Get the free Stock Investment Plan - DRIP Investor

Show details

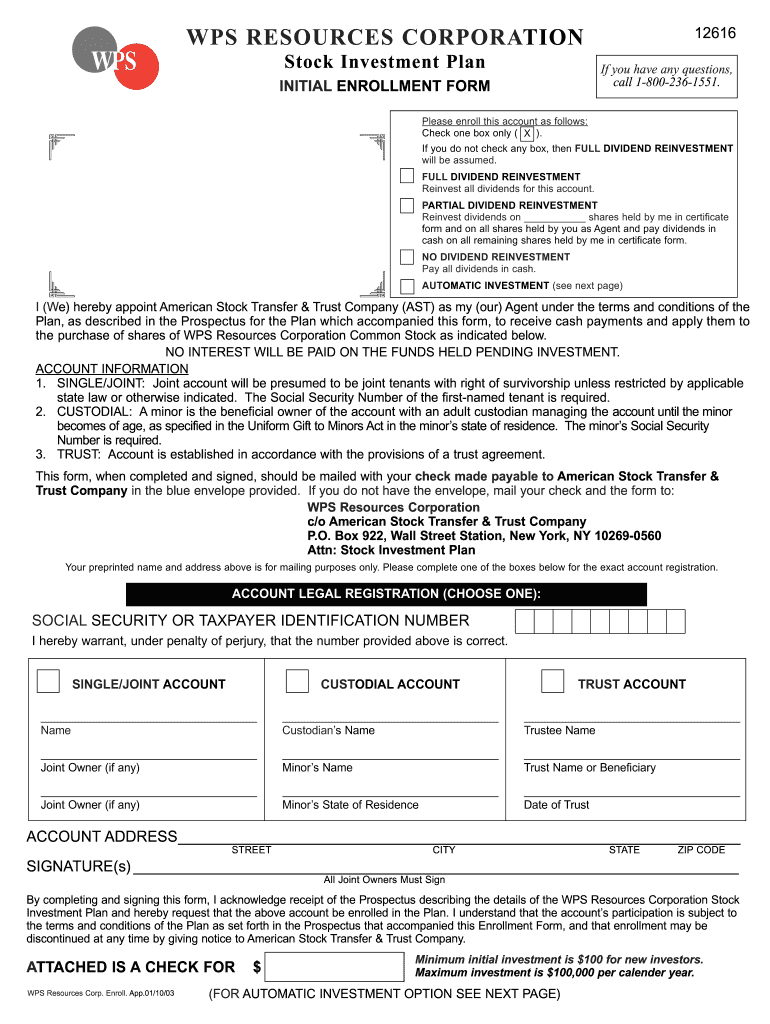

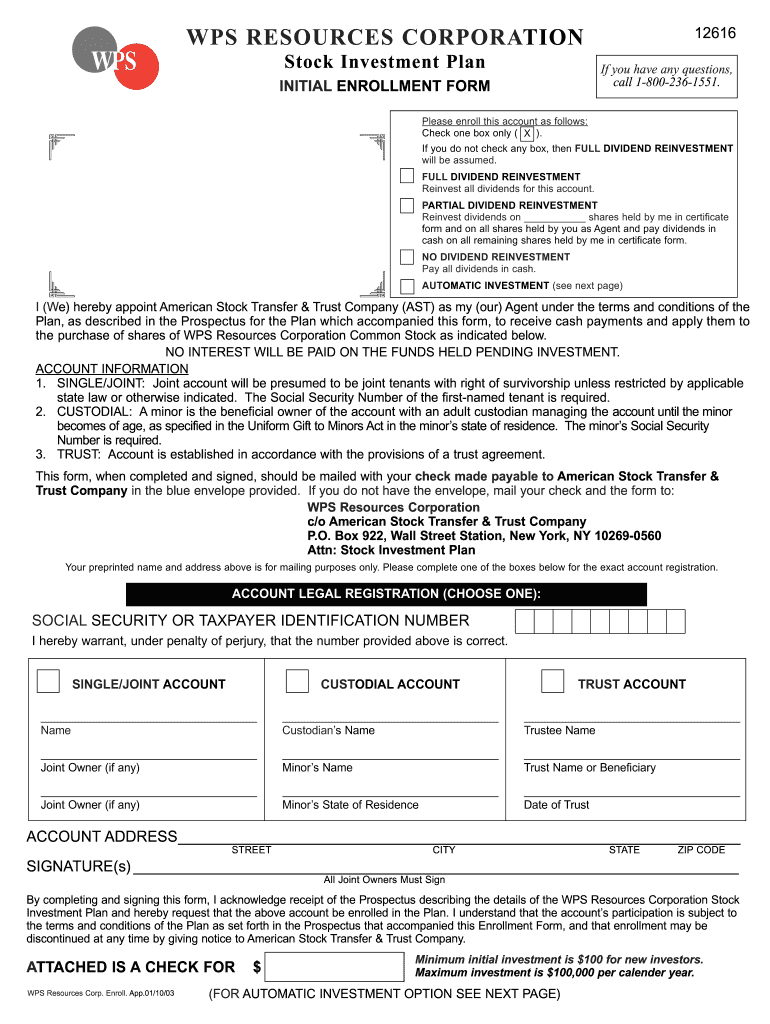

12616 WPS RESOURCES CORPORATION Stock Investment Plan If you have any questions, call 1-800-236-1551. INITIAL ENROLLMENT FORM Please enroll this account as follows: Check one box only (X). If you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stock investment plan

Edit your stock investment plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stock investment plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stock investment plan online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit stock investment plan. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out stock investment plan

How to fill out a stock investment plan:

01

Start by assessing your financial goals and risk tolerance. Determine how much money you are willing to invest and what you hope to achieve with your investments. Understand that investing in stocks carries a level of risk, and ensure that your investment plan aligns with your risk tolerance.

02

Conduct thorough research on different stocks and companies. Look for companies that have a strong track record, solid financials, and potential for growth. Consider factors like industry trends, competitive advantages, and management expertise. This information can help you make informed investment decisions.

03

Determine the appropriate allocation of your investment portfolio. Decide how much of your portfolio you want to allocate to stocks and how much to other asset classes like bonds or cash. This allocation should be based on your risk tolerance, financial goals, and investment timeframe.

04

Set realistic expectations and be patient. Stock market investments are long-term commitments, and it's important to have a long-term perspective. Understand that the stock market can be volatile, and short-term fluctuations are normal. Stick to your investment plan and avoid making impulsive decisions based on short-term market movements.

05

Open a brokerage account. To invest in stocks, you will need a brokerage account. Research different brokerage firms and choose one that suits your needs in terms of fees, trading platform, research tools, and customer support. Follow the account-opening process and provide the required information and documentation.

06

Fund your brokerage account. Transfer funds into your brokerage account to make investments. You can do this through electronic funds transfer or by writing a check. Ensure that you have enough funds available before making any investment decisions.

07

Create a diversified portfolio. Diversification is key to managing risk and maximizing returns. Invest in a variety of stocks across different industries and sectors. Diversification helps reduce the impact of any one stock's performance on your overall portfolio.

08

Monitor your investments regularly. Stay updated with the latest news and developments related to the companies in which you have invested. Keep an eye on the overall market trends and economic indicators. Regularly review your investment portfolio and make adjustments as necessary.

Who needs a stock investment plan?

01

Individuals looking to build long-term wealth: Investing in stocks can provide an opportunity to grow your wealth over time. If you have a long-term financial goal, such as saving for retirement or buying a home, a stock investment plan can help you achieve these goals.

02

Retirement savers: Stocks can play a crucial role in retirement planning. By investing in stocks, you have the potential to earn higher returns compared to more conservative investments like bonds. This growth can help you build a substantial retirement nest egg.

03

Risk-tolerant investors: Stock market investments come with a certain level of risk. If you are comfortable with taking on risk in exchange for potentially higher returns, a stock investment plan might be suitable for you. However, it's important to align your investment decisions with your risk tolerance.

04

Those looking for passive income: Dividend-paying stocks can provide a regular stream of income. If you are seeking passive income, a stock investment plan that focuses on dividend stocks can be beneficial.

05

Individuals with a solid financial foundation: Before investing in stocks, ensure that you have a strong financial foundation. This includes having an emergency fund, managing debt, and having a stable source of income. Investing in stocks should not jeopardize your financial stability.

Remember, it's always a good idea to consult with a financial advisor or professional before making any investment decisions. They can provide personalized advice based on your specific financial situation and goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send stock investment plan for eSignature?

Once you are ready to share your stock investment plan, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I create an eSignature for the stock investment plan in Gmail?

Create your eSignature using pdfFiller and then eSign your stock investment plan immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete stock investment plan on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your stock investment plan. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is stock investment plan?

A stock investment plan is a strategy or arrangement for investing in stocks with the goal of earning a return on investment.

Who is required to file stock investment plan?

Individuals or organizations who are actively investing in stocks and want to have a structured plan for their investments.

How to fill out stock investment plan?

To fill out a stock investment plan, one must determine their investment goals, risk tolerance, time horizon, and desired asset allocation.

What is the purpose of stock investment plan?

The purpose of a stock investment plan is to provide a roadmap for investing in stocks that aligns with an individual's financial goals and risk tolerance.

What information must be reported on stock investment plan?

Information such as investment goals, risk tolerance, asset allocation, stock selection criteria, and monitoring procedures.

Fill out your stock investment plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stock Investment Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.