IRS 1023-EZ Instructions 2017 free printable template

Show details

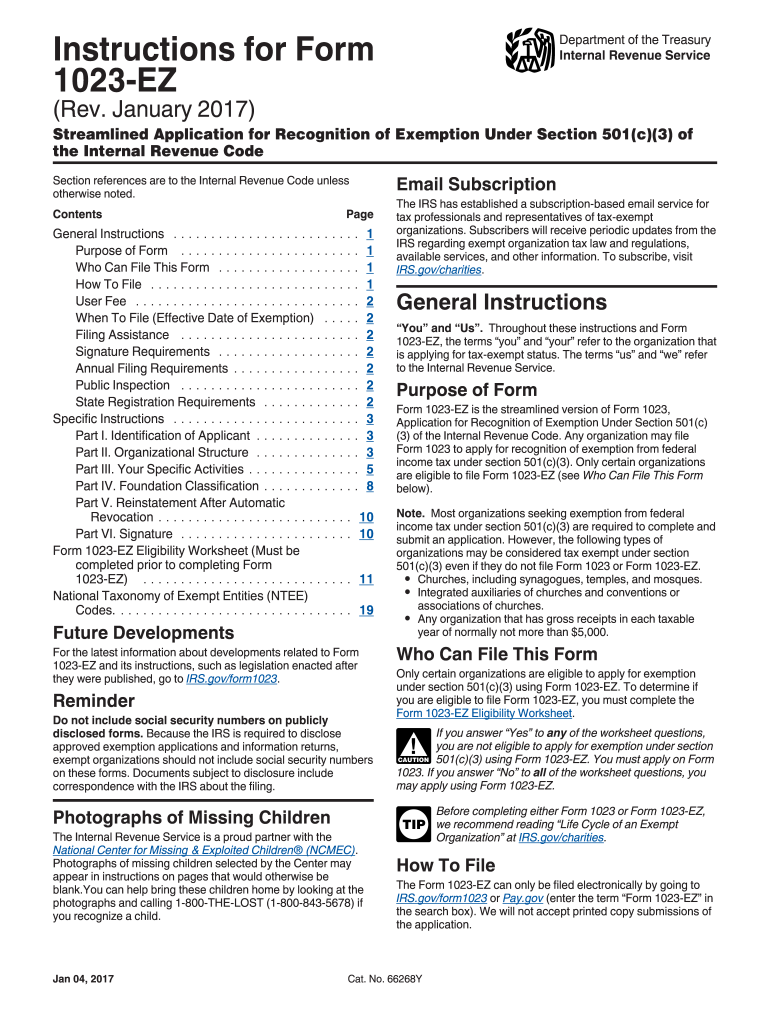

Instructions for Form 1023EZ Department of the Treasury Internal Revenue Service (Rev. January 2017) Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS 1023-EZ Instructions

Edit your IRS 1023-EZ Instructions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS 1023-EZ Instructions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS 1023-EZ Instructions online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit IRS 1023-EZ Instructions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS 1023-EZ Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS 1023-EZ Instructions

How to fill out IRS 1023-EZ Instructions

01

Step 1: Determine Eligibility - Confirm that your organization qualifies to use IRS Form 1023-EZ based on the eligibility criteria.

02

Step 2: Gather Required Information - Collect the necessary details about your organization, including its legal name, address, and Employer Identification Number (EIN).

03

Step 3: Complete the Online Form - Access the Form 1023-EZ on the IRS website and fill it out electronically.

04

Step 4: Answer Questions - Respond to specific questions related to your organization's activities, finances, and governance.

05

Step 5: Review Your Application - Ensure all information is accurate and complete, and check for any errors.

06

Step 6: Submit the Form - File the completed Form 1023-EZ electronically through the IRS website and pay any applicable user fee.

07

Step 7: Await Confirmation - After submission, monitor the email for confirmation from the IRS regarding the status of your application.

Who needs IRS 1023-EZ Instructions?

01

Organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

02

Small nonprofit organizations with gross receipts of $50,000 or less in the past three years and total assets of $250,000 or less.

03

Start-up charities that are eligible to take advantage of a streamlined application process.

Fill

form

: Try Risk Free

People Also Ask about

What are the limitations for 1023-EZ?

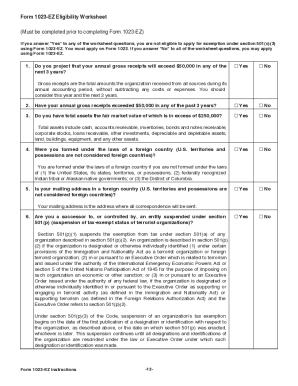

Who Qualifies to File the Form 1023-EZ Projected annual gross receipts must not exceed $50,000 in any of the next 3 years. Actual annual gross receipts must not have exceeded $50,000 in any of the past 3 years. Total assets must not exceed $250,000.

What are the limitations for 1023 EZ?

Basic Eligibility Requirements for the 1023-EZ gross income under $50,000 in the past 3 years. estimated gross income less than $50,00 for the next 3 years. fair market assets under $250,000. formed in the United States. mailing address in the United States.

What happens if I use Form 1023-EZ and bring in more than $50 000?

The IRS has also said that a recognition letter may not be relied on by donors if it is based on “any inaccurate material information.” If you get more than $50,000 in a year, you will have to file at least a Form 990-EZ and bring yourself to the attention of the IRS.

Who can help me fill out 1023 form?

The IRS. To get help with your 1023, you can also go straight to the source. The Internal Revenue Service has a guide with instructions dedicated to filing their forms. You can find the publication specific to the 1023 here.

How do you write a narrative description for Form 1023?

To write a compelling Narrative Description of Activities, you need to answer the following questions with the smallest detail: What is the nonprofit activity? Who conducts the activity? When is the activity conducted? Where is the activity conducted?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get IRS 1023-EZ Instructions?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific IRS 1023-EZ Instructions and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an eSignature for the IRS 1023-EZ Instructions in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your IRS 1023-EZ Instructions and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I complete IRS 1023-EZ Instructions on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your IRS 1023-EZ Instructions. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IRS 1023-EZ Instructions?

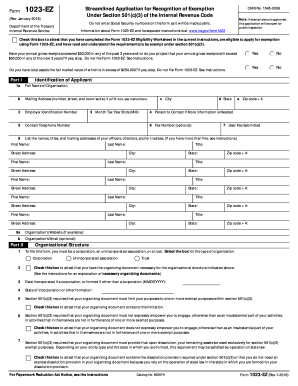

The IRS 1023-EZ Instructions provide guidance for eligible small tax-exempt organizations on how to apply for 501(c)(3) tax-exempt status using the simplified Form 1023-EZ, which is a streamlined application.

Who is required to file IRS 1023-EZ Instructions?

Organizations with gross receipts of $50,000 or less in the last three years, and organizations with total assets of $250,000 or less, can file the IRS 1023-EZ form. However, organizations that do not meet these criteria must use the standard Form 1023.

How to fill out IRS 1023-EZ Instructions?

To fill out IRS 1023-EZ Instructions, applicants must gather necessary information about their organization, complete the online form through Pay.gov, and answer eligibility questions accurately, making sure to follow the instructions provided for each section.

What is the purpose of IRS 1023-EZ Instructions?

The purpose of IRS 1023-EZ Instructions is to simplify the application process for small organizations seeking tax-exempt status under 501(c)(3), making it easier and more accessible to obtain the necessary recognition from the IRS.

What information must be reported on IRS 1023-EZ Instructions?

The information required includes the organization's name, address, employer identification number (EIN), details on the organization’s activities, a description of its exempt purpose, financial data, and information on its governing body and management.

Fill out your IRS 1023-EZ Instructions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS 1023-EZ Instructions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.