NY CT-400 2014 free printable template

Show details

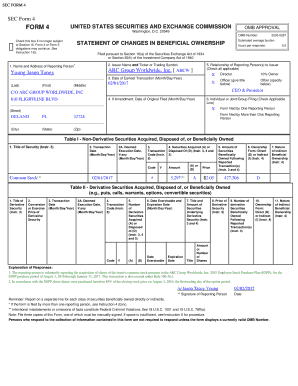

CT-400 (4/14) New York State Department of Taxation and Finance Estimated Tax for Corporations Installment payment amount Employer identification number File no. Return type (Required) Tax subtype

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY CT-400

Edit your NY CT-400 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY CT-400 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY CT-400 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit NY CT-400. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CT-400 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY CT-400

How to fill out NY CT-400

01

Obtain the NY CT-400 form from the New York State Department of Taxation and Finance website.

02

Read the instructions carefully before filling out the form.

03

Enter your business name, address, and identification number in the designated fields.

04

Complete the section that pertains to your specific business activities.

05

Calculate the estimated corporation tax based on your business income and fill in the figures.

06

Review the form to ensure all information is accurate and complete.

07

Sign and date the form before submission.

08

Submit the form by mail or through an online tax portal by the specified due date.

Who needs NY CT-400?

01

Businesses operating in New York State that are subject to corporation tax requirements.

02

Corporations and business entities that need to report estimated taxes for the year.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay estimated taxes all at once?

Many people wonder, “can I make estimated tax payments all at once?” or pay a quarter up front? Because people might think it's a nuisance to file taxes quarterly, this is a common question. The answer is no.

How do I pay estimated taxes for C corporation?

C Corp Estimated Tax Payments Calculate your taxable income. Multiply the total by 21 percent, the corporate tax rate. If you can claim any tax credits, write down the total and subtract from your tax bill. Add to your bill for any other taxes you owe, such as recaptured tax credits or base erosion minimum tax.

How do I automatically pay estimated taxes?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

What are the quarterly taxes for 2022?

When are estimated taxes due in 2022? First-quarter payments: April 18, 2022. Second-quarter payments: June 15, 2022. Third-quarter payments: Sept. 15, 2022. Fourth-quarter payments: Jan. 17, 2023.

When can I pay 2022 estimated taxes?

So, for example, if you didn't have any taxable income in 2022 until August, you don't have to make an estimated tax payment until September 15. At that point, you can either pay your entire estimated tax by the September 15 due date or pay it in two installments by September 15 and January 17.

How do I make estimated tax payments for 2022?

The IRS provides various methods for making 2022 quarterly estimated tax payments: You may credit an overpayment on your 2021 tax return to your 2022 estimated tax; You may mail your payment with payment voucher, Form 1040-ES; You may pay by phone or online (refer to Form 1040-ES instructions);

What are the due dates for corporate estimated tax payments 2022?

Aside from income tax, taxpayers can pay other taxes through estimated tax payments. This includes self-employment tax and the alternative minimum tax. The remaining deadlines for paying 2022 quarterly estimated tax are: June 15, September 15, and January 17, 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY CT-400 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your NY CT-400 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I execute NY CT-400 online?

pdfFiller has made it easy to fill out and sign NY CT-400. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I edit NY CT-400 on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing NY CT-400.

What is NY CT-400?

NY CT-400 is the New York State Department of Taxation and Finance form used to report estimated tax payments for certain pass-through entities being taxed at the entity level.

Who is required to file NY CT-400?

Entities such as partnerships and S corporations that have a taxable income above a certain threshold are required to file NY CT-400.

How to fill out NY CT-400?

To fill out NY CT-400, you need to provide details on the entity's income, deductions, credits, and calculate estimated tax payments owed based on New York state tax rates.

What is the purpose of NY CT-400?

The purpose of NY CT-400 is to ensure that pass-through entities in New York State remit estimated taxes, thereby aiding in compliance with state tax regulations.

What information must be reported on NY CT-400?

NY CT-400 requires reporting of the entity's gross income, deductions, credits, and estimated tax payment amounts, as well as identifying information about the entity.

Fill out your NY CT-400 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY CT-400 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.