NY CT-400 2022-2025 free printable template

Show details

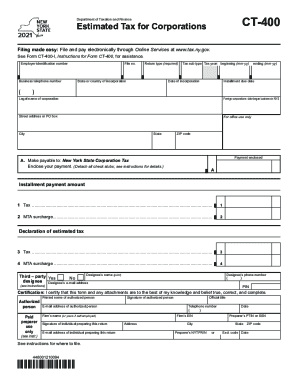

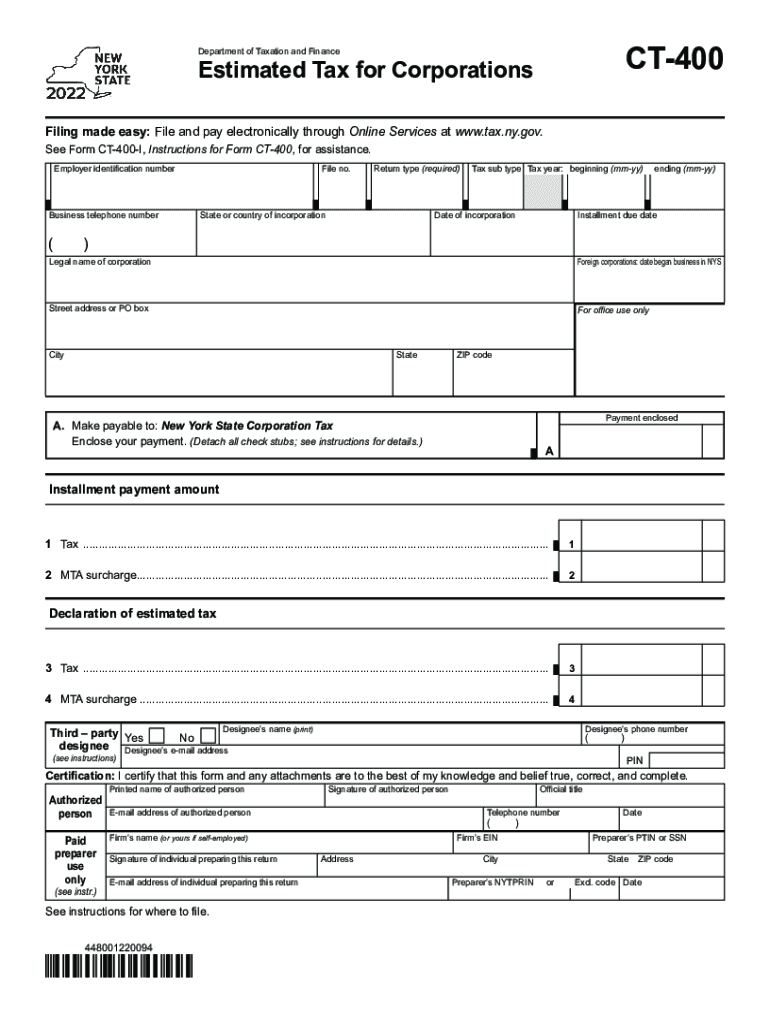

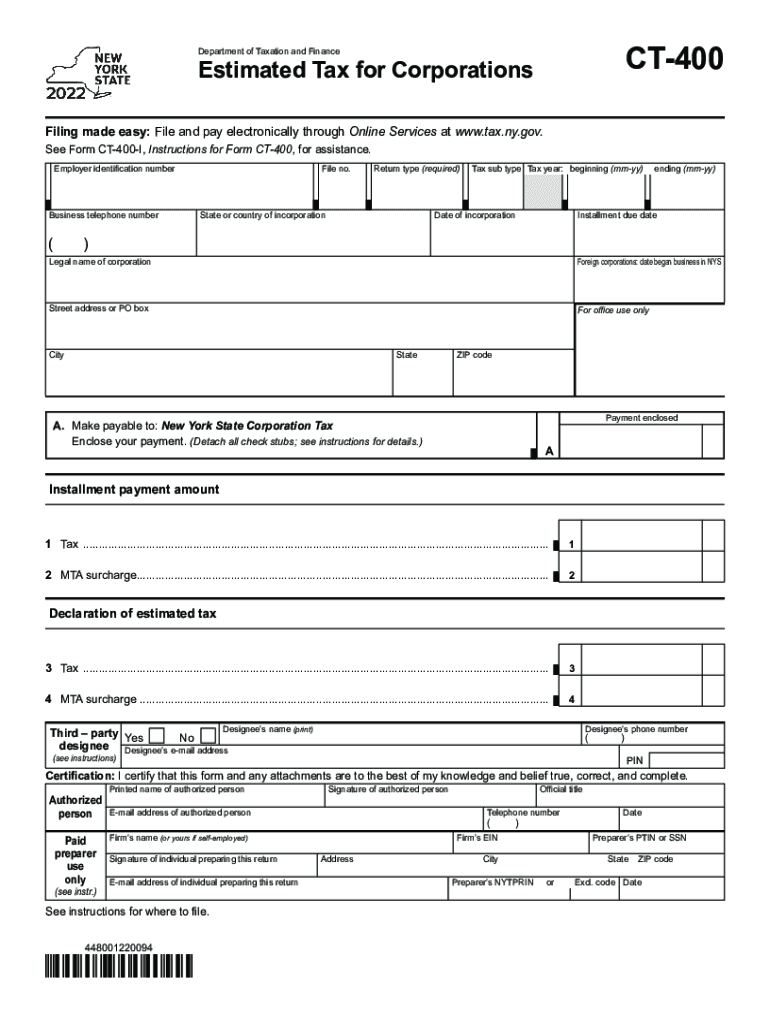

CT400Department of Taxation and FinanceEstimated Tax for Corporations Filing made easy: File and pay electronically through Online Services at www.tax.ny.gov. See Form CT400I, Instructions for Form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY CT-400

Edit your NY CT-400 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY CT-400 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY CT-400 online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY CT-400. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY CT-400 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY CT-400

How to fill out NY CT-400

01

Begin by downloading the NY CT-400 form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information, including your name, Social Security number, and address at the top of the form.

03

Indicate the type of corporation you are filing for and the period covered by the return.

04

Complete the income section by reporting your total receipts, deductions, and taxable income.

05

Calculate the tax on your taxable income using the appropriate tax rate for your corporation type.

06

Fill out any applicable sections, such as credits or payments made throughout the tax year.

07

Review your entries for accuracy and ensure all required documents are attached.

08

Sign and date the form, and submit it to the appropriate address as provided in the instructions.

Who needs NY CT-400?

01

Businesses registered as corporations in New York State that need to report their income and calculate their tax liabilities.

02

Corporations that have their principal business office located in New York State.

03

Any corporation that meets the filing threshold requirements, including gross receipts.

Fill

form

: Try Risk Free

People Also Ask about

Can I pay estimated taxes all at once?

Many people wonder, “can I make estimated tax payments all at once?” or pay a quarter up front? Because people might think it's a nuisance to file taxes quarterly, this is a common question. The answer is no.

How do I pay estimated taxes for C corporation?

C Corp Estimated Tax Payments Calculate your taxable income. Multiply the total by 21 percent, the corporate tax rate. If you can claim any tax credits, write down the total and subtract from your tax bill. Add to your bill for any other taxes you owe, such as recaptured tax credits or base erosion minimum tax.

How do I automatically pay estimated taxes?

To make estimated tax payments online, first establish an account with the IRS at the EFTPS website. Once you have an EFTPS account established, you can schedule automatic withdrawals for your quarterly estimated taxes, specifying the amounts and the dates of the payments.

What are the quarterly taxes for 2022?

When are estimated taxes due in 2022? First-quarter payments: April 18, 2022. Second-quarter payments: June 15, 2022. Third-quarter payments: Sept. 15, 2022. Fourth-quarter payments: Jan. 17, 2023.

When can I pay 2022 estimated taxes?

So, for example, if you didn't have any taxable income in 2022 until August, you don't have to make an estimated tax payment until September 15. At that point, you can either pay your entire estimated tax by the September 15 due date or pay it in two installments by September 15 and January 17.

How do I make estimated tax payments for 2022?

The IRS provides various methods for making 2022 quarterly estimated tax payments: You may credit an overpayment on your 2021 tax return to your 2022 estimated tax; You may mail your payment with payment voucher, Form 1040-ES; You may pay by phone or online (refer to Form 1040-ES instructions);

What are the due dates for corporate estimated tax payments 2022?

Aside from income tax, taxpayers can pay other taxes through estimated tax payments. This includes self-employment tax and the alternative minimum tax. The remaining deadlines for paying 2022 quarterly estimated tax are: June 15, September 15, and January 17, 2023.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send NY CT-400 to be eSigned by others?

Once your NY CT-400 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I execute NY CT-400 online?

Easy online NY CT-400 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out NY CT-400 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY CT-400 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NY CT-400?

NY CT-400 is a New York State form used by certain businesses to report their corporate tax due and to adjust their estimated tax payments.

Who is required to file NY CT-400?

Businesses that are subject to the corporate franchise tax and meet specific criteria, including partnerships and limited liability companies, may be required to file NY CT-400.

How to fill out NY CT-400?

To fill out NY CT-400, businesses must provide their identifying information, calculate their total tax due, report any estimated payments made, and detail any credits or adjustments applicable.

What is the purpose of NY CT-400?

The purpose of NY CT-400 is to ensure that businesses correctly report their corporate taxes, make necessary payments, and comply with state tax regulations.

What information must be reported on NY CT-400?

NY CT-400 requires businesses to report their business name, tax identification number, total income, total tax calculated, estimated payments, and any applicable credits or adjustments.

Fill out your NY CT-400 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY CT-400 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.