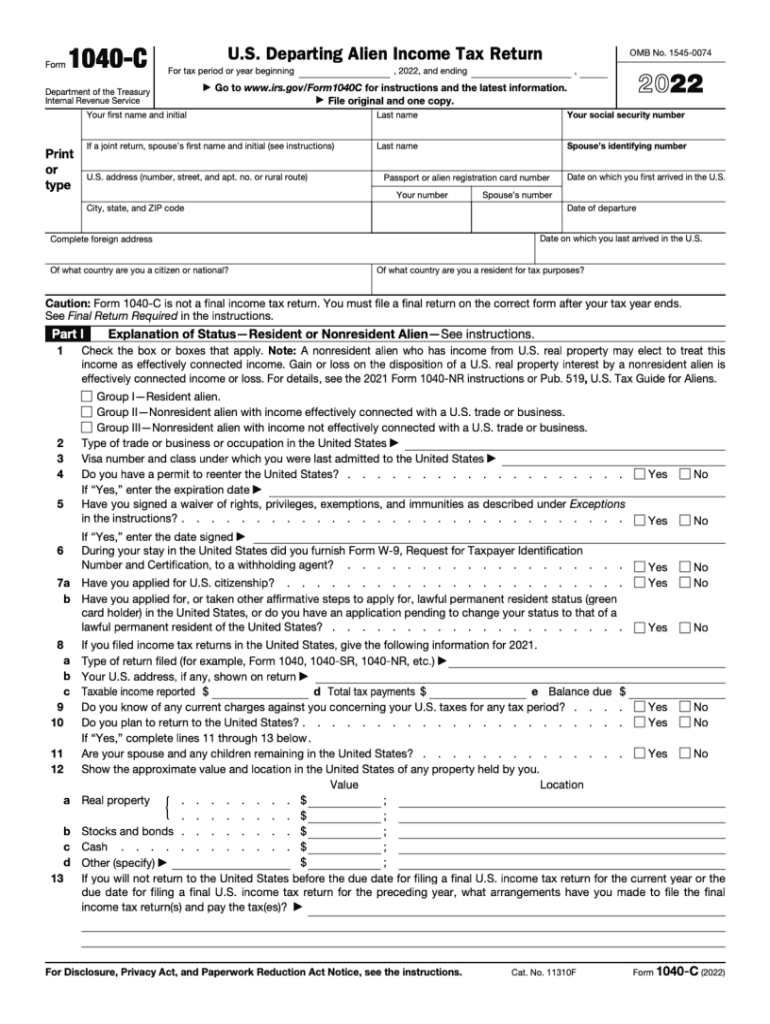

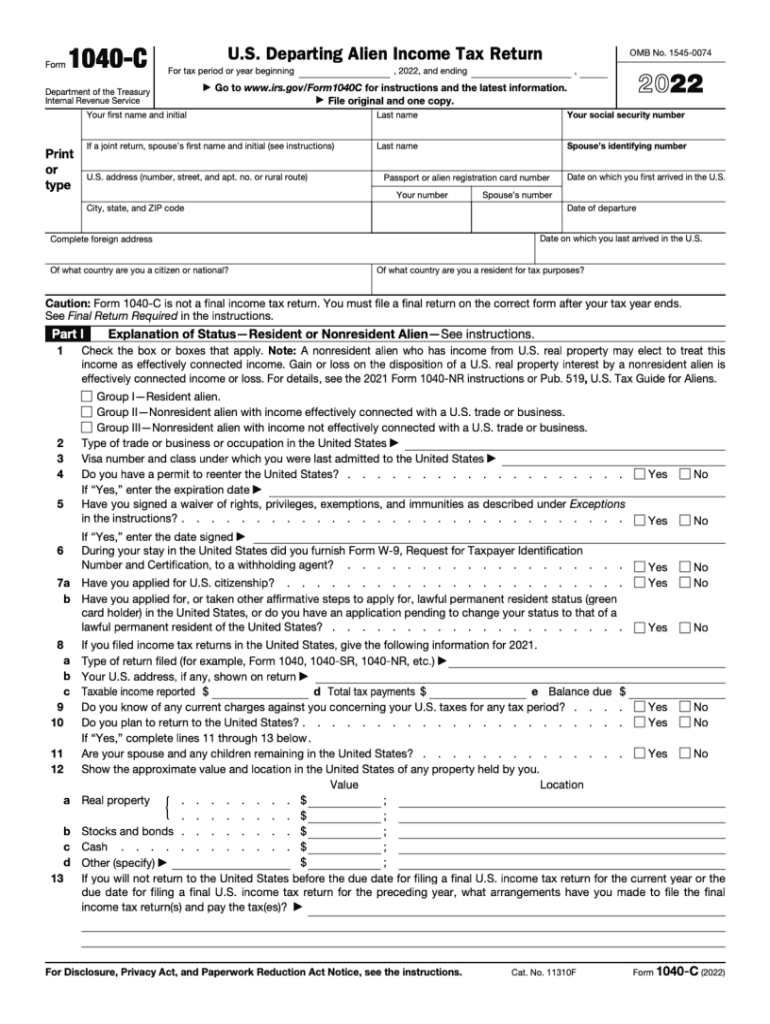

Form1040CU. S. Departing Alien Income Tax Return

For tax period or year beginning

Department of the Treasury

Internal Revenue ServicePrint

or

type OMB No. 15450074, 2022, and ending,2022Go to www.irs.gov/Form1040C

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your irs income tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs income tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs income tax return online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 1040c form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

IRS 1040-C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out irs income tax return

How to fill out irs income tax return:

01

Gather all necessary documents such as W-2s, 1099 forms, and receipts.

02

Determine your filing status (single, married filing jointly, etc.) and choose the appropriate tax form.

03

Fill in personal information including your name, address, and social security number.

04

Report all sources of income, including wages, self-employment income, and investment income.

05

Enter deductions and credits you qualify for, such as student loan interest or mortgage interest.

06

Calculate your tax liability based on your income and deductions.

07

Determine if you owe taxes or if you are expecting a refund.

08

Sign and date the tax return form.

09

Mail the completed tax return to the appropriate IRS mailing address or e-file it using online tax software.

Who needs irs income tax return:

01

Individuals who earn income from various sources such as employment, self-employment, or investments.

02

Business owners, including sole proprietors, partners, and shareholders of S-corporations.

03

Individuals who meet specific requirements set by the IRS, such as having a certain amount of income or receiving certain tax forms like a 1099 or Schedule K-1.

Fill 2022 irs income tax return : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file irs income tax return?

Generally, any US citizen or resident alien who earns over a certain amount of income is required to file a federal income tax return with the Internal Revenue Service (IRS). The exact amount of income depends on your filing status, age, and whether or not you are claimed as a dependent on another person's tax return. The IRS website has a helpful tool that can help you determine if you are required to file a tax return.

What is the purpose of irs income tax return?

The purpose of filing an IRS income tax return is to report your income, calculate your taxes, and determine if you are entitled to a refund or if you owe additional taxes. It is also used to report any deductions or credits you may be eligible to receive.

What information must be reported on irs income tax return?

1. Personal information such as name, address, and Social Security Number.

2. Filing status (Single, Married Filing Jointly, Married Filing Separately, Head of Household, Qualifying Widow(er) with Dependent Child).

3. Income from wages, salaries, tips, interest, dividends, capital gains, etc.

4. Certain adjustments to income such as alimony, certain business expenses, etc.

5. Taxable income.

6. Tax credits, such as Earned Income Credit, Child Tax Credit, etc.

7. Tax payments made throughout the year, such as estimated tax payments, withholding, etc.

8. Refundable credits, such as Additional Child Tax Credit.

9. Any other taxes owed, such as self-employment tax, etc.

10. Signature and date.

When is the deadline to file irs income tax return in 2023?

The deadline to file IRS income tax returns for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of irs income tax return?

The penalty for filing a late tax return is generally 5% of the unpaid taxes for each month or part of a month that a tax return is late, up to a maximum of 25%. In addition, if a tax return is more than 60 days late, the minimum penalty is the smaller of $135 or 100% of the taxes owed.

What is irs income tax return?

The IRS income tax return refers to the process and documents required by the Internal Revenue Service (IRS) in the United States for individuals and businesses to report their income, calculate their tax liability, and request any refunds or make payments for the applicable tax year. It involves filling out various forms and schedules, such as Form 1040 or Form 1040EZ, to report income from various sources, deductions, credits, and other relevant information needed for tax calculation purposes. The income tax return is typically filed annually by taxpayers, providing a snapshot of their financial situation for that particular tax year.

How to fill out irs income tax return?

To fill out an IRS income tax return, follow these steps:

1. Gather your documents: Collect all the necessary documents such as W-2 forms, 1099 forms, receipts, and records of deductible expenses.

2. Choose your filing status: Determine your filing status, which can be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

3. Complete your personal information: Provide your name, address, Social Security number, and any other required personal information.

4. Report your income: Fill out the income section of the tax return form, including wages from your job, self-employment income, interest, dividends, and any other sources of income.

5. Deductions and credits: Calculate and claim the deductions and credits you are eligible for, such as the standard deduction, itemized deductions, child tax credit, or earned income credit.

6. Calculate your tax liability: Use the provided tax tables or tax software to determine the amount of tax you owe based on your income and deductions.

7. Pay any tax due or request a refund: If you owe tax, include payment with your tax return or set up a payment plan. If you overpaid, you can choose to receive a refund or apply the excess towards next year's taxes.

8. Sign and date: Sign and date your tax return, certifying that the information you provided is accurate.

9. Submit your return: Mail your completed tax return to the appropriate IRS address or file electronically using an e-file service.

Note: It is highly recommended to use tax preparation software or consult a professional tax preparer if your tax situation is complex or if you are unsure about any aspect of the process.

How do I execute irs income tax return online?

Easy online 1040c form completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit irs income tax return form in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your irs income tax return online, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit internal revenue service income tax on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign 1040 c tax form. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your irs income tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Income Tax Return Form is not the form you're looking for?Search for another form here.

Keywords relevant to 2022 1040c form

Related to 2022 1040 c

If you believe that this page should be taken down, please follow our DMCA take down process

here

.